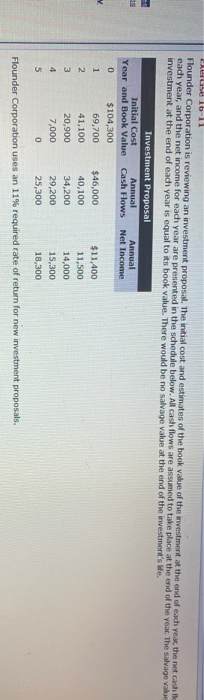

CAT lb-ll Flounder Corporation is reviewing an investment proposal. The initial cost and estimates of the book value of the investment at the end of each year, the net cash fle each year, and the net income for each year are presented in the schedule below. All cash flows are assumed to take place at the end of the year. The salvage value investment at the end of each year is equal to its book value. There would be no salvage value at the end of the investment's We. v Investment Proposal Initial Cost Annual Annual Year and Book Value Cash Flows Net Income 0 $104,300 69,700 $46,000 $11,400 2. 41,100 40,100 11,500 3 20,900 34,200 14,000 4 7,000 29,200 15,300 5 0 25,300 18,300 1 Flounder Corporation uses an 11% required rate of return for new investment proposals. URCES CALCIRATOR PRINTER VERO HACK MENTE Exercise 16-9 Sheffield Service Center just purchased an automobile host for $33,700. The hoist has an 8-year Me and an estimated salvage value of $3,640. Installation costs and the charges were $3,550 and $820, respectively. Sheffield uses straight line depreciation The new hoist will be used to replace mufflers and tires on automobiles. Sheffield estimates that the new hoist will enable us mechanics to replace 6 extra mufflers per week. Each muffler sells for $72 installed. The cost of a muller is $39, and the labor cost to install a muller is $13. (a) Compute the cash payback period for the new hoist. (Round answer to 2 decimal places, s. 10.50) CAT lb-ll Flounder Corporation is reviewing an investment proposal. The initial cost and estimates of the book value of the investment at the end of each year, the net cash fle each year, and the net income for each year are presented in the schedule below. All cash flows are assumed to take place at the end of the year. The salvage value investment at the end of each year is equal to its book value. There would be no salvage value at the end of the investment's We. v Investment Proposal Initial Cost Annual Annual Year and Book Value Cash Flows Net Income 0 $104,300 69,700 $46,000 $11,400 2. 41,100 40,100 11,500 3 20,900 34,200 14,000 4 7,000 29,200 15,300 5 0 25,300 18,300 1 Flounder Corporation uses an 11% required rate of return for new investment proposals. URCES CALCIRATOR PRINTER VERO HACK MENTE Exercise 16-9 Sheffield Service Center just purchased an automobile host for $33,700. The hoist has an 8-year Me and an estimated salvage value of $3,640. Installation costs and the charges were $3,550 and $820, respectively. Sheffield uses straight line depreciation The new hoist will be used to replace mufflers and tires on automobiles. Sheffield estimates that the new hoist will enable us mechanics to replace 6 extra mufflers per week. Each muffler sells for $72 installed. The cost of a muller is $39, and the labor cost to install a muller is $13. (a) Compute the cash payback period for the new hoist. (Round answer to 2 decimal places, s. 10.50)