Answered step by step

Verified Expert Solution

Question

1 Approved Answer

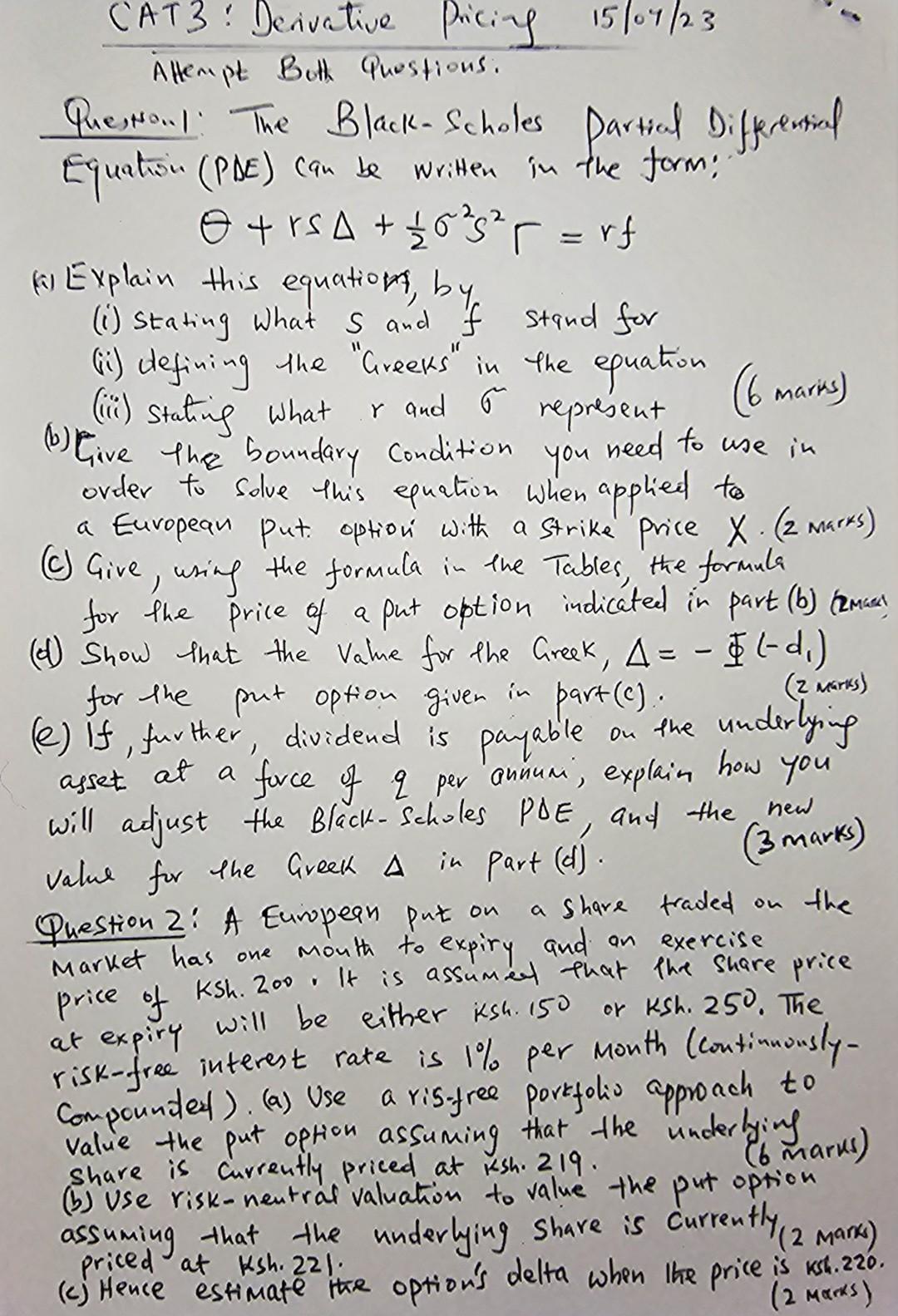

CAT3: Derivative pricing 15/04/23 Altempt Both Questions. Quesso..1: The Black-Scholes partial Differential Equation (PDE) can be written in the form: +rs+212s2=rf (a) Explain this equation,

CAT3: Derivative pricing 15/04/23 Altempt Both Questions. Quesso..1: The Black-Scholes partial Differential Equation (PDE) can be written in the form: +rs+212s2=rf (a) Explain this equation, by (i) Stating what S and f stand for (ii) defining the "Greeks" in the equation (iii) Stating what r and represent ( 6 marins) (b) Give the boundary condition you need to use in order to solve this equation when applied to a European put option with a strike price X. (2 marks) (c) Give, using the formula in the Tables, the formula for the price of a put option indicated in part (b) (2maan) (d) Show that the value for the Greek, =(d1) for the put option given in part(c). (e) If, further, dividend is payable on the underlying asset at a force of q per annum, explain how you will adjust the Black-Scholes PE, and the new value for the Greek in part (d). Question 2: A European put on a shave traded on the market has one mouth to expiry and an exercise price of Ksh. 200 . It is assumed that the share price at expiry will be either ksh. 150 or ksh. 25. The risk-free interest rate is 1% per month (continnouslycompounded). (a) Use a ris-free porkfolio approach to value the put option assuming that the underlying share is currently priced at ksh. 219 . (b) Use risk-nentral valuation to value the put option assuming that the underlying share is currently (2 mans) priced at ksh.221. (c) Hence estimate the option's delta when the price ( 2 maxas)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started