Answered step by step

Verified Expert Solution

Question

1 Approved Answer

cashflow question, kindly provide me solution The Statement of Financial Position of C.F. plc for the year ended 31 December 20X4, together with comparative figures

cashflow question, kindly provide me solution

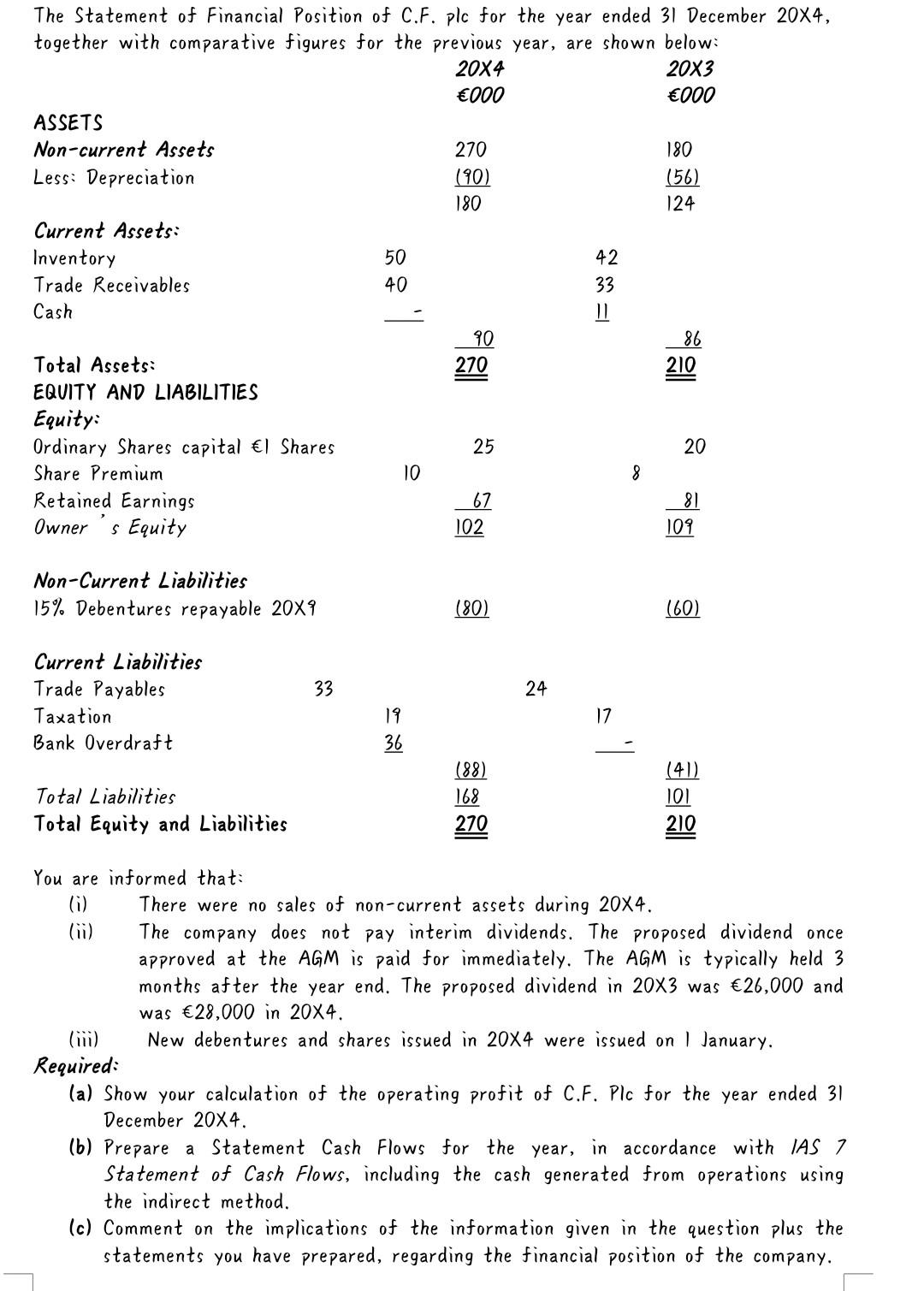

The Statement of Financial Position of C.F. plc for the year ended 31 December 20X4, together with comparative figures for the previous year, are shown below: 20X4 20X3 000 000 ASSETS Non-current Assets 270 180 Less: Depreciation (90) (56) 180 124 Current Assets: Inventory 50 42 Trade Receivables 40 33 Cash 11 90 86 Total Assets: 270 210 EQUITY AND LIABILITIES Equity: Ordinary Shares capital Shares 25 20 Share Premium 10 8 Retained Earnings 67 81 Owner s Equity 102 109 of Non-Current Liabilities 15% Debentures repayable 20x9 (80) (60) 33 24 Current Liabilities Trade Payables Taxation Bank Overdraft 17 19 36 Total Liabilities Total Equity and Liabilities (88) 168 270 (41) 101 210 You are informed that: (1) There were no sales of non-current assets during 20X4. The company does not pay interim dividends. The proposed dividend once approved at the AGM is paid for immediately. The AGM is typically held 3 months after the year end. The proposed dividend in 20x3 was 26,000 and was 28,000 in 20X4. New debentures and shares issued in 20X4 were issued on January. Required: (a) Show your calculation of the operating profit of C.F. Plc for the year ended 31 December 20X4. (b) Prepare a statement Cash Flows for the year, in accordance with IAS 7 Statement of Cash Flows, including the cash generated from operations using the indirect method. (c) Comment on the implications of the information given in the question plus the statements you have prepared, regarding the financial position of the companyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started