Question

CASH MANAGEMENT AND BUDGETING: 1. The owner of the Alpha Hotel is contemplating a major expansion of the hotels ground floor bar area in order

CASH MANAGEMENT AND BUDGETING:

1. The owner of the Alpha Hotel is contemplating a major expansion of the hotels ground floor bar area in order to take advantage of large retail development that will be built adjacent to the hotel.

The cost of the expansion will be 2,500,000 and it has been estimated that the new facilities would increase current bar revenues of 3,000,000 by 600,000 (before inflation) a year and that the annual incremental cost of operating the bar would be 140,000 (before inflation). The companys usual cost of finance is 3%. Assume an inflation rate after the first year of operation for costs and revenue of 1.5%, a 10% discount rate and a ten year life for the project, after which the new assets will have a residual value of 30,000.

Calculate the NPV of the project using the Alpha Hotel tab in the spreadsheet provided. Should the investment be made? Answer directly on the template.

2. Charlies restaurant is contemplating adding pizzas to its menu and requires the installation of a wood-burning oven that will cost 75,000. The oven has an estimated seven year life and the manager has determined that, although the sale of pizzas are likely to reduce existing restaurant sales of 400,000 by approximately 10% but the restaurant could sell approximately 70,000 of pizzas each year. Cost structure will remain stable with the same food cost of 30% of total revenue, and variable labor cost of 20% of total revenue. At the end of year seven, the oven should be able to bring 7,500 at auction. Assume that both revenue and cost inflation is 1.5%. Assume that the owner of Charlies requires a 12% return on investment.

2. Charlies restaurant is contemplating adding pizzas to its menu and requires the installation of a wood-burning oven that will cost 75,000. The oven has an estimated seven year life and the manager has determined that, although the sale of pizzas are likely to reduce existing restaurant sales of 400,000 by approximately 10% but the restaurant could sell approximately 70,000 of pizzas each year. Cost structure will remain stable with the same food cost of 30% of total revenue, and variable labor cost of 20% of total revenue. At the end of year seven, the oven should be able to bring 7,500 at auction. Assume that both revenue and cost inflation is 1.5%. Assume that the owner of Charlies requires a 12% return on investment.

Using the Charlies tab in the spreadsheet provided, calculate the IRR of the project. Should the oven be purchased? Answer directly on the template.

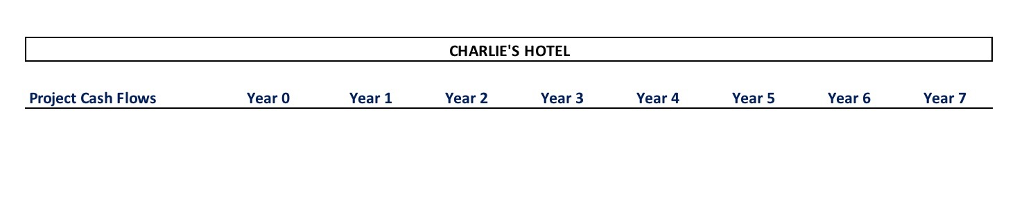

3. You are the financial controller of the Echo Hotel and you have been presented with five capital expenditure projects prepared by various members of the management team and you are now charged with the responsibility to prepare a financial analysis that will become part of a presentation of these projects for the General Manager that will assist in the decision-making process.

Company policy requires you to consider NPV, IRR and PI as measures of capital projects, but there is a preference for NPV maximization as the final, decisive criterion in marginal cases.

All the projects have a ten year useful life and some have a residual value at the end of this period. Projects B and C are mutually exclusive and there is a limit of 450.000 that can be invested in capital projects. The discount rate is 9%. Annual inflation of 2% should be applied from years 2 to 10.

Assume that the company wishes to invest all the capital budget of 450.000 and that any excess funds from investing less than the budget in other projects would not be invested in other projects with a higher NPV.

Based on the information above, prepare calculations of NPV, IRR and PI for each project using the data provided in the Excel spreadsheet provided and answer the following questions:

1. What is the optimal combination of projects?

2. Based on the results of your calculations, is NPV maximization the most suitable selection criterion?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started