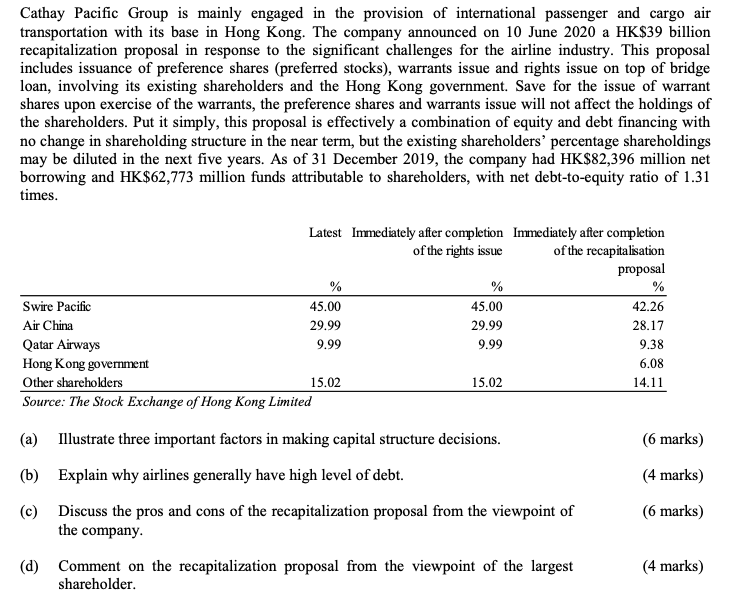

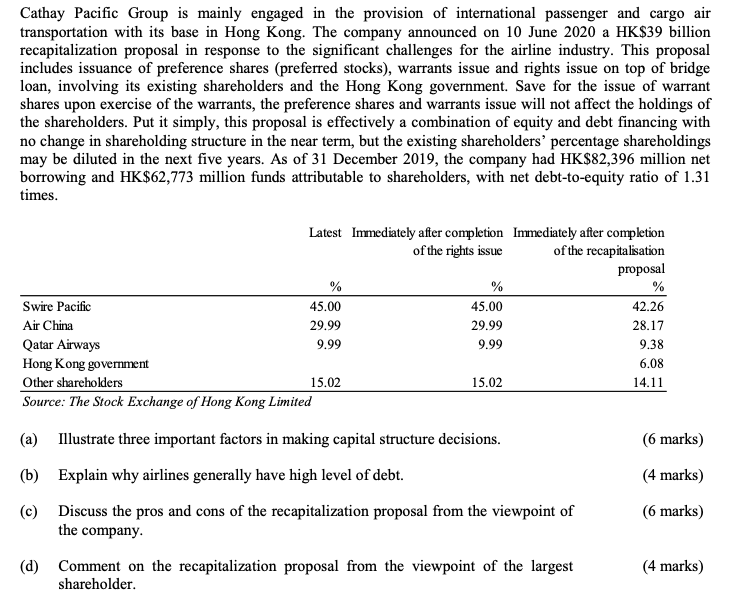

Cathay Pacific Group is mainly engaged in the provision of international passenger and cargo air transportation with its base in Hong Kong. The company announced on 10 June 2020 a HK$39 billion recapitalization proposal in response to the significant challenges for the airline industry. This proposal includes issuance of preference shares (preferred stocks), warrants issue and rights issue on top of bridge loan, involving its existing shareholders and the Hong Kong government. Save for the issue of warrant shares upon exercise of the warrants, the preference shares and warrants issue will not affect the holdings of the shareholders. Put it simply, this proposal is effectively a combination of equity and debt financing with no change in shareholding structure in the near term, but the existing shareholders' percentage shareholdings may be diluted in the next five years. As of 31 December 2019, the company had HK$82,396 million net borrowing and HK$62,773 million funds attributable to shareholders, with net debt-to-equity ratio of 1.31 times. Latest Immediately after completion Immediately after completion of the rights issue of the recapitalisation proposal % Swire Pacific 45.00 45.00 42.26 Air China 29.99 29.99 28.17 Qatar Airways 9.99 9.99 9.38 Hong Kong government 6.08 Other shareholders 15.02 15.02 14.11 Source: The Stock Exchange of Hong Kong Limited (6 marks) (4 marks) (a) Illustrate three important factors in making capital structure decisions. (b) Explain why airlines generally have high level of debt. (c) Discuss the pros and cons of the recapitalization proposal from the viewpoint of the company. (6 marks) (d) Comment on the recapitalization proposal from the viewpoint of the largest shareholder (4 marks) Cathay Pacific Group is mainly engaged in the provision of international passenger and cargo air transportation with its base in Hong Kong. The company announced on 10 June 2020 a HK$39 billion recapitalization proposal in response to the significant challenges for the airline industry. This proposal includes issuance of preference shares (preferred stocks), warrants issue and rights issue on top of bridge loan, involving its existing shareholders and the Hong Kong government. Save for the issue of warrant shares upon exercise of the warrants, the preference shares and warrants issue will not affect the holdings of the shareholders. Put it simply, this proposal is effectively a combination of equity and debt financing with no change in shareholding structure in the near term, but the existing shareholders' percentage shareholdings may be diluted in the next five years. As of 31 December 2019, the company had HK$82,396 million net borrowing and HK$62,773 million funds attributable to shareholders, with net debt-to-equity ratio of 1.31 times. Latest Immediately after completion Immediately after completion of the rights issue of the recapitalisation proposal % Swire Pacific 45.00 45.00 42.26 Air China 29.99 29.99 28.17 Qatar Airways 9.99 9.99 9.38 Hong Kong government 6.08 Other shareholders 15.02 15.02 14.11 Source: The Stock Exchange of Hong Kong Limited (6 marks) (4 marks) (a) Illustrate three important factors in making capital structure decisions. (b) Explain why airlines generally have high level of debt. (c) Discuss the pros and cons of the recapitalization proposal from the viewpoint of the company. (6 marks) (d) Comment on the recapitalization proposal from the viewpoint of the largest shareholder (4 marks)