Answered step by step

Verified Expert Solution

Question

1 Approved Answer

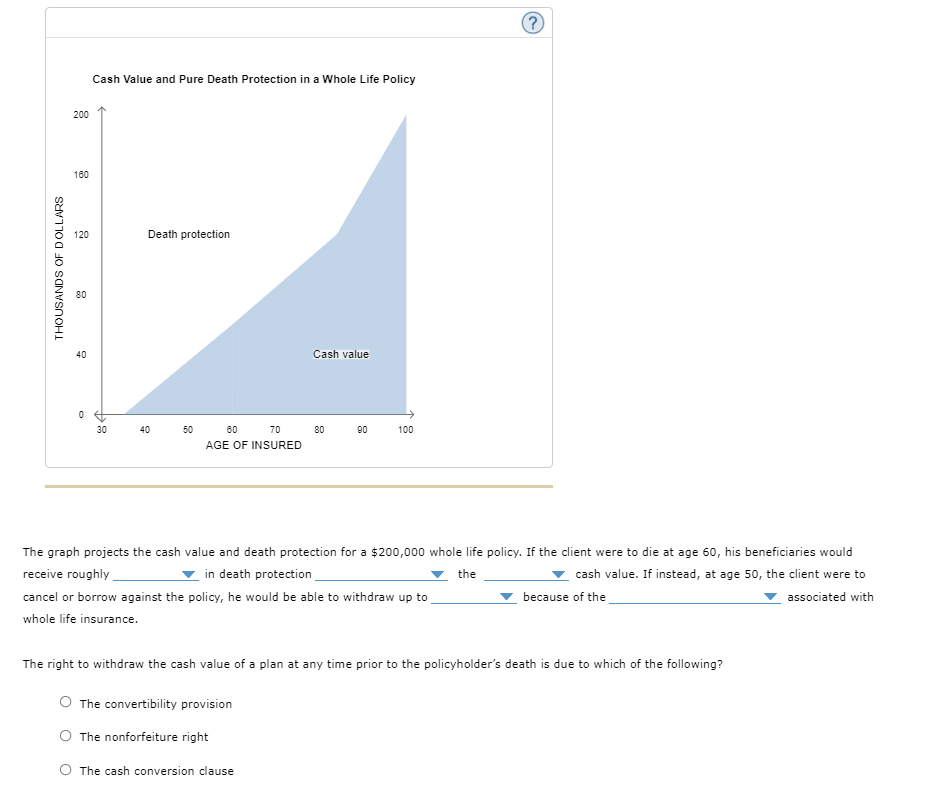

Cash Value and Pure Death Protection in a Whole Life Policy The graph projects the cash value and death protection for a $ 2 0

Cash Value and Pure Death Protection in a Whole Life Policy

The graph projects the cash value and death protection for a $ whole life policy. If the client were to die at age his beneficiaries would

receive roughly

in death protection

the

cash value. If instead, at age the client were to

cancel or borrow against the policy, he would be able to withdraw up to

because of the

associated with

whole life insurance.

The right to withdraw the cash value of a plan at any time prior to the policyholder's death is due to which of the following?

The convertibility provision

The nonforfeiture right

The cash conversion clause

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started