Answered step by step

Verified Expert Solution

Question

1 Approved Answer

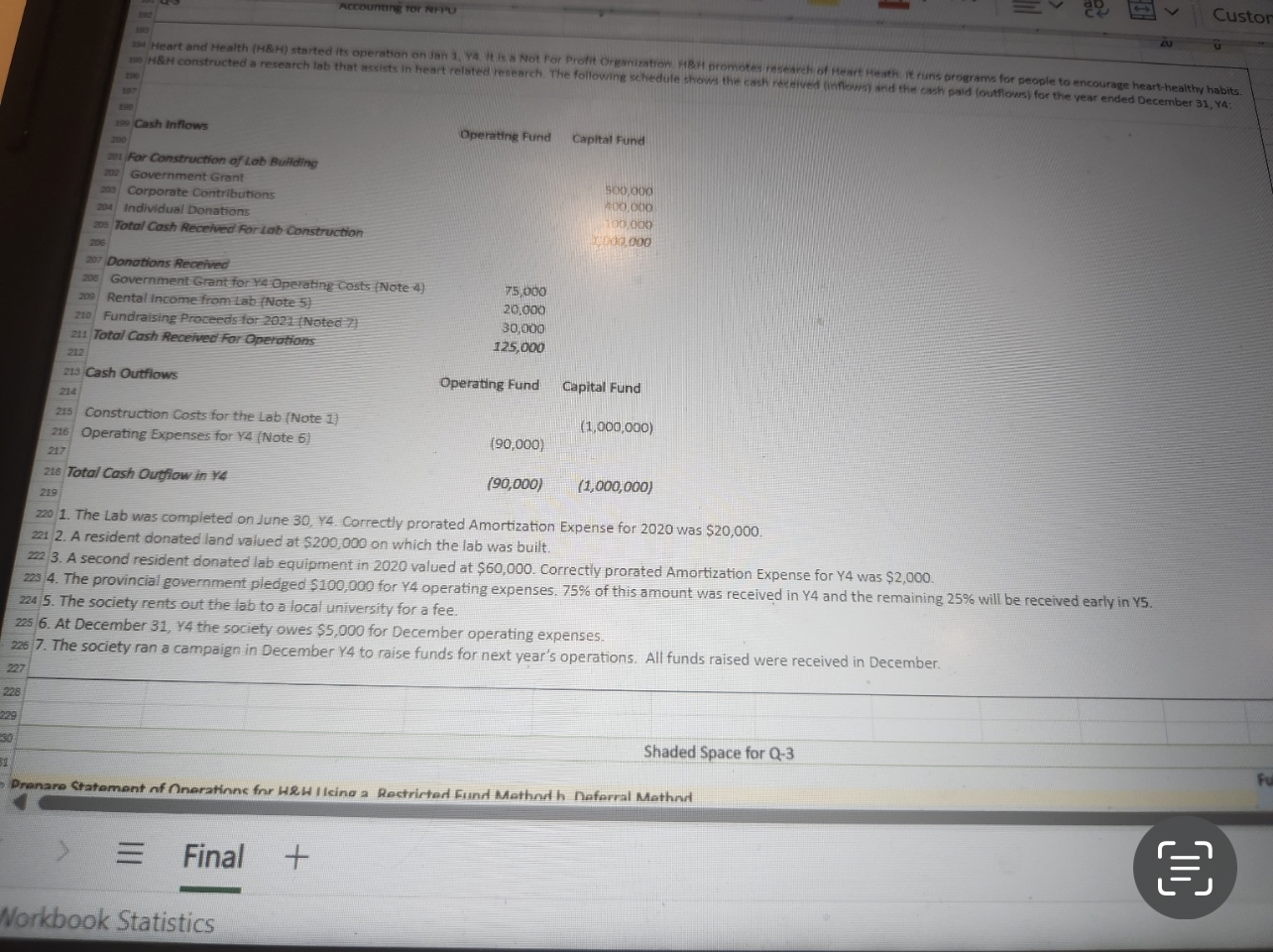

Cash Inflows Operating Fund Capital Fund For Construction of Lab Building Government Grant Corporate Contributions 5 0 0 , 0 0 0 4 0 0

Cash Inflows

Operating Fund

Capital Fund

For Construction of Lab Building

Government Grant

Corporate Contributions

Donations Received

Government Grant for Y Operating Costs Note

Rental income from Lab Note

Cash Outfiows

Operating Fund

Capital Fund

Construction Costs for the Lab Note

Operating Expenses for YNote

Total Cash Outfiow in

The Lab was completed on June Y Correctly prorated Amortization Expense for was $

A resident donated land valued at $ on which the lab was built.

A second resident donated lab equipment in valued at $ Correctly prorated Amortization Expense for was $

The provincial government pledged $ for operating expenses. of this amount was received in and the remaining will be received early in

The society rents out the lab to a local university for a fee.

At December Y the society owes $ for December operating expenses.

The society ran a campaign in December Y to raise funds for next year's operations. All funds raised were received in December.

Shaded Space for Q

Pranare Statement if Onerations fror Hew I Ising a Rectrinted Fund Methnd h Neforral Methind

Vorkbook Statistics

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started