Answered step by step

Verified Expert Solution

Question

1 Approved Answer

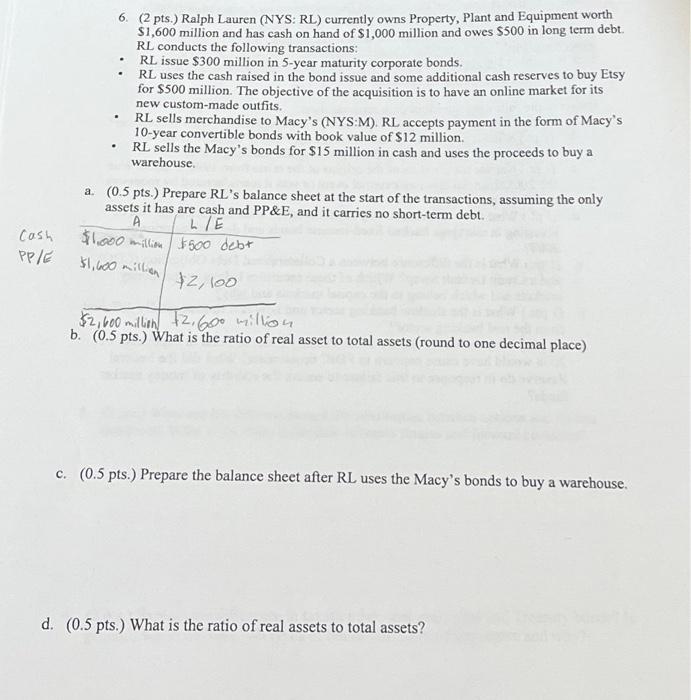

Cash PP/E 6. (2 pts.) Ralph Lauren (NYS: RL) currently owns Property, Plant and Equipment worth $1,600 million and has cash on hand of $1,000

Cash PP/E 6. (2 pts.) Ralph Lauren (NYS: RL) currently owns Property, Plant and Equipment worth $1,600 million and has cash on hand of $1,000 million and owes $500 in long term debt. RL conducts the following transactions: RL issue $300 million in 5-year maturity corporate bonds. RL uses the cash raised in the bond issue and some additional cash reserves to buy Etsy for $500 million. The objective of the acquisition is to have an online market for its new custom-made outfits. a. RL sells merchandise to Macy's (NYS:M). RL accepts payment in the form of Macy's 10-year convertible bonds with book value of $12 million. RL sells the Macy's bonds for $15 million in cash and uses the proceeds to buy a warehouse. (0.5 pts.) Prepare RL's balance sheet at the start of the transactions, assuming the only assets it has are cash and PP&E, and it carries no short-term debt. A L/E $1.000 million $500 debt $1,600 million $2,100 $2,600 million $2,60 million. b. (0.5 pts.) What is the ratio of real asset to total assets (round to one decimal place) c. (0.5 pts.) Prepare the balance sheet after RL uses the Macy's bonds to buy a warehouse. d. (0.5 pts.) What is the ratio of real assets to total assets?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started