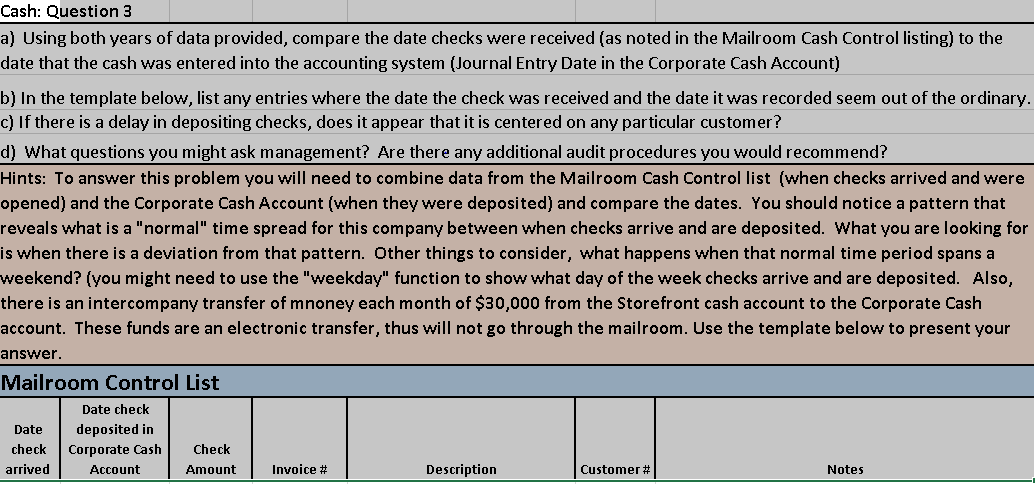

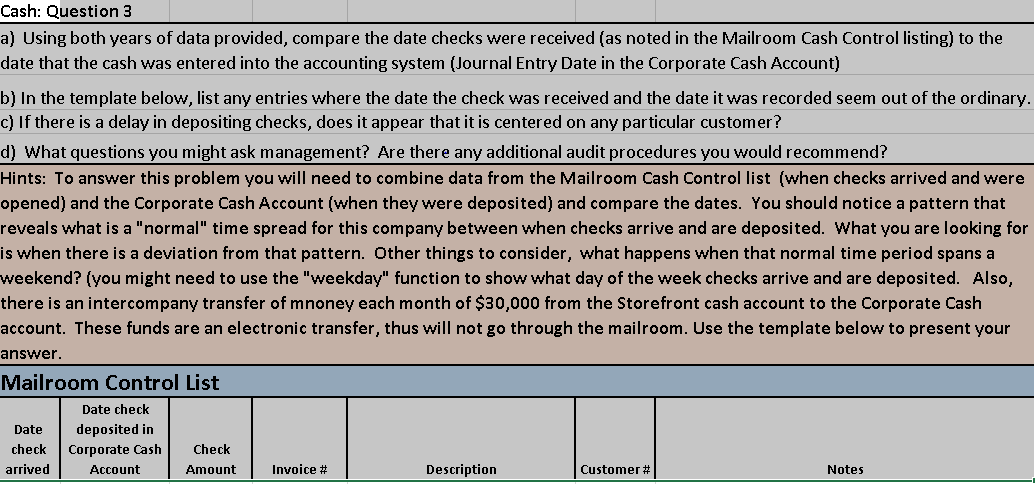

Cash: Question 3 a) Using both years of data provided, compare the date checks were received (as noted in the Mailroom Cash Control listing) to the date that the cash was entered into the accounting system (Journal Entry Date in the Corporate Cash Account) b) In the template below, list any entries where the date the check was received and the date it was recorded seem out of the ordinary. c) If there is a delay in depositing checks, does it appear that it is centered on any particular customer? d) What questions you might ask management? Are there any additional audit procedures you would recommend? Hints: To answer this problem you will need to combine data from the Mailroom Cash Control list (when checks arrived and were opened) and the Corporate Cash Account (when they were deposited) and compare the dates. You should notice a pattern that reveals what is a "normal" time spread for this company between when checks arrive and are deposited. What you are looking for is when there is a deviation from that pattern. Other things to consider, what happens when that normal time period spans a weekend? (you might need to use the "weekday" function to show what day of the week checks arrive and are deposited. Also, there is an intercompany transfer of mnoney each month of $30,000 from the Storefront cash account to the Corporate Cash account. These funds are an electronic transfer, thus will not go through the mailroom. Use the template below to present your answer Mailroom Control List Date check deposited in Date check Corporate Cash Check arrived Account Invoice Description Customer # Amount Notes Cash: Question 3 a) Using both years of data provided, compare the date checks were received (as noted in the Mailroom Cash Control listing) to the date that the cash was entered into the accounting system (Journal Entry Date in the Corporate Cash Account) b) In the template below, list any entries where the date the check was received and the date it was recorded seem out of the ordinary. c) If there is a delay in depositing checks, does it appear that it is centered on any particular customer? d) What questions you might ask management? Are there any additional audit procedures you would recommend? Hints: To answer this problem you will need to combine data from the Mailroom Cash Control list (when checks arrived and were opened) and the Corporate Cash Account (when they were deposited) and compare the dates. You should notice a pattern that reveals what is a "normal" time spread for this company between when checks arrive and are deposited. What you are looking for is when there is a deviation from that pattern. Other things to consider, what happens when that normal time period spans a weekend? (you might need to use the "weekday" function to show what day of the week checks arrive and are deposited. Also, there is an intercompany transfer of mnoney each month of $30,000 from the Storefront cash account to the Corporate Cash account. These funds are an electronic transfer, thus will not go through the mailroom. Use the template below to present your answer Mailroom Control List Date check deposited in Date check Corporate Cash Check arrived Account Invoice Description Customer # Amount Notes