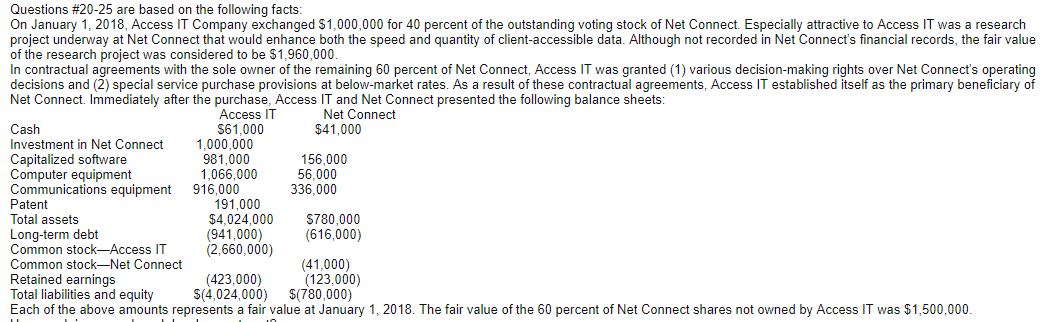

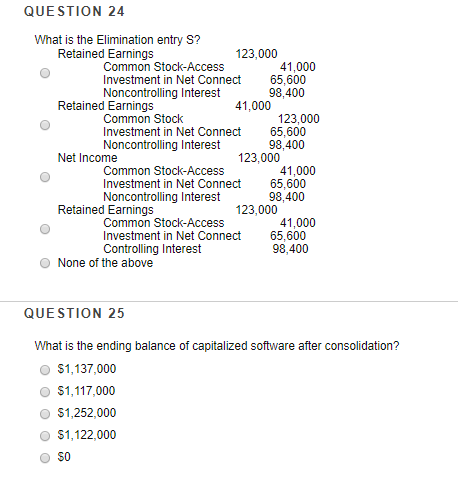

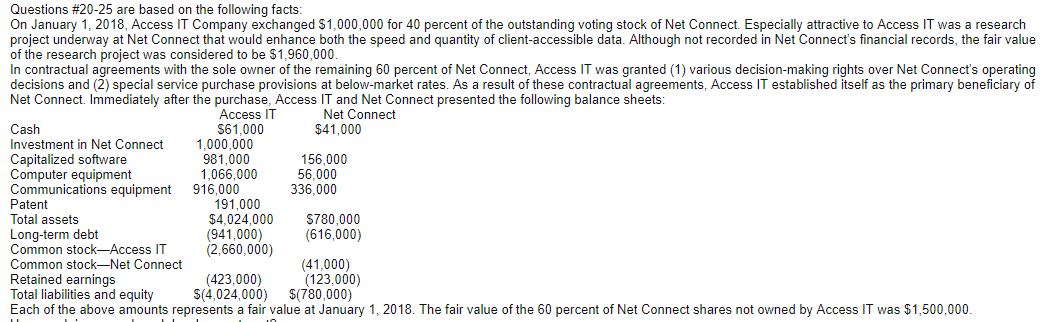

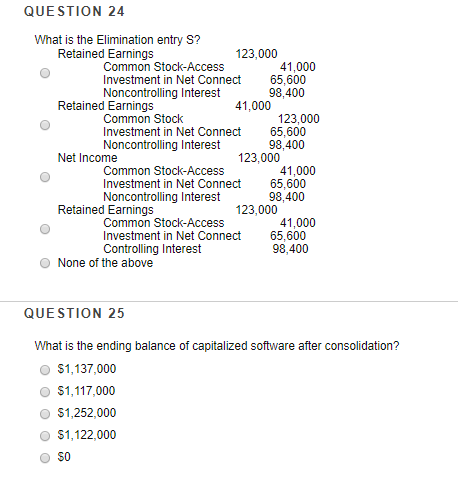

Cash Questions #20-25 are based on the following facts: On January 1, 2018, Access IT Company exchanged $1,000,000 for 40 percent of the outstanding voting stock of Net Connect. Especially attractive to Access IT was a research project underway at Net Connect that would enhance both the speed and quantity of client accessible data. Although not recorded in Net Connect's financial records, the fair value of the research project was considered to be $1,960,000. In contractual agreements with the sole owner of the remaining 60 percent of Net Connect, Access IT was granted (1) various decision-making rights over Net Connect's operating decisions and (2) special service purchase provisions at below-market rates. As a result of these contractual agreements, Access IT established itself as the primary beneficiary of Net Connect. Immediately after the purchase, Access IT and Net Connect presented the following balance sheets: Access IT Net Connect $61,000 $41,000 Investment in Net Connect 1,000,000 Capitalized software 981,000 156,000 Computer equipment 1,066,000 56,000 Communications equipment 916,000 336,000 Patent 191,000 Total assets $4,024,000 $780,000 Long-term debt (941,000) (616,000) Common stock-Access IT (2,660,000) Common stock-Net Connect (41,000) Retained earnings (423,000) (123,000) Total liabilities and equity $(4,024,000) $(780,000) Each of the above amounts represents a fair value at January 1, 2018. The fair value of the 60 percent of Net Connect shares not owned by Access IT was $1,500,000. QUESTION 24 What is the Elimination entry S? Retained Earnings 123.000 Common Stock-Access 41,000 Investment in Net Connect 65,600 Noncontrolling Interest 98,400 Retained Earnings 41,000 Common Stock 123,000 Investment in Net Connect 65,600 Noncontrolling Interest 98,400 Net Income 123,000 Common Stock-Access 41,000 Investment in Net Connect 65,600 Noncontrolling Interest 98,400 Retained Earnings Common Stock-Access 41,000 Investment in Net Connect 65,600 Controlling Interest 98,400 None of the above controlling Interest 123.000 QUESTION 25 What is the ending balance of capitalized software after consolidation? $1,137,000 $1,117,000 $1,252,000 $1,122,000 $0 Cash Questions #20-25 are based on the following facts: On January 1, 2018, Access IT Company exchanged $1,000,000 for 40 percent of the outstanding voting stock of Net Connect. Especially attractive to Access IT was a research project underway at Net Connect that would enhance both the speed and quantity of client accessible data. Although not recorded in Net Connect's financial records, the fair value of the research project was considered to be $1,960,000. In contractual agreements with the sole owner of the remaining 60 percent of Net Connect, Access IT was granted (1) various decision-making rights over Net Connect's operating decisions and (2) special service purchase provisions at below-market rates. As a result of these contractual agreements, Access IT established itself as the primary beneficiary of Net Connect. Immediately after the purchase, Access IT and Net Connect presented the following balance sheets: Access IT Net Connect $61,000 $41,000 Investment in Net Connect 1,000,000 Capitalized software 981,000 156,000 Computer equipment 1,066,000 56,000 Communications equipment 916,000 336,000 Patent 191,000 Total assets $4,024,000 $780,000 Long-term debt (941,000) (616,000) Common stock-Access IT (2,660,000) Common stock-Net Connect (41,000) Retained earnings (423,000) (123,000) Total liabilities and equity $(4,024,000) $(780,000) Each of the above amounts represents a fair value at January 1, 2018. The fair value of the 60 percent of Net Connect shares not owned by Access IT was $1,500,000. QUESTION 24 What is the Elimination entry S? Retained Earnings 123.000 Common Stock-Access 41,000 Investment in Net Connect 65,600 Noncontrolling Interest 98,400 Retained Earnings 41,000 Common Stock 123,000 Investment in Net Connect 65,600 Noncontrolling Interest 98,400 Net Income 123,000 Common Stock-Access 41,000 Investment in Net Connect 65,600 Noncontrolling Interest 98,400 Retained Earnings Common Stock-Access 41,000 Investment in Net Connect 65,600 Controlling Interest 98,400 None of the above controlling Interest 123.000 QUESTION 25 What is the ending balance of capitalized software after consolidation? $1,137,000 $1,117,000 $1,252,000 $1,122,000 $0