Answered step by step

Verified Expert Solution

Question

1 Approved Answer

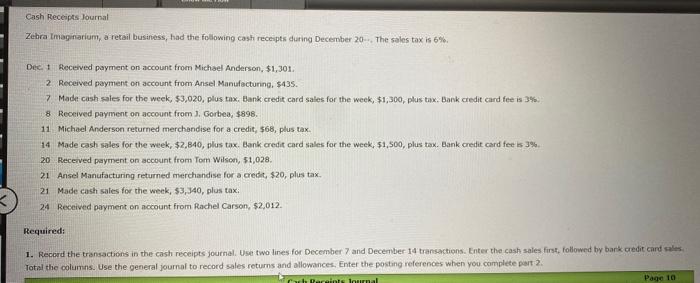

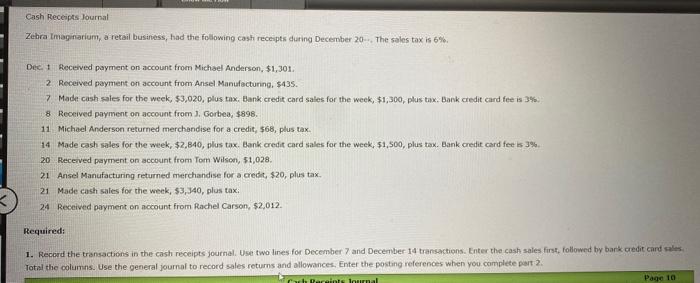

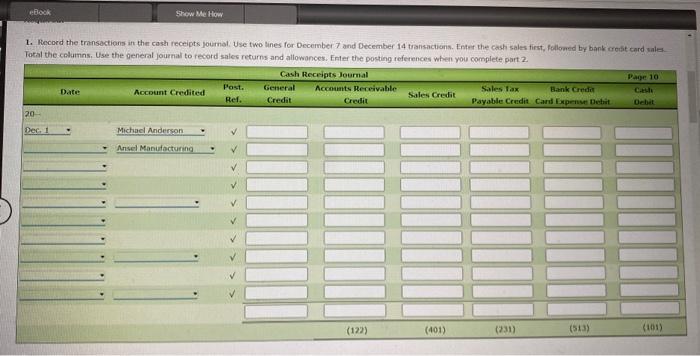

cash receipts journal Zehra Imaginarium, a retail businiess, had the following cast receipts during December 20. The sales tax is 6%. Dec, 1 Received payment

cash receipts journal

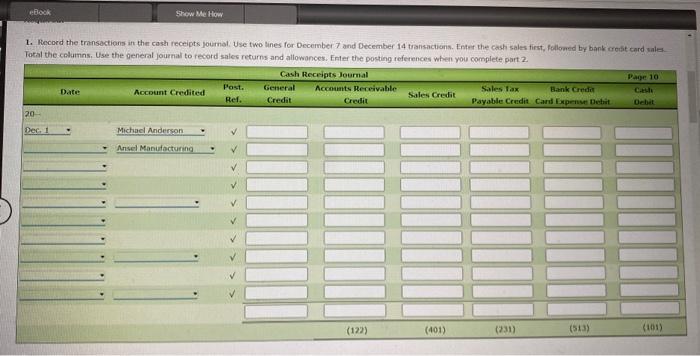

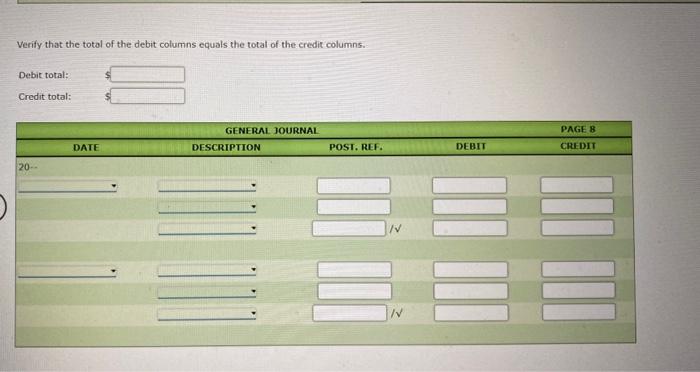

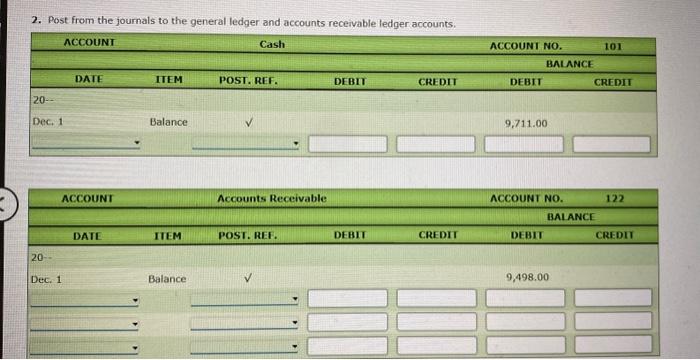

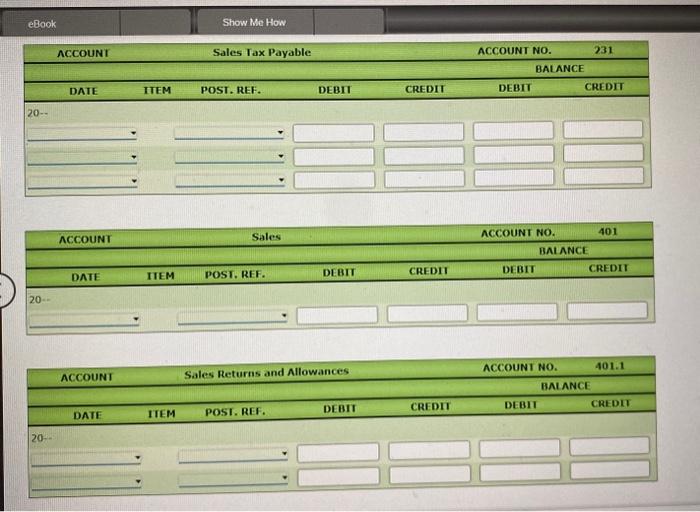

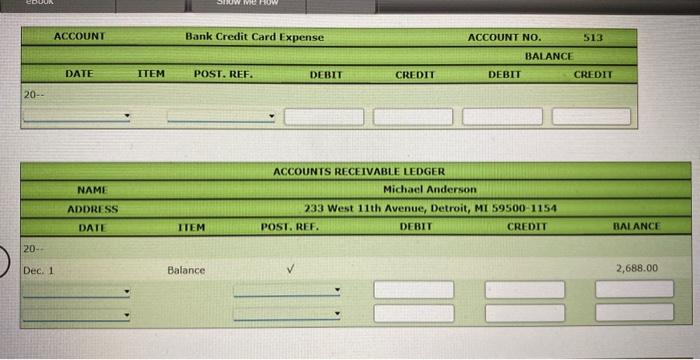

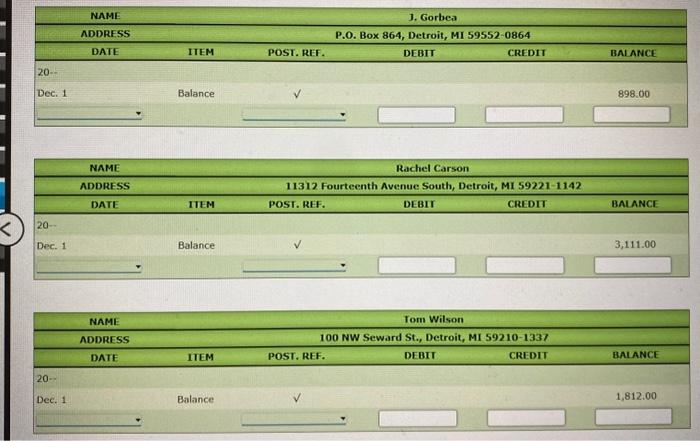

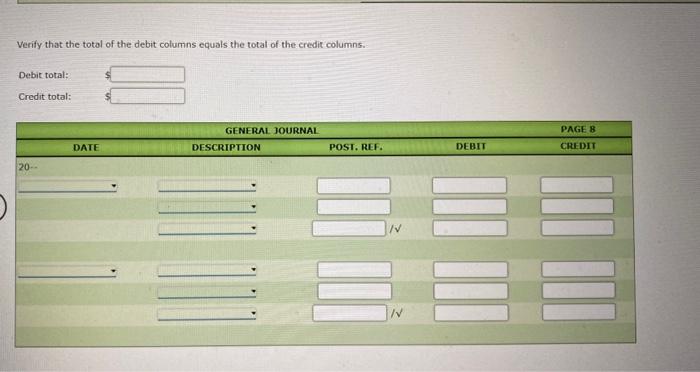

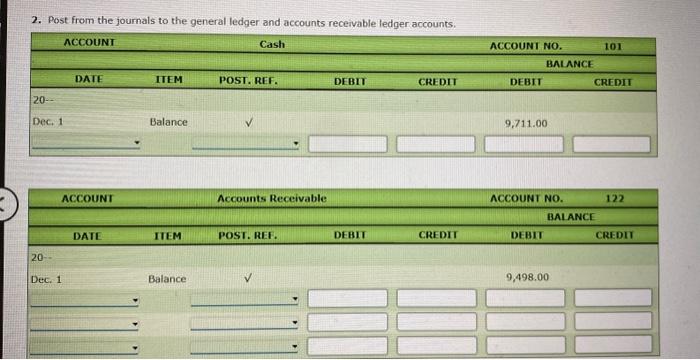

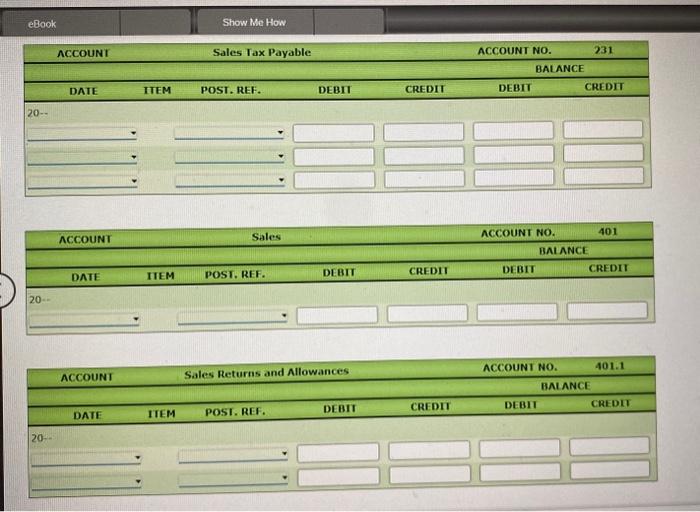

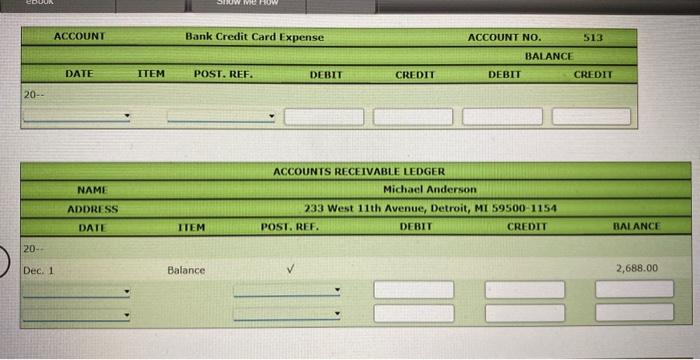

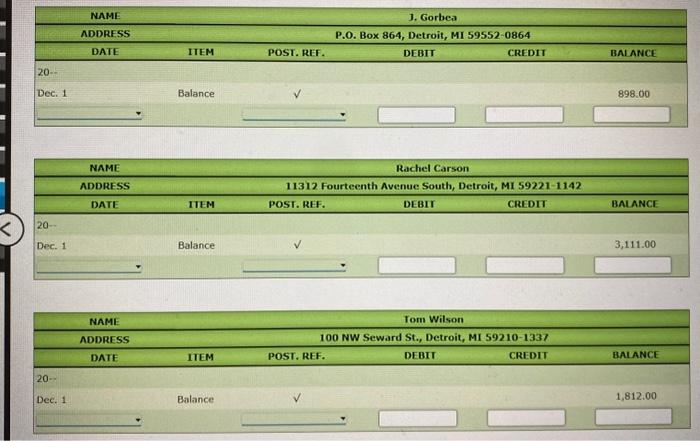

Zehra Imaginarium, a retail businiess, had the following cast receipts during December 20. The sales tax is 6%. Dec, 1 Received payment on account from Michael Anderson, $1,301. 2. Received payment on account from Ansel Manufacturing. $435. 7 . Made cash sales for the week, $3,020, plus tax. Bank credit card sales for the week, $1,300, plus tax. Bank credit card fee is 345 . 8 Received payment on account from J. Gorbea, $898. 11. Michael Anderson returned merchandise for a credit, $68, plus tax. 14 Made cash sales for the week, $2,840, plus tax. Bank credit card sales for the week, $1,500, plus tax. Bank credit card fee is 3%. 20 Received payment on account from Tom Wilson, 51,028. 21 Ansel Manufacturing returned merchandise for a credi, $20, plus tax. 21 Made cash sales for the week, 53,340 , plus tax: 24 Received payment on account from Rachel Carson, $2,012. Required; 1. Record the transactions in the cash receipts journal. Use two lines for December 7 and December It transactions. Enter the cash sales first, followed by bark credit cand s Total the columns. Use the general journal to record sales retums and allowances, Enter the posting reterences when you camplete part 2. 1. Record the transections in the cash receipts journal: Use two lines for December 7 and December 14 transactions. Enter the cash sales first, folloned by bank crebt card sale Total the colamns, Use the general journal to record sales returns and allowances. Enter the posting references when you complete part 2. Verify that the total of the debit columns equals the totat of the credit columns. 2. Post from the journals to the general ledger and accounts receivable ledger accounts. Zehra Imaginarium, a retail businiess, had the following cast receipts during December 20. The sales tax is 6%. Dec, 1 Received payment on account from Michael Anderson, $1,301. 2. Received payment on account from Ansel Manufacturing. $435. 7 . Made cash sales for the week, $3,020, plus tax. Bank credit card sales for the week, $1,300, plus tax. Bank credit card fee is 345 . 8 Received payment on account from J. Gorbea, $898. 11. Michael Anderson returned merchandise for a credit, $68, plus tax. 14 Made cash sales for the week, $2,840, plus tax. Bank credit card sales for the week, $1,500, plus tax. Bank credit card fee is 3%. 20 Received payment on account from Tom Wilson, 51,028. 21 Ansel Manufacturing returned merchandise for a credi, $20, plus tax. 21 Made cash sales for the week, 53,340 , plus tax: 24 Received payment on account from Rachel Carson, $2,012. Required; 1. Record the transactions in the cash receipts journal. Use two lines for December 7 and December It transactions. Enter the cash sales first, followed by bark credit cand s Total the columns. Use the general journal to record sales retums and allowances, Enter the posting reterences when you camplete part 2. 1. Record the transections in the cash receipts journal: Use two lines for December 7 and December 14 transactions. Enter the cash sales first, folloned by bank crebt card sale Total the colamns, Use the general journal to record sales returns and allowances. Enter the posting references when you complete part 2. Verify that the total of the debit columns equals the totat of the credit columns. 2. Post from the journals to the general ledger and accounts receivable ledger accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started