Answered step by step

Verified Expert Solution

Question

1 Approved Answer

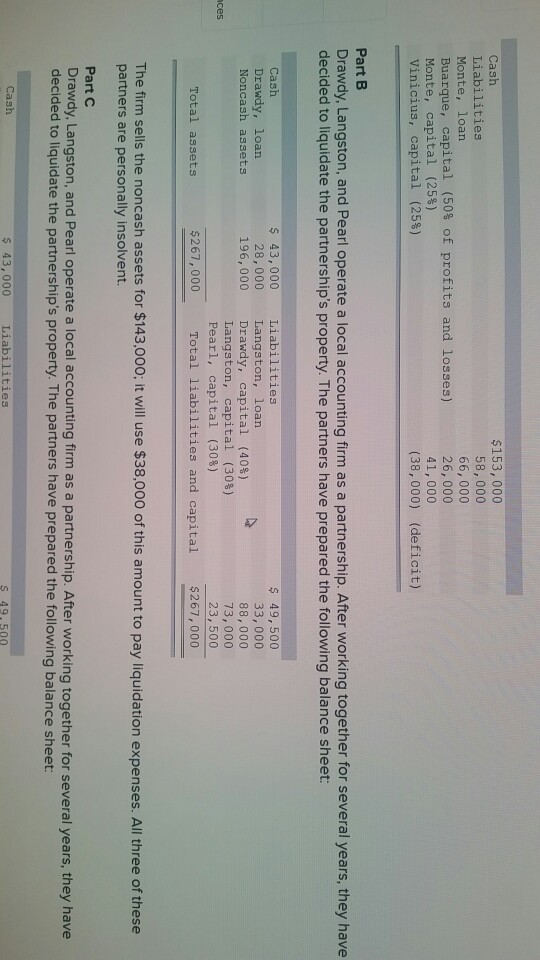

Cash Liabilities Monte, loan Buarque, capital (50% of Monte, capital (25%) Vinicius, capital (25%) $153, 000 58, 000 66, 000 26, 000 41,000 (38,000) profits

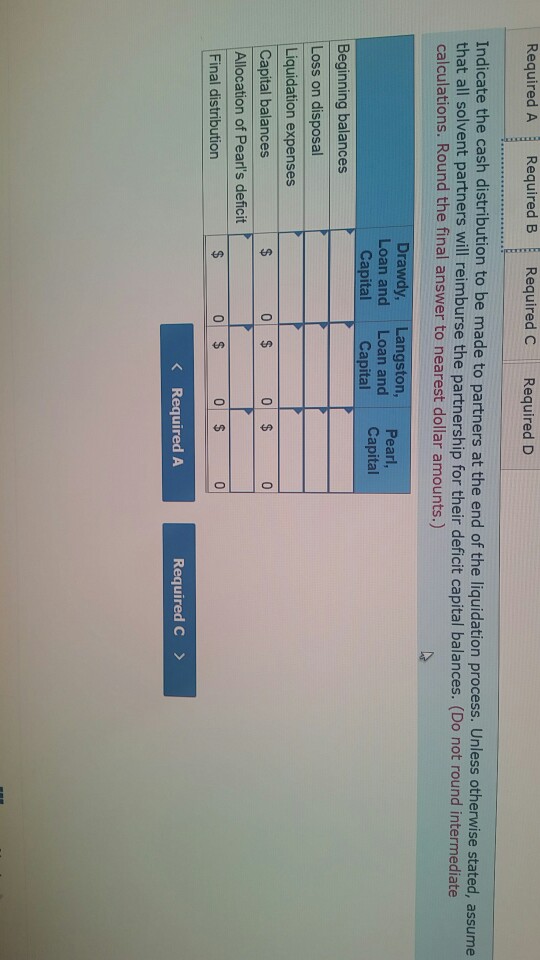

Cash Liabilities Monte, loan Buarque, capital (50% of Monte, capital (25%) Vinicius, capital (25%) $153, 000 58, 000 66, 000 26, 000 41,000 (38,000) profits and losses) (deficit) Part B Drawdy, Langston, and Pearl operate a local accounting firm as a partnership. After working together for several years, they have decided to liquidate the partnership's property. The partners have prepared the following balance sheet: s 49,500 33,000 88,000 73,000 23, 500 $267,000 Cash Drawdy, loan Noncash assets s 43,000 Liabilities 28, 000 Langston, loan 196,000 Drawdy, capital (40%) Langston, capital (30%) Pearl, capital (30%) ces Total assets $267,000 Total liabilities and capital The firm sells the noncash assets for $143,000; it will use $38,000 of this amount to pay liquidation expenses. All three of these partners are personally insolvent. Part C Drawdy, Langston, and Pearl operate a local accounting firm as a partnership. After working together for several years, they have decided to liquidate the partnership's property. The partners have prepared the following balance sheet: Cash $ 43,000 Liabilities s 49. 500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started