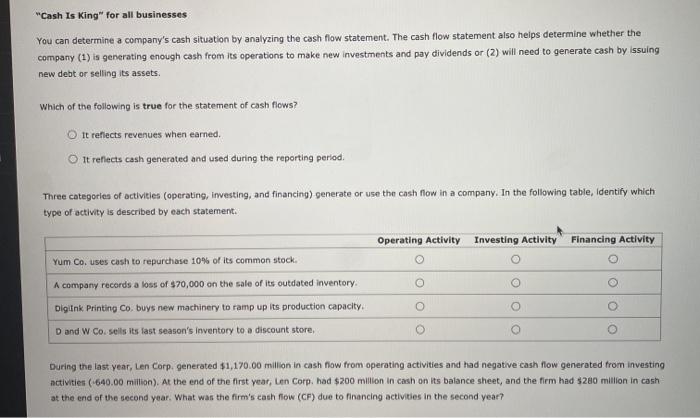

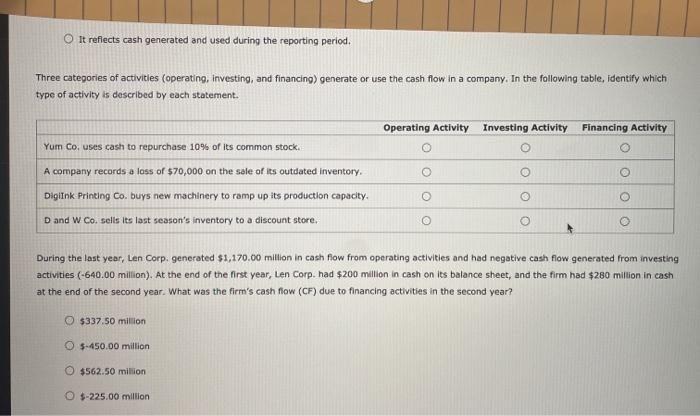

"Cash Is King" for all businesses You can determine a company's cash situation by analyzing the cash flow statement. The cash flow statement also helps determine whether the company (1) is generating enough cash from its operations to make new investments and pay dividends or (2) will need to generate cash by issuing new debt or selling its assets. Which of the following is true for the statement of cash flows? It reflects revenues when earned. It reflects cash generated and used during the reporting period, Three categories of activities (operating, Investing, and financing) generate or use the cash flow in a company. In the following table, identify which type of activity is described by each statement Operating Activity Investing Activity Financing Activity Yum Co, uses cash to repurchase 10% of its common stock. A company records a loss of $70,000 on the sale of its outdated Inventory Diglink Printing Co. buys new machinery to ramp up its production capacity O D and W Co. sells its fast season's inventory to a discount store During the last year, Len Corp. generated $1,170.00 million in cash now from operating activities and had negative cash flow generated from investing activities (640.00 million). At the end of the first year, Len Corp. had $200 million in cash on its balance sheet, and the firm had $200 million in cash at the end of the second year. What was the firm's cash flow (CF) due to financing activities in the second year? It reflects cash generated and used during the reporting period. Three categories of activities (operating, investing, and financing) generate or use the cash flow in a company. In the following table, identify which type of activity is described by each statement. Operating Activity Investing Activity Financing Activity Yum Co. uses cash to repurchase 10% of its common stock. A company records a loss of $70,000 on the sale of its outdated inventory. Digiink Printing co. buys new machinery to ramp up its production capacity. D and W Co. sells its last season's inventory to a discount store, During the last year, Len Corp. generated $1,170.00 million in cash flow from operating activities and had negative cash flow generated from investing activities (-640.00 million). At the end of the first year, Len Corp. had $200 million in cash on its balance sheet, and the firm had $280 million in cash at the end of the second year. What was the firm's cash flow (CF) due to financing activities in the second year? $337.50 million $-450.00 million $562.50 million O $-225.00 million