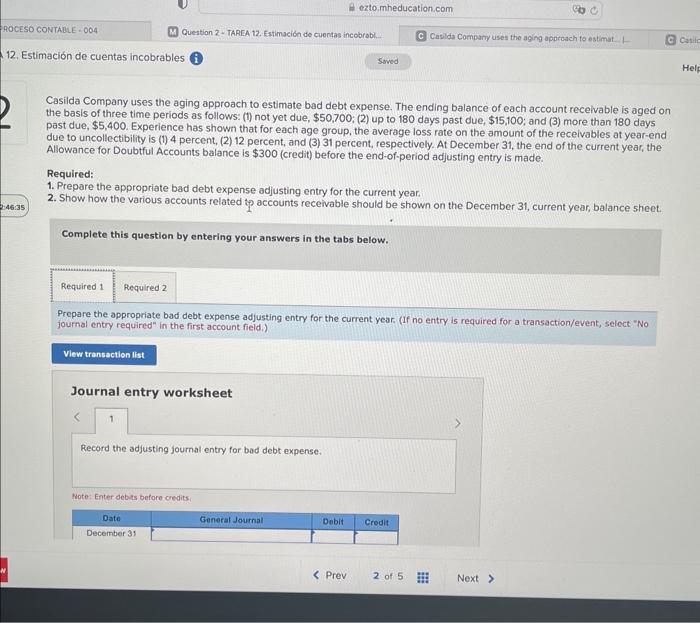

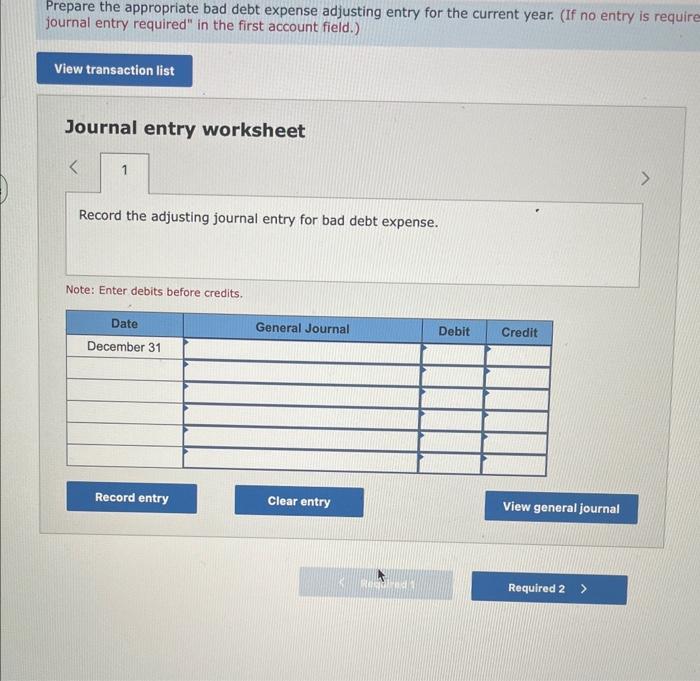

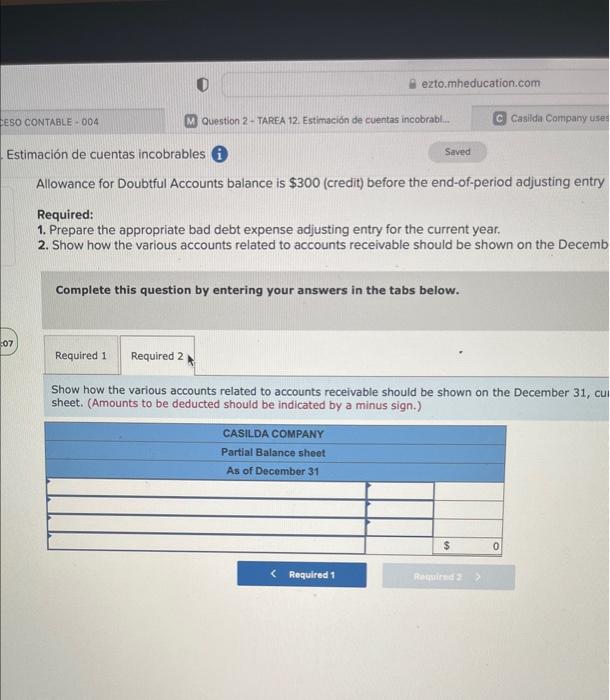

Casilda Company uses the aging approach to estimate bad debt expense. The ending balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, $50,700; (2) up to 180 days past due, $15,100; and (3) more than 180 days past due, $5,400. Experience has shown that for each age group, the average loss rate on the amount of the receivables at year-end due to uncollectibility is (1) 4 percent, (2) 12 percent, and (3) 31 percent, respectively. At December 31 , the end of the current year, the Allowance for Doubtful Accounts balance is $300 (credit) before the end-of-period adjusting entry is made. Required: 1. Prepare the appropriate bad debt expense adjusting entry for the current year: 2. Show how the various accounts related tp accounts receivable should be shown on the December 31 , current year, balance sheet. Complete this question by entering your answers in the tabs below. Prepare the appropriate bad debt expense adjusting entry for the current year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the adjusting journal entry for bad debt expense. Wote: Enter debits before oredits: Prepare the appropriate bad debt expense adjusting entry for the current year. (If no entry is requir journal entry required" in the first account field.) Journal entry worksheet Record the adjusting journal entry for bad debt expense. Note: Enter debits before credits. Allowance for Doubtful Accounts balance is $300 (credit) before the end-of-period adjusting entry Required: 1. Prepare the appropriate bad debt expense adjusting entry for the current year. 2. Show how the various accounts related to accounts receivable should be shown on the Decemb Complete this question by entering your answers in the tabs below. Show how the various accounts related to accounts receivable should be shown on the December 31 , cu sheet. (Amounts to be deducted should be indicated by a minus sign.) Casilda Company uses the aging approach to estimate bad debt expense. The ending balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, $50,700; (2) up to 180 days past due, $15,100; and (3) more than 180 days past due, $5,400. Experience has shown that for each age group, the average loss rate on the amount of the receivables at year-end due to uncollectibility is (1) 4 percent, (2) 12 percent, and (3) 31 percent, respectively. At December 31 , the end of the current year, the Allowance for Doubtful Accounts balance is $300 (credit) before the end-of-period adjusting entry is made. Required: 1. Prepare the appropriate bad debt expense adjusting entry for the current year: 2. Show how the various accounts related tp accounts receivable should be shown on the December 31 , current year, balance sheet. Complete this question by entering your answers in the tabs below. Prepare the appropriate bad debt expense adjusting entry for the current year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the adjusting journal entry for bad debt expense. Wote: Enter debits before oredits: Prepare the appropriate bad debt expense adjusting entry for the current year. (If no entry is requir journal entry required" in the first account field.) Journal entry worksheet Record the adjusting journal entry for bad debt expense. Note: Enter debits before credits. Allowance for Doubtful Accounts balance is $300 (credit) before the end-of-period adjusting entry Required: 1. Prepare the appropriate bad debt expense adjusting entry for the current year. 2. Show how the various accounts related to accounts receivable should be shown on the Decemb Complete this question by entering your answers in the tabs below. Show how the various accounts related to accounts receivable should be shown on the December 31 , cu sheet. (Amounts to be deducted should be indicated by a minus sign.)