Question

Castillo Products Company The Castillo Products Company was started in 2017. The company manufactures components for personal digital assistant (PDA) products and for other handheld

Castillo Products Company The Castillo Products Company was started in 2017. The company manufactures components for personal digital assistant (PDA) products and for other handheld electronic products. A difficult operating year, 2018, was followed by a profitable 2019. The founders (Cindy and Rob Castillo) are interested in estimating their cost of financial capital because they are expecting to secure additional external financing to support planned growth.

Short-term bank loans are available at an 8 percent interest rate. Cindy and Rob believe that the cost of obtaining long-term debt and equity capital will be somewhat higher. The real interest rate is estimated to be 2 percent, and a long-run inflation premium is estimated at 3 percent. The interest rate on long-term government bonds is 7 percent. A default-risk premium on long-term debt is estimated at 6 percent; plus Castillo Products is expecting to have to pay a liquidity premium of 3 percent due to the illiquidity associated with its long-term debt. The market risk premium on large-firm common stocks over the rate on long-term government bonds is estimated to be 6 percent. Cindy and Rob expect that equity investors in their venture will require an additional investment risk premium estimated at two times the market risk premium on large-firm common stocks.

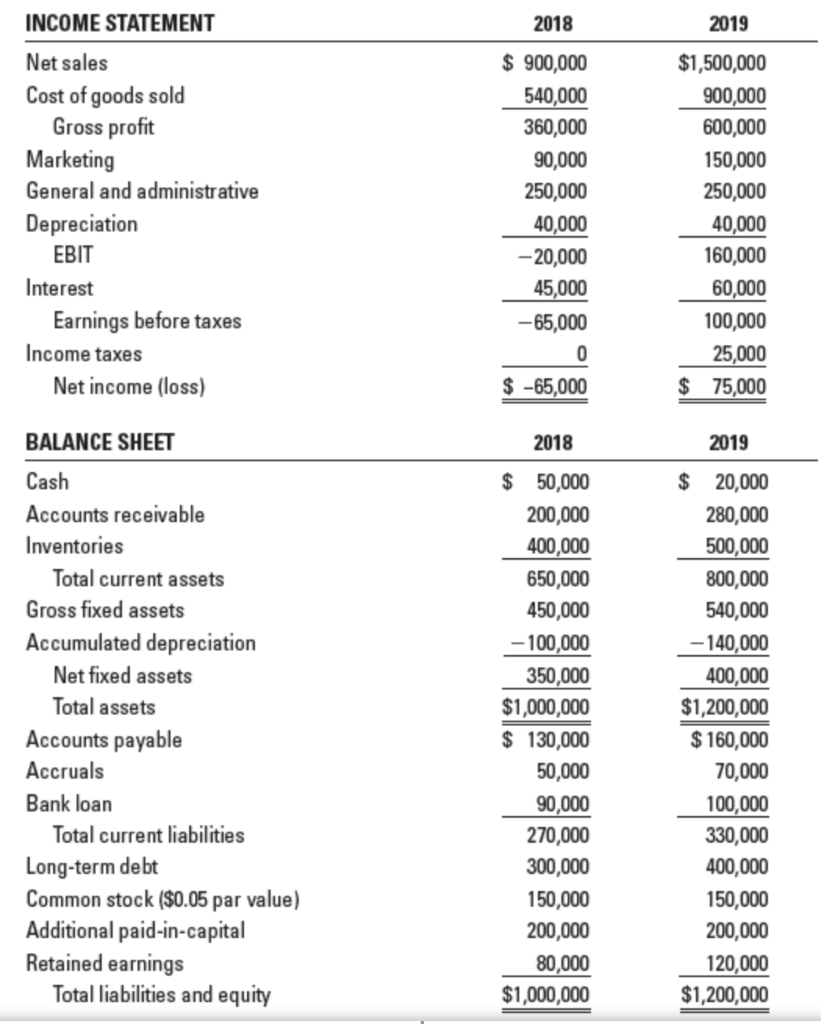

Following are income statements and balance sheets for the Castillo Products Company for 2018 and 2019.

Calculate the net profit margin, total-sales-to-total-assets ratio, the equity multiplier, and the return on equity for both 2018 and 2019 for the Castillo Products Corporation. Describe what happened in terms of financial performance between the two years.

Estimate the cost of short-term bank loans, long-term debt, and common equity capital for the Castillo Products Corporation.

Although, Castillo Products paid a low effective tax rate in 2019, a 30 percent income tax rate is considered more appropriate when looking to the future. Estimate the after-tax cost of short-term bank loans, long-term debt, and the ventures common equity.

Estimate the weighted average cost of capital (WACC) for the Castillo Products Corporation using the book values of interest-bearing debt and stockholders equity capital at the end of 2019.

Cindy and Rob estimate that the market value of the common equity in the venture is $900,000 at the end of 2019. The market values of interest-bearing debt are judged to be the same as the recorded book values at the end of 2019. Estimate the market value-based weighted average cost of capital for Castillo Products.

Would you recommend to Cindy and Rob that they use the book valuebased WACC estimate or the market valuebased WACC estimate for planning purposes? Why?

INCOME STATEMENT 2018 2019 Net sales Cost of goods sold Gross profit Marketing General and administrative Depreciation EBIT Interest Earnings before taxes Income taxes Net income (loss) $ 900,000 540,000 360,000 90,000 250,000 40,000 -20,000 45,000 -65,000 0 $ -65,000 $1,500,000 900,000 600,000 150,000 250,000 40,000 160,000 60,000 100,000 25,000 $ 75,000 BALANCE SHEET 2018 2019 Cash Accounts receivable Inventories Total current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets Accounts payable Accruals Bank loan Total current liabilities Long-term debt Common stock ($0.05 par value) Additional paid-in-capital Retained earnings Total liabilities and equity $ 50,000 200,000 400,000 650,000 450,000 - 100,000 350,000 $1,000,000 $ 130,000 50,000 90,000 270,000 300,000 150,000 200,000 80,000 $1,000,000 $ 20,000 280,000 500,000 800,000 540,000 -140,000 400,000 $1,200,000 $ 160,000 70,000 100,000 330,000 400,000 150,000 200,000 120,000 $1,200,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started