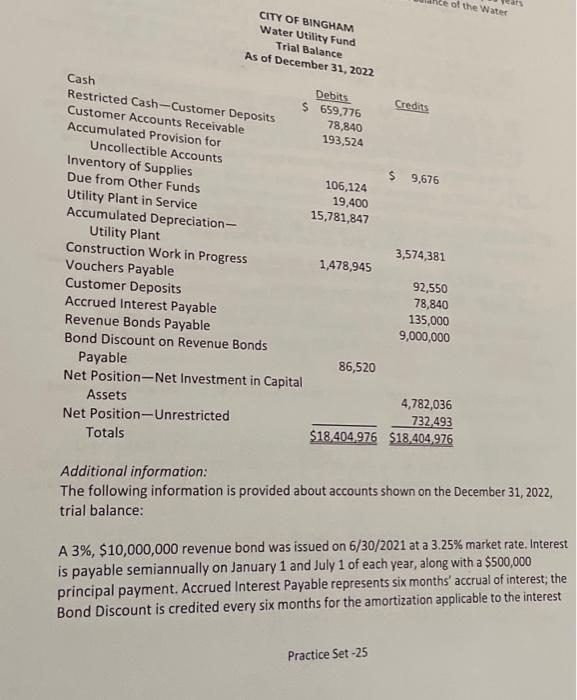

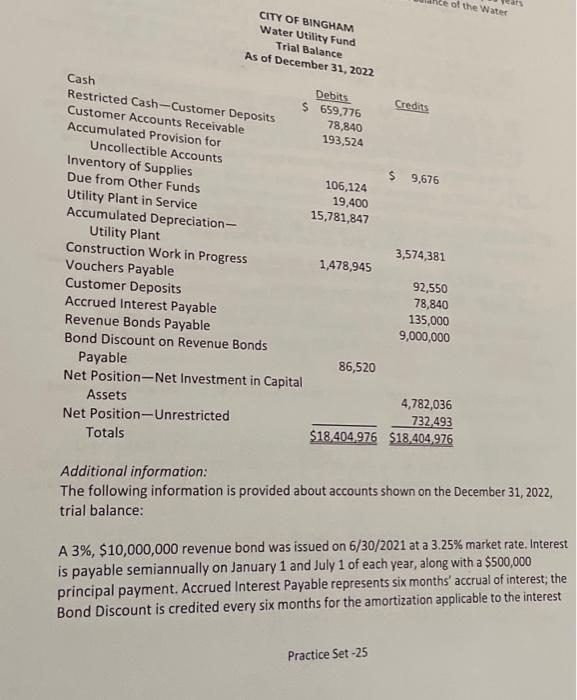

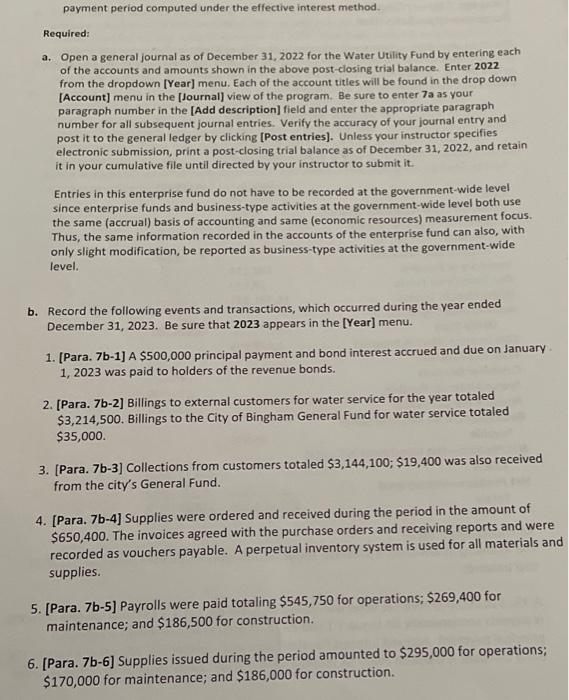

Cash Restricted Cash-Customer Deposits Customer Accounts Receivable Accumulated Provision for Uncollectible Accounts Inventory of Supplies Due from Other Funds Utility Plant in Service Assets CITY OF BINGHAM Water Utility Fund Trial Balance As of December 31, 2022 Accumulated Depreciation- Utility Plant Construction Work in Progress Vouchers Payable Customer Deposits Accrued Interest Payable Revenue Bonds Payable Bond Discount on Revenue Bonds Payable Net Position-Net Investment in Capital Net Position-Unrestricted Totals Debits $ 659,776 78,840 193,524 106,124 19,400 15,781,847 1,478,945 86,520 Credits ce of the Water $ 9,676 Practice Set -25 3,574,381 92,550 78,840 135,000 9,000,000 4,782,036 732,493 $18,404,976 $18,404,976 Additional information: The following information is provided about accounts shown on the December 31, 2022, trial balance: A 3%, $10,000,000 revenue bond was issued on 6/30/2021 at a 3.25% market rate. Interest is payable semiannually on January 1 and July 1 of each year, along with a $500,000 principal payment. Accrued Interest Payable represents six months' accrual of interest; the Bond Discount is credited every six months for the amortization applicable to the interest

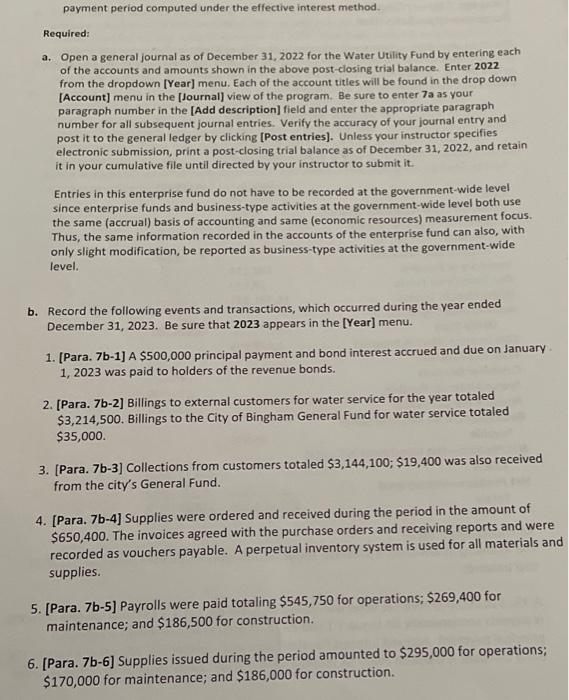

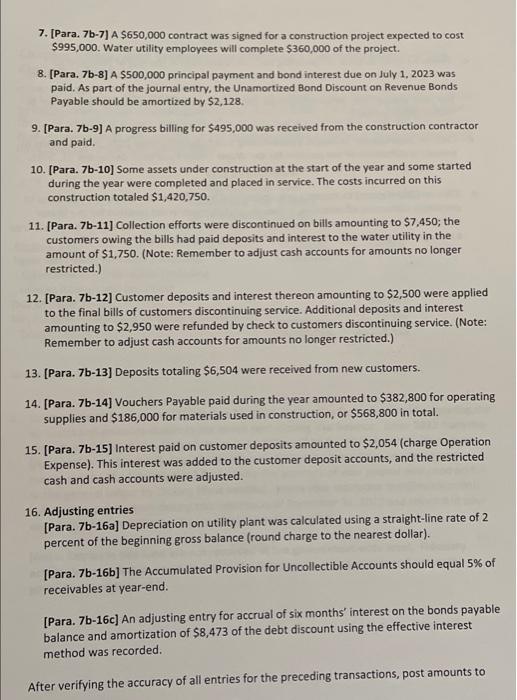

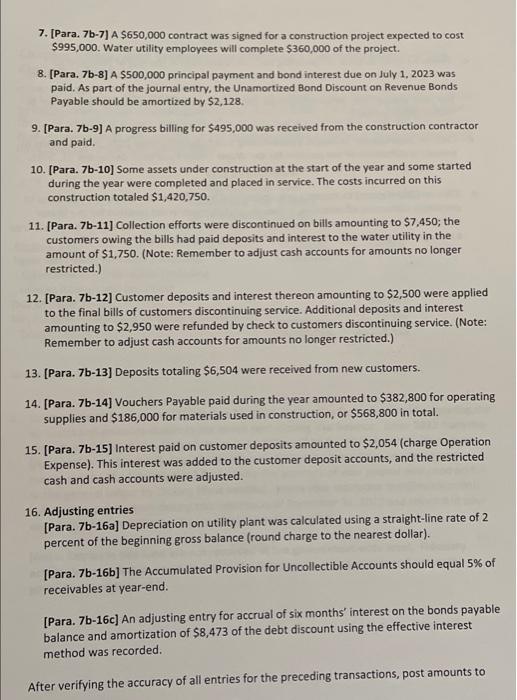

CITY OF BINGHAM Water Utility Fund Trial Balance. As of Additional information: The following information is provided about accounts shown on the December 31, 2022, trial balance: A 3%,$10,000,000 revenue bond was issued on 6/30/2021 at a 3.25% market rate. Interest is payable semiannually on January 1 and July 1 of each year, along with a $500,000 principal payment. Accrued Interest Payable represents six months' accrual of interest; the Bond Discount is credited every six months for the amortization applicable to the interest payment period computed under the effective interest method. Required: a. Open a general journal as of December 31,2022 for the Water Utility Fund by entering each of the accounts and amounts shown in the above post-closing trial bafance. Enter 2022 from the dropdown [Year] menu. Each of the account titles will be found in the drop down [Account] menu in the [Journal] view of the program. Be sure to enter 7a as your paragraph number in the [Add description] field and enter the appropriate paragraph number for all subsequent journal entries. Verify the accuracy of your journal entry and post it to the general ledger by clicking [Post entries]. Unless your instructor specifies electronic submission, print a post-closing trial balance as of December 31,2022, and retain it in your cumulative file until directed by your instructor to submit it: Entries in this enterprise fund do not have to be recorded at the government-wide level since enterprise funds and business-type activities at the government-wide level both use the same (accrual) basis of accounting and same (economic resources) measurement focus. Thus, the same information recorded in the accounts of the enterprise fund can also, with only slight modification, be reported as business-type activities at the government-wide level. b. Record the following events and transactions, which occurred during the year ended December 31, 2023. Be sure that 2023 appears in the [Year] menu. 1. [Para. 7b-1] A $500,000 principal payment and bond interest accrued and due on January 1,2023 was paid to holders of the revenue bonds. 2. [Para. 7b-2] Billings to external customers for water service for the year totaled $3,214,500. Billings to the City of Bingham General Fund for water service totaled $35,000. 3. [Para. 7b-3] Collections from customers totaled $3,144,100;$19,400 was also received from the city's General Fund. 4. [Para. 7b-4] Supplies were ordered and received during the period in the amount of $650,400. The invoices agreed with the purchase orders and receiving reports and were recorded as vouchers payable. A perpetual inventory system is used for all materials and supplies. 5. [Para. 7b-5] Payrolls were paid totaling $545,750 for operations; $269,400 for maintenance; and $186,500 for construction. 6. [Para. 7b-6] Supplies issued during the period amounted to $295,000 for operations; $170,000 for maintenance; and $186,000 for construction. 7. [Para. 7b-7] A $650,000 contract was signed for a construction project expected to cost $995,000. Water utility employees will complete $360,000 of the project. 8. [Para. 7b-8] A \$500,000 principal payment and bond interest due on July 1, 2023 was paid. As part of the journal entry, the Unamortized Bond Discount on Revenue Bonds Payable should be amortized by $2,128. 9. [Para. 7b-9] A progress billing for $495,000 was received from the construction contractor and paid. 10. [Para. 7b-10] Some assets under construction at the start of the year and some started during the year were completed and placed in service. The costs incurred on this construction totaled $1,420,750. 11. [Para. 7b11] Collection efforts were discontinued on bills amounting to $7,450; the customers owing the bills had paid deposits and interest to the water utility in the amount of $1,750. (Note: Remember to adjust cash accounts for amounts no longer restricted.) 12. [Para. 7b-12] Customer deposits and interest thereon amounting to $2,500 were applied to the final bills of customers discontinuing service. Additional deposits and interest amounting to $2,950 were refunded by check to customers discontinuing service. (Note: Remember to adjust cash accounts for amounts no longer restricted.) 13. [Para. 7b-13] Deposits totaling $6,504 were received from new customers. 14. [Para. 7b-14] Vouchers Payable paid during the year amounted to $382,800 for operating supplies and $186,000 for materials used in construction, or $568,800 in total. 15. [Para. 7b-15] Interest paid on customer deposits amounted to $2,054 (charge Operation Expense). This interest was added to the customer deposit accounts, and the restricted cash and cash accounts were adjusted. 16. Adjusting entries [Para. 7b-16a] Depreciation on utility plant was calculated using a straight-line rate of 2 percent of the beginning gross balance (round charge to the nearest dollar). [Para. 7b-16b] The Accumulated Provision for Uncollectible Accounts should equal 5% of receivables at year-end. [Para. 7b-16c] An adjusting entry for accrual of six month' interest on the bonds payable balance and amortization of $8,473 of the debt discount using the effective interest method was recorded. After verifying the accuracy of all entries for the preceding transactions, post amounts to