CAT Company is considering two independent business projects; which are constructing a luxury condominium (project A) and building a plaza avenue (similar to J-Avenue)

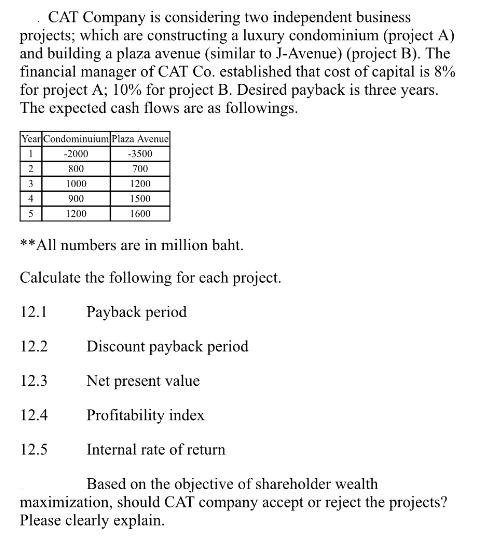

CAT Company is considering two independent business projects; which are constructing a luxury condominium (project A) and building a plaza avenue (similar to J-Avenue) (project B). The financial manager of CAT Co. established that cost of capital is 8% for project A; 10% for project B. Desired payback is three years. The expected cash flows are as followings. Year Condominuium Plaza Avenue 1 -2000 800 1000 900 1200 2 3 4 5 **All numbers are in million baht. Calculate the following for each project. 12.1 12.2 12.3 12.4 -3500 700 1200 1500 1600 12.5 Payback period Discount payback period Net present value Profitability index Internal rate of return Based on the objective of shareholder wealth maximization, should CAT company accept or reject the projects? Please clearly explain.

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Here are the calculations and analysis for each project Project A Condominium 121 Payback period 3 y...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started