Answered step by step

Verified Expert Solution

Question

1 Approved Answer

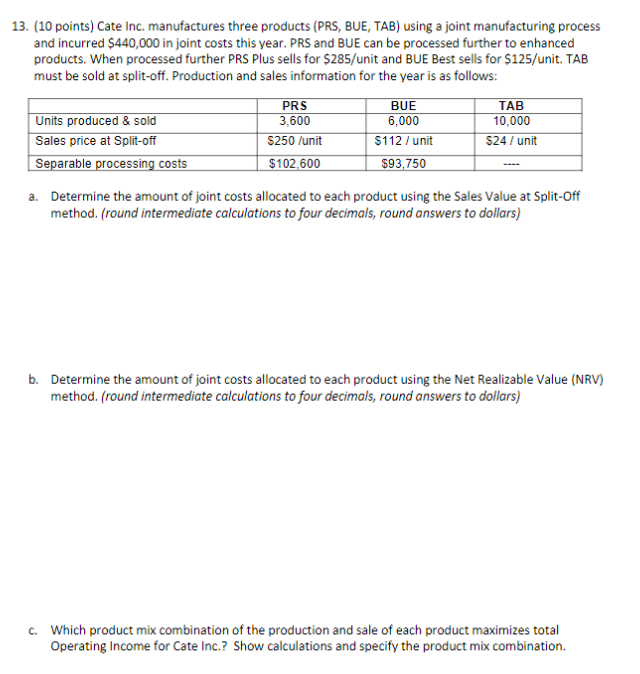

Cate Inc. manufactures three products ( PRS , BUE, TAB ) using a joint manufacturing process and incurred $ 4 4 0 , 0 0

Cate Inc. manufactures three products PRS BUE, TAB using a joint manufacturing process and incurred $ in joint costs this year. PRS and BUE can be processed further to enhanced products. When processed further PRS Plus sells for $unit and BUE Best sells for $unit TAB must be sold at splitoff. Production and sales information for the year is as follows Determine the amount of joint costs allocated to each product using the Sales Value at SplitOff method. round intermediate calculations to four decimals, round answers to dollars points Cate Inc. manufactures three products PRS BUE, TAB using a joint manufacturing process

and incurred $ in joint costs this year. PRS and BUE can be processed further to enhanced

products. When processed further PRS Plus sells for $ unit and BUE Best sells for $ unit. TAB

must be sold at splitoff. Production and sales information for the year is as follows:

a Determine the amount of joint costs allocated to each product using the Sales Value at SplitOff

method. round intermediate calculations to four decimals, round answers to dollars

b Determine the amount of joint costs allocated to each product using the Net Realizable Value NRV

method. round intermediate calculations to four decimals, round answers to dollars

c Which product mix combination of the production and sale of each product maximizes total

Operating Income for Cate Inc.? Show calculations and specify the product mix combination.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started