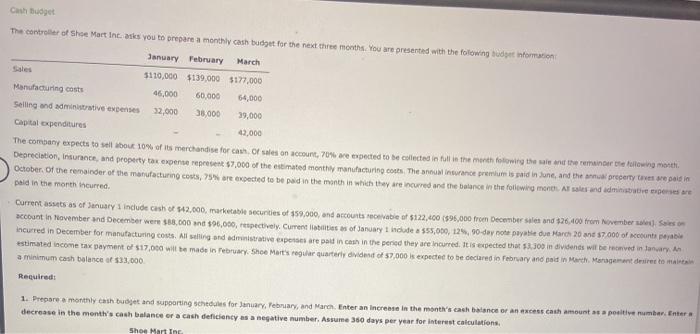

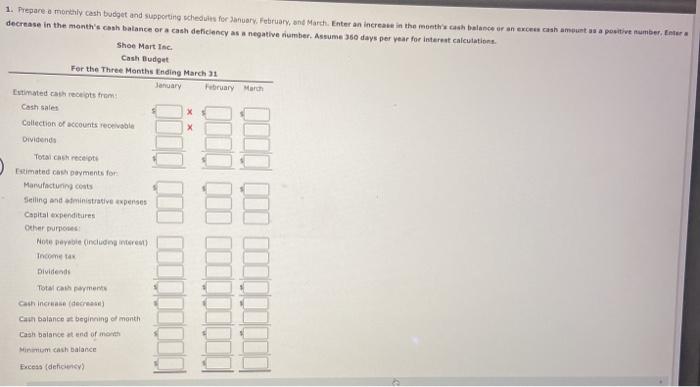

Cash tuge The control of Shoe Mart Int. asks you to prepare a monthly cash budget for the next three months. You are presented with the folowing det information January February March $110,000 $139,000 $177,000 Manufacturing costs 46,000 60,000 64,000 Selling and administrative expenses 35,000 29,000 Capital expenditures 49.000 The comany expects to sell about 10% of its merchandise forca Of sales on account, 70% are expected to be collected into the month flowing the sale of the remainder the following month. Depreciation, Insurance, and property tax expense represent $7,000 of the estimated monthly manufacturing costs. The insurance premium is paid in one, and the property tres se pedin October. Of the remainder of the manufacturing costs, are expected to be paid in the month in which they are incurred and the balance in the following monen. Al sales and admin the expenses we paid in the month incurred. Current assets as of January 1 include cash of $42.000, marcate secundies of $59.000, and accounts receivable $122,400 (595,000 from December sier and $26.400 from November Seson account in November and December were 588,000 $90,000, respectively. Currenties as of January 1 include a $55,000, 129-day not payable du March 20 and 7.000 of accounts incurred in December for manufacturing costs. All selling and administrative expenses are paid in cash in the period they are incurred. It is expected that 53.300 in dividends will be removed in January estimated income tax payment of $17,000 will be made in February, Shoe Mart's regular quarterly dividend of $7,000 is expected to be declared in February and paid in March. Management desired to maine a minimum cash balance of 533,000 Required: 1. Prepare a monthly cash budget and supporting schedus for January February, and March, Enter an increase in the month's cash balance or an excess cash amount as a positive number Enter decrease in the month's cash balance or a cash deficiency as a negative number. Assume 360 days per year for interest calculations Shoe Martine 1. Prepare a monthly cash budget and supporting ches for January February, and March. Enter an increase in the month's cash balance or an exo cash amount as a positive number, Enter decrease in the month's cash balance or cash deficiency as negative number. Assume 360 days per year for interest calculations. Shoe Martine Cash Budget For the Three Months Ending March 31 January February March Estimated costs from Cash sales X Collection of accounts receivable X Dividendo Total Carece te Estimated cash payments for Manufacturing costs Selling and ministrative expenses Capital expenditures Other purpos Note Daybe including interest Income tax Dividends Total cath payment Cash increase (dec) can balance beginning of month Cash balance and of moth Minimum cash balance Excesa (dec)