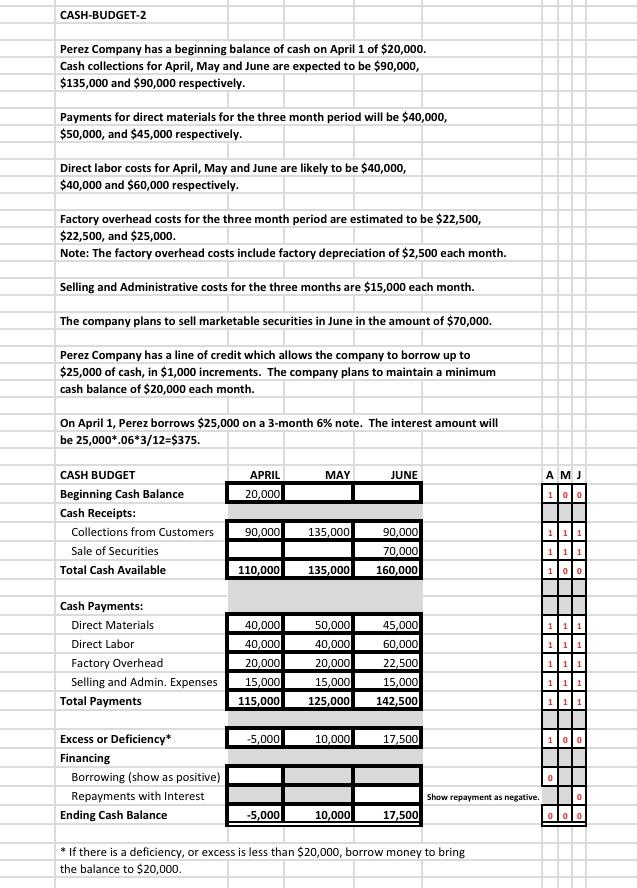

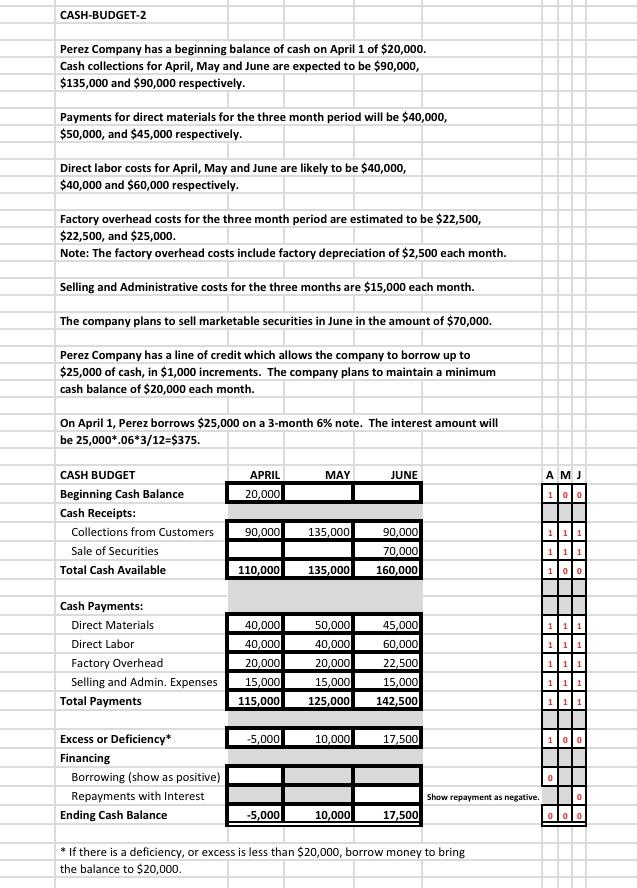

CASH-BUDGET-2 Perez Company has a beginning balance of cash on April 1 of $20,000. Cash collections for April, May and June are expected to be $90,000, $135,000 and $90,000 respectively. Payments for direct materials for the three month period will be $40,000, $50,000, and $45,000 respectively. Direct labor costs for April, May and June are likely to be $40,000, $40,000 and $60,000 respectively. Factory overhead costs for the three month period are estimated to be $22,500, $22,500, and $25,000. Note: The factory overhead costs include factory depreciation of $2,500 each month. Selling and Administrative costs for the three months are $15,000 each month. The company plans to sell marketable securities in June in the amount of $70,000. Perez Company has a line of credit which allows the company to borrow up to $25,000 of cash, in $1,000 increments. The company plans to maintain a minimum cash balance of $20,000 each month. On April 1, Perez borrows $25,000 on a 3-month 6% note. The interest amount will be 25,000*.06*3/12-$375. CASH BUDGET APRIL MAY JUNE Beginning Cash Balance 20,000 Cash Receipts: Collections from Customers 90,000 135,000 90,000 Sale of Securities 70,000 Total Cash Available 110,000 135,000 160,000 Cash Payments: Direct Materials 40,000 50,000 45,000 Direct Labor 40,000 40,000 60,000 Factory Overhead 20,000 20,000 22,500 Selling and Admin. Expenses 15,000 15,000 15,000 Total Payments 115,000 125,000 142,500 Excess or Deficiency* -5,000 10,000 17,500 Financing Borrowing (show as positive) Repayments with Interest Ending Cash Balance -5,000 10,000 17,500 * If there is a deficiency, or excess is less than $20,000, borrow money to bring the balance to $20,000. Show repayment as negative. A MJ 100 1 1 1 1 11 100 111 111 111 111 100 000 CASH-BUDGET-2 Perez Company has a beginning balance of cash on April 1 of $20,000. Cash collections for April, May and June are expected to be $90,000, $135,000 and $90,000 respectively. Payments for direct materials for the three month period will be $40,000, $50,000, and $45,000 respectively. Direct labor costs for April, May and June are likely to be $40,000, $40,000 and $60,000 respectively. Factory overhead costs for the three month period are estimated to be $22,500, $22,500, and $25,000. Note: The factory overhead costs include factory depreciation of $2,500 each month. Selling and Administrative costs for the three months are $15,000 each month. The company plans to sell marketable securities in June in the amount of $70,000. Perez Company has a line of credit which allows the company to borrow up to $25,000 of cash, in $1,000 increments. The company plans to maintain a minimum cash balance of $20,000 each month. On April 1, Perez borrows $25,000 on a 3-month 6% note. The interest amount will be 25,000*.06*3/12-$375. CASH BUDGET APRIL MAY JUNE Beginning Cash Balance 20,000 Cash Receipts: Collections from Customers 90,000 135,000 90,000 Sale of Securities 70,000 Total Cash Available 110,000 135,000 160,000 Cash Payments: Direct Materials 40,000 50,000 45,000 Direct Labor 40,000 40,000 60,000 Factory Overhead 20,000 20,000 22,500 Selling and Admin. Expenses 15,000 15,000 15,000 Total Payments 115,000 125,000 142,500 Excess or Deficiency* -5,000 10,000 17,500 Financing Borrowing (show as positive) Repayments with Interest Ending Cash Balance -5,000 10,000 17,500 * If there is a deficiency, or excess is less than $20,000, borrow money to bring the balance to $20,000. Show repayment as negative. A MJ 100 1 1 1 1 11 100 111 111 111 111 100 000