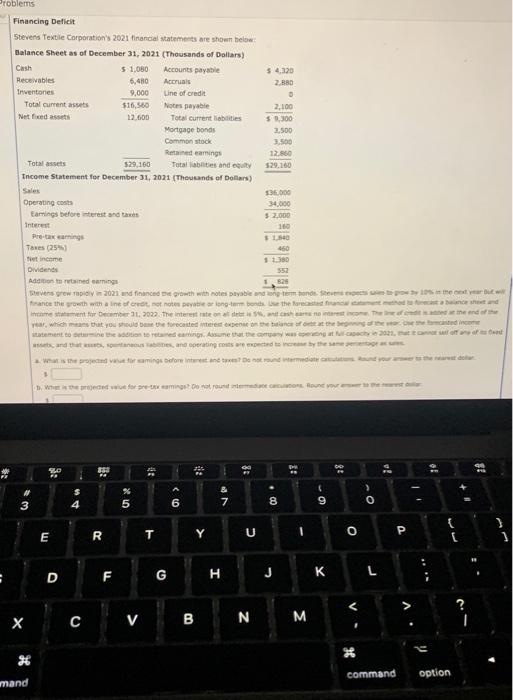

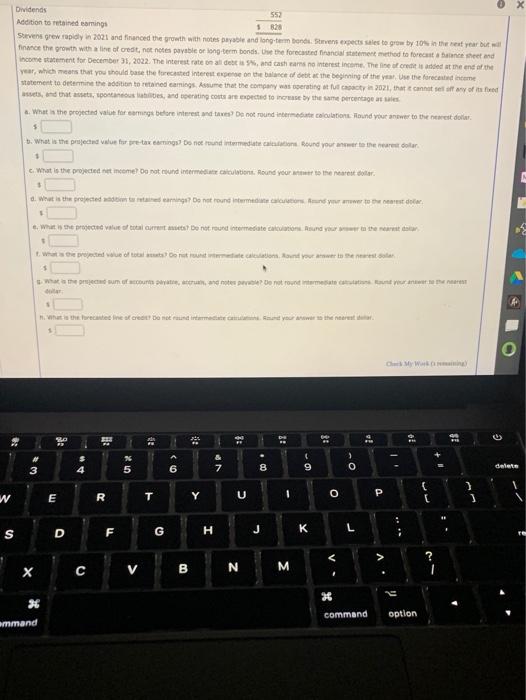

Cash Problems Financing Deficit Stevens Textile Corporation's 2021 financial statements are shown below: Balance Sheet as of December 31, 2021 (Thousands of Dollars) $ 1,080 Accounts payable $ 4,320 Recevables 6,480 Accruals 2.880 Inventories 9,000 Line of credit 0 Total current assets $16,560 Notes payable 2.100 Net fedt 12.600 Total current librities $9.300 Mortgage bonds 2.500 Common stock 3.500 Retained earings 12.860 Totalaus $29.160 Totalities and equity 529,160 Income Statement for December 31, 2021 (Thousands of Dollars) Sales 53,000 Operating costs 34.000 Earnings before interest and taxes $ 2.000 interest 160 Pretaxerings $1.50 Tanes (2 450 et income 11.30 Dividende And carings Stevens grew ap 2021 and finance the growth with notes payable and contermondsey france the growth with a line of the peong-term bond the forecast med nement for Dember 31, 2022. The interest to share on year, which means that you should be forcedes Bence the watement to the wings asume that the cost 2021 and an operating costs expected since the the projected to anings before and most 5 1 Wed for person SO 13 38 :: % 5 & 7 6 00 O E T Y R o P U G - H DF J L v B N # mand command option Dividends 552 Addition to retained comings 3828 Shevens grew rapidly in 2021 and financed the growth with not payable and long term bondstvensectes to grow by 10% in the year but finance the growth with a line of credit, not notes payable or long term bonds. On the forecast financial statement method to forectance sheet and income statement for December 31, 2022. The interest rate on alles and tashas no interest income. The line of credit is died at the end of the year, which means that you should be the forecated interest expere on the balance of the beginning of the year. Use the forecastintame statement to determine the sition to retained camings. Assume that the company was erating of cocin 2021, that cannot set off any of its sets, and that as pontaneous ates, and toering costs are expected to increase by the same percentage as 2. What is the projected value foraming before interest and tes De not round interaction. Tound your answer to the newest dollar 5 . What is the projected value for pre-tex comingu do not run intermediate action. Round your awer to the newest colar 1 c. What is the projected net income? Do not und intermediation. Round you to the rest or a. What is the projected edition to retained coming? Do not found informatie over Round your awer to the doar c. What is the productes de retroud mediate and you the most tweede of Dorte Round your own $ the ed umur per te? De not row meat contentaret A whats the located in a creat Do not rendimento at your was the nearest D SO T! ! SI 3 6 . . 3 7 -O 5 8 Galata 9 w E R T Y U o [ D F G S H J L