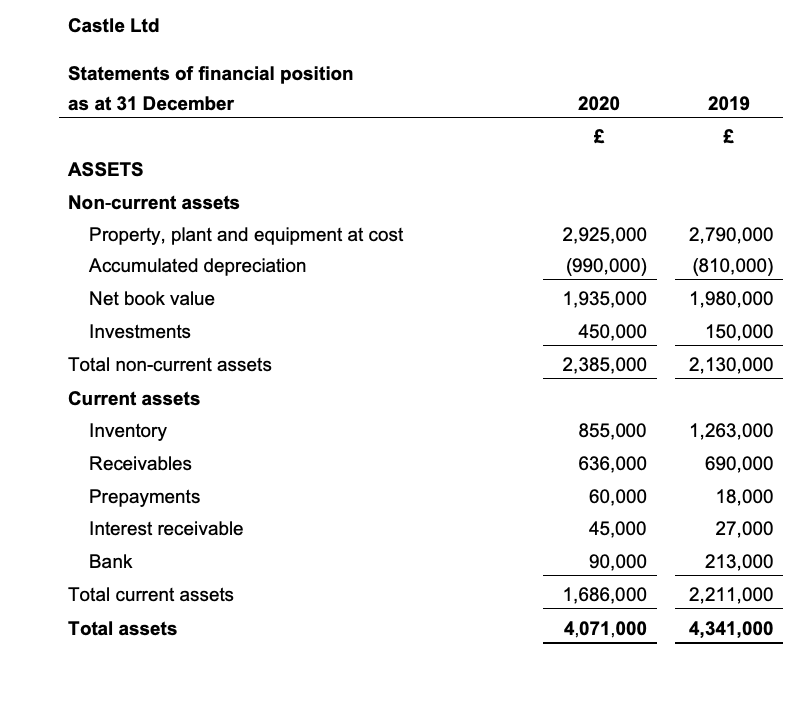

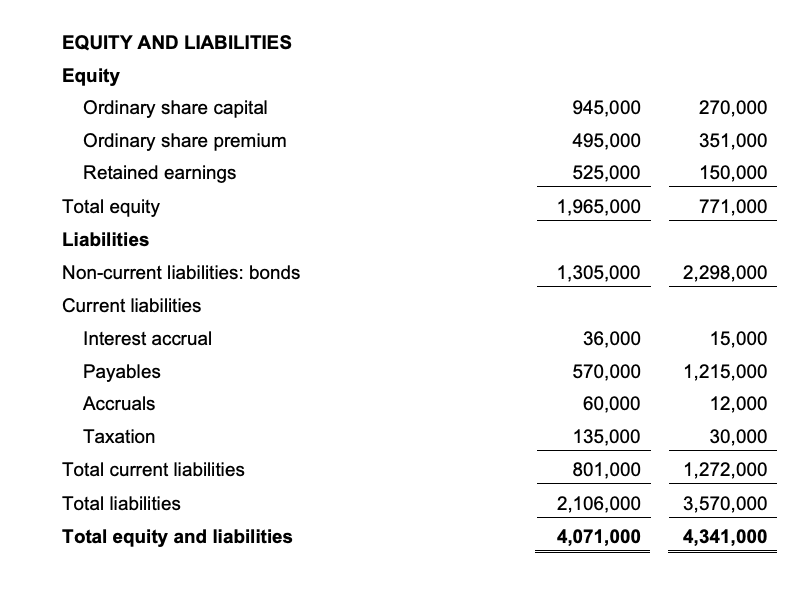

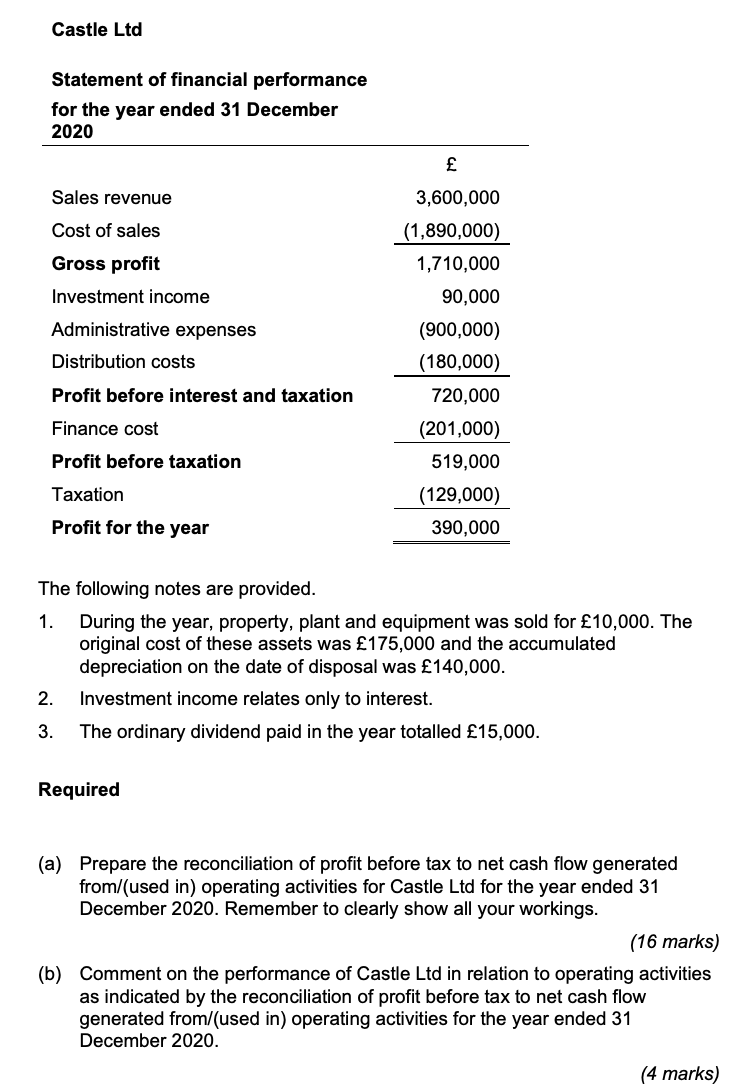

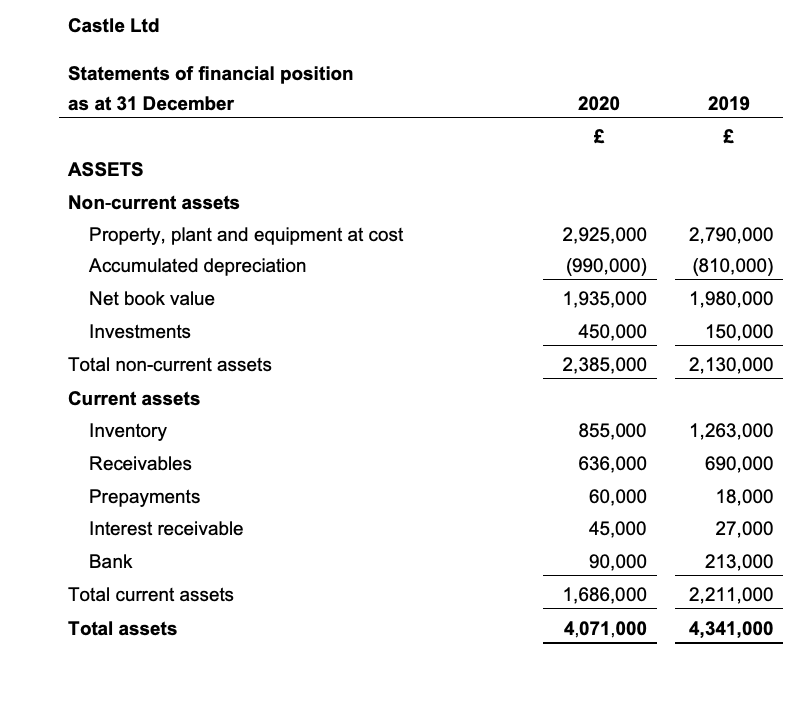

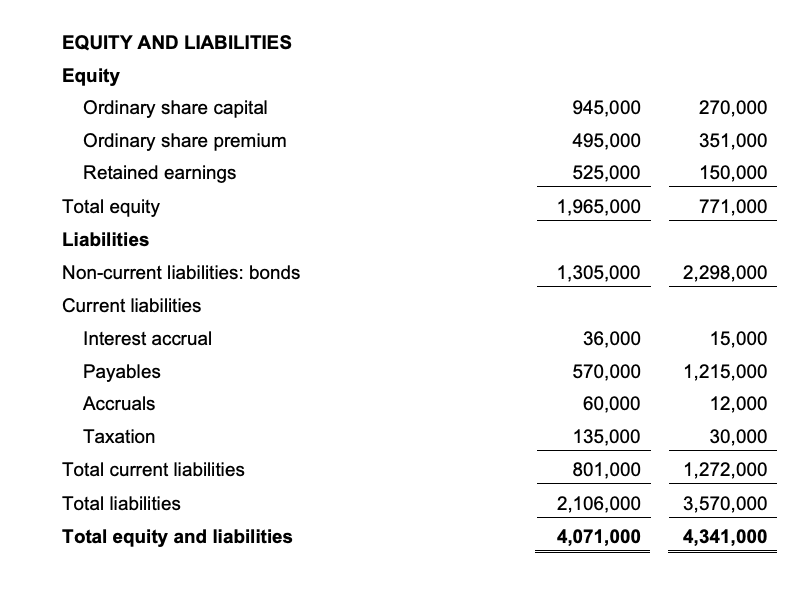

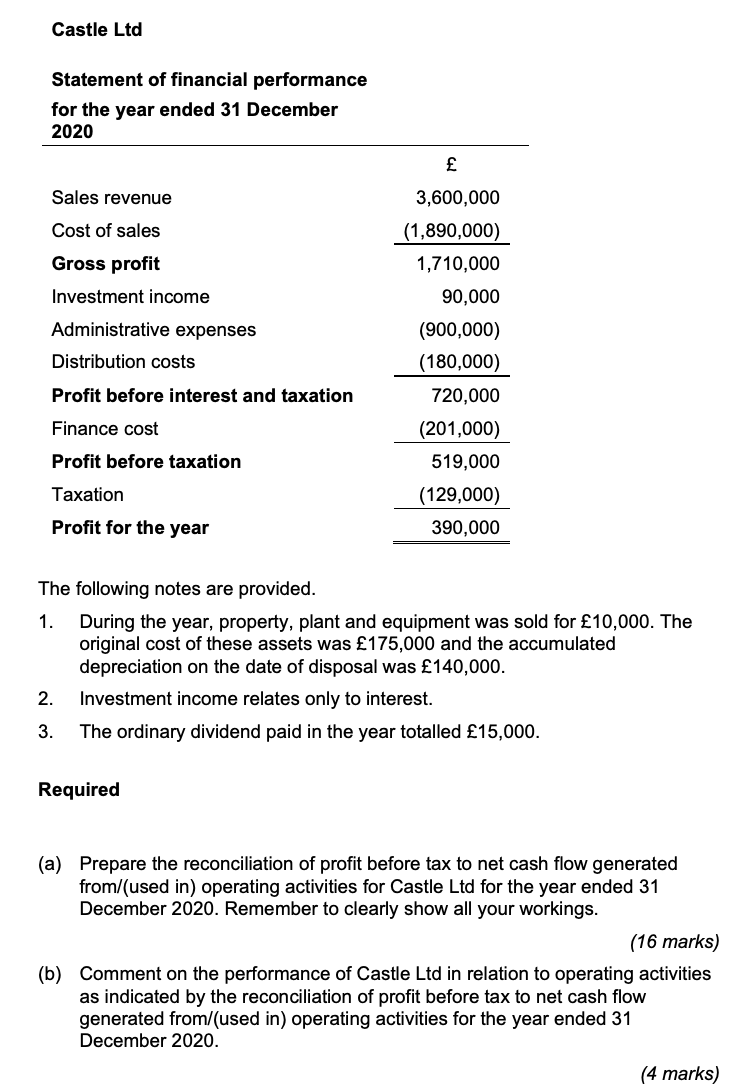

Castle Ltd Statements of financial position as at 31 December 2020 2019 2,925,000 (990,000) 1,935,000 450,000 2,385,000 2,790,000 (810,000) 1,980,000 150,000 2,130,000 ASSETS Non-current assets Property, plant and equipment at cost Accumulated depreciation Net book value Investments Total non-current assets Current assets Inventory Receivables Prepayments Interest receivable Bank Total current assets Total assets 855,000 636,000 60,000 45,000 1,263,000 690,000 18,000 27,000 90,000 213,000 1,686,000 4,071,000 2,211,000 4,341,000 945,000 495,000 525,000 270,000 351,000 150,000 771,000 1,965,000 1,305,000 2,298,000 EQUITY AND LIABILITIES Equity Ordinary share capital Ordinary share premium Retained earnings Total equity Liabilities Non-current liabilities: bonds Current liabilities Interest accrual Payables Accruals Taxation Total current liabilities Total liabilities Total equity and liabilities 36,000 15,000 570,000 60,000 135,000 801,000 1,215,000 12,000 30,000 1,272,000 3,570,000 4,341,000 2,106,000 4,071,000 Castle Ltd Statement of financial performance for the year ended 31 December 2020 Sales revenue Cost of sales Gross profit Investment income Administrative expenses Distribution costs 3,600,000 (1,890,000) 1,710,000 90,000 (900,000) (180,000) 720,000 (201,000) 519,000 (129,000) 390,000 Profit before interest and taxation Finance cost Profit before taxation Taxation Profit for the year The following notes are provided. 1. During the year, property, plant and equipment was sold for 10,000. The original cost of these assets was 175,000 and the accumulated depreciation on the date of disposal was 140,000. 2. Investment income relates only to interest. 3. The ordinary dividend paid in the year totalled 15,000. Required (a) Prepare the reconciliation of profit before tax to net cash flow generated from/(used in) operating activities for Castle Ltd for the year ended 31 December 2020. Remember to clearly show all your workings. (16 marks) (b) Comment on the performance of Castle Ltd in relation to operating activities as indicated by the reconciliation of profit before tax to net cash flow generated from/(used in) operating activities for the year ended 31 December 2020. (4 marks)