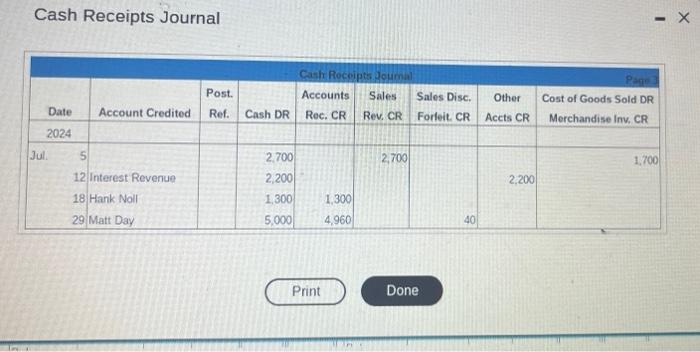

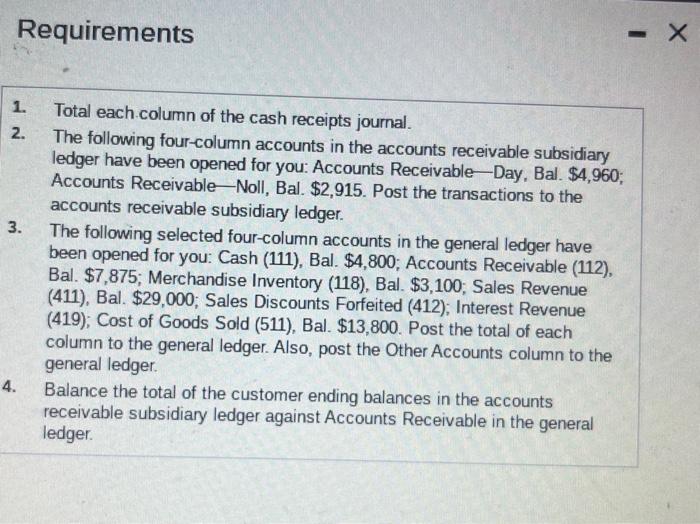

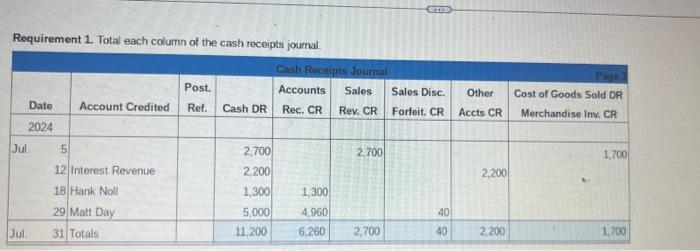

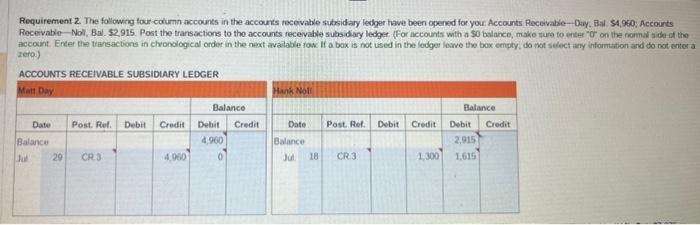

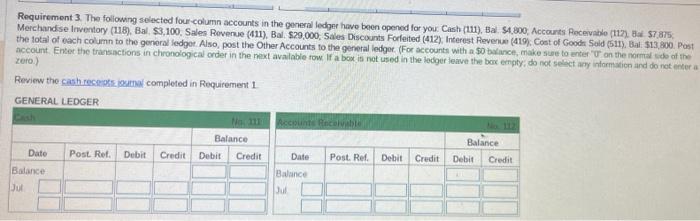

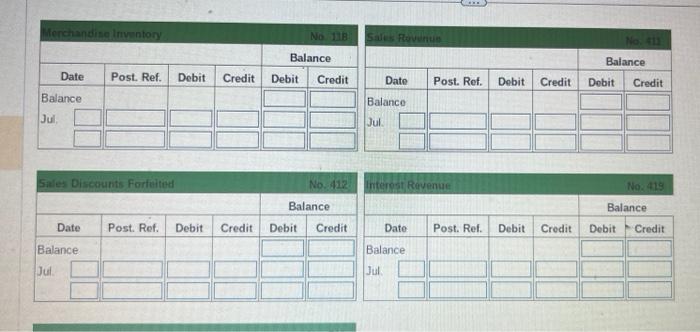

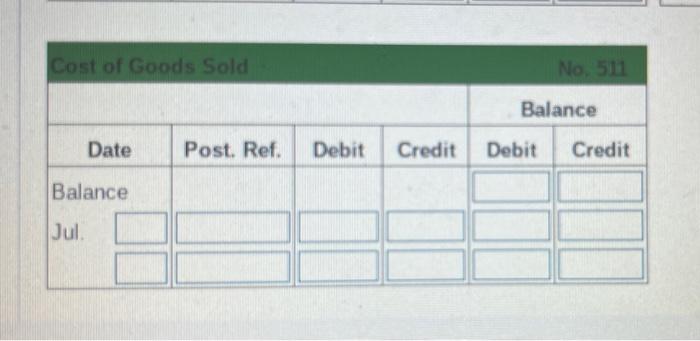

Cash Receipts Journal 2. The following four-column accounts in the accounts receivable subsidiary ledger have been opened for you: Accounts Receivable-Day, Bal. $4,960; Accounts Receivable - Noll, Bal. \$2,915. Post the transactions to the accounts receivable subsidiary ledger. 3. The following selected four-column accounts in the general ledger have been opened for you: Cash (111), Bal. \$4,800; Accounts Receivable (112), Bal. \$7,875; Merchandise Inventory (118), Bal. \$3,100; Sales Revenue (411), Bal. \$29,000; Sales Discounts Forfeited (412); Interest Revenue (419); Cost of Goods Sold (511), Bal. $13,800. Post the total of each column to the general ledger. Also, post the Other Accounts column to the general ledger. 4. Balance the total of the customer ending balances in the accounts receivable subsidiary ledger against Accounts Receivable in the general ledger. Requirement 1. Total each column of the cash receipts journal. Requirement 2. The following four-column accounts in the accourts tecevable subsidary ledger have been opened for your Accounts Receivatie Day. Bal S4, 9s0, Accourts Recervabio- Noll, Bal. \$2,915. Post the transactions to the accounts recevable sulsidiary ledget (For accounts with a $0 bslance, meike nure to enter "or on tise romal a de of the account. Eneer the transactions in chooological order in the next avalable fow. if a box is not used in the ledgor leave the box empty, do not select any infarmation and do not enter a tere) Merchandise Inventory (115), Bal, $3,100, Sales Roverne (411), Bal, $29,000, Sales Discounts Forfeited (412), Interest Revenue (419), Coot of Gooda Sald (511), Bal. \$13,800. Post the total of bach column to the gonoral iedgor. Also, post the Other Accounts to the gerneral ledgor. (For accounth with a 50 bxance, make sues to enter " F, an the normal kido of the account Enter the transactions in chronologi cal order in the next avalable fow. If a box is not used in the ladger leave the box ennpty; do not selact any intormation and do not enter a zero) Review the cash receats iosanal completed in Requirement 1. \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{ Sars ruvinues } & \multicolumn{2}{c|}{ Balance } \\ \hline Date & Post. Ref. & Debit & Credit & Dobit & Credit \\ \hline Balance & & & & & \\ \hline Jul. & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline Sales Discounts Forfeited & \multicolumn{2}{|c|}{ No.412. } \\ \hline Date & Post. Ref. & Debit & Credit & Debit & Credit \\ \hline Balance \\ \hline Jul. & & & & & \\ \hline \end{tabular} Inferest Revenue No. 419 Cost of Goods Sold No. 511 \begin{tabular}{|c|c|c|c|c|c|} \hline Date & Post. Ref. & Debit & Credit & Debit & Credit \\ \hline Balance \\ Jul. & & & & & \end{tabular}