Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cathedral City Services (CCS) is a not-for-profit organization offering two services in a mid-sized city. The services are Elder Meals and Jobs4UElder Meals is a

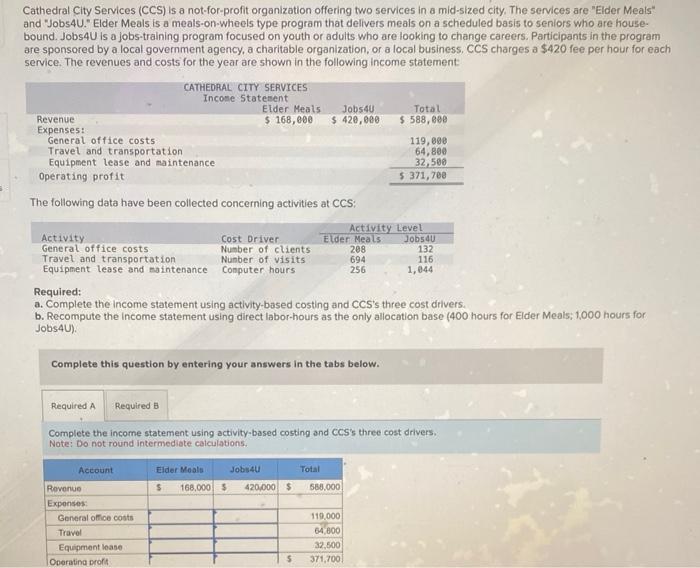

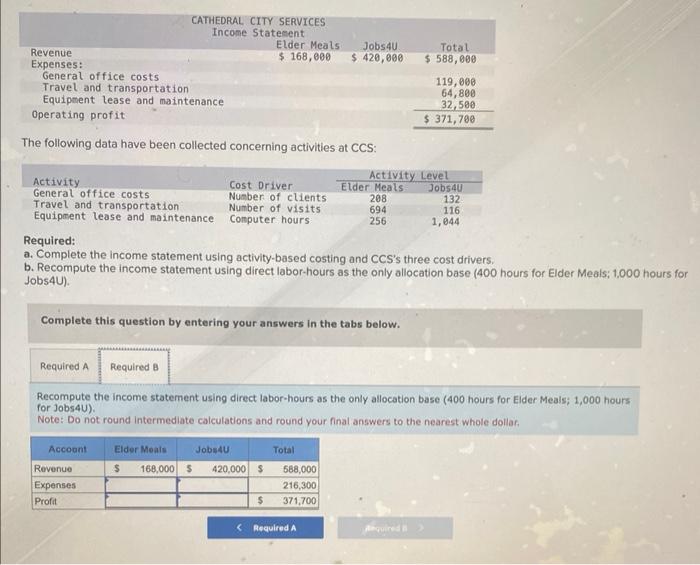

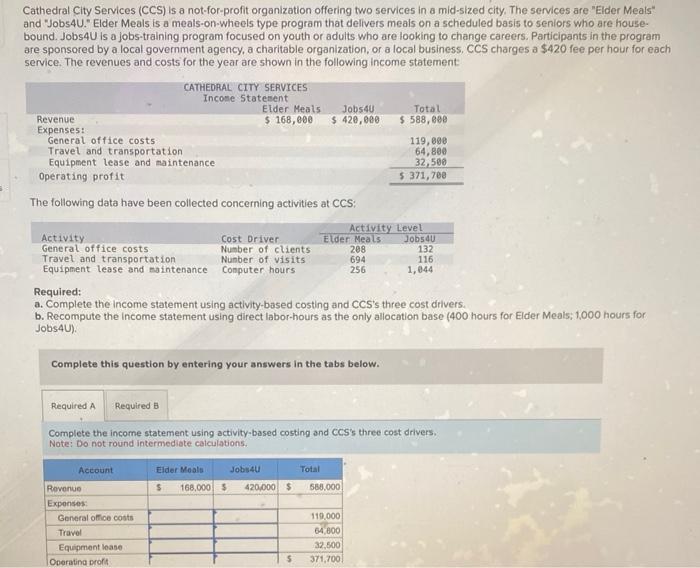

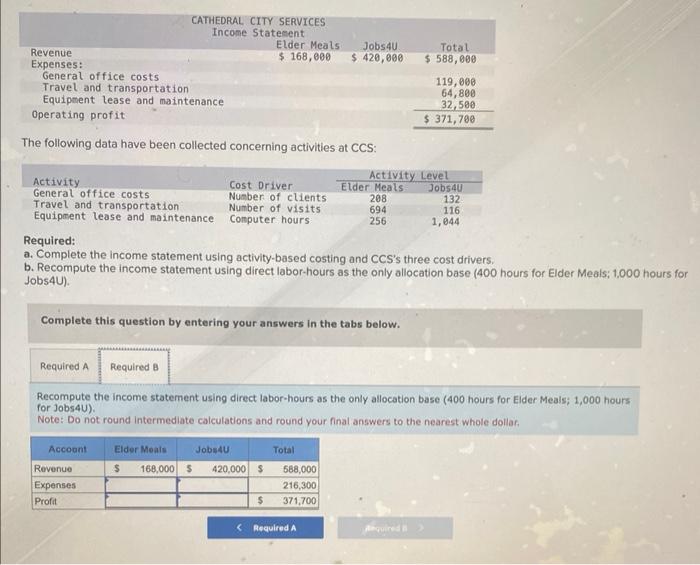

Cathedral City Services (CCS) is a not-for-profit organization offering two services in a mid-sized city. The services are Elder Meals and Jobs4UElder Meals is a meals-on-wheels type program that delivers meals on a scheduled basis to seniors who are house boundJobs4U a jobs-training program focused on youth or adults who are looking to change careers. Participants in the program are sponsored by a local government agency, a charitable organization, or a local businessCCS charges a $420 fee per hour for each service. The revenues and costs for the year are shown in the following income statement Jobs4U 420,000 Total CATHEDRAL CITY SERVICES Income Statement Elder Meals Revenue 168,000 Expenses: General office costs Travel and transportation Equipment lease and maintenance Operating profit 119,000 64,800 32,500 $ 371,788 The following data have been collected concerning activities at CCS Activity Cost Driver General office costs Number of clients Travel [Please answer Required A and B]

Cathedral City Services (CCS) is a not-for-profit organization offering two services in a mid-sized city, The services are "Elder Meals" and "Jobs4U." Elder Meals is a meals-on-wheels type program that delivers meals on a scheduled basis to seniors who are housebound. Jobs4U is a jobs-training program focused on youth or adults who are looking to change careers. Participants in the program are sponsored by a local government agency, a charitable organization, or a local business. CCS charges a $420 fee per hour for each service. The revenues and costs for the year are shown in the following income statement: The following data have been collected concerning activities at CCS: Required: a. Complete the income statement using actlvity-based costing and CCS's three cost drivers. b. Recompute the income statement using direct labor-hours as the only allocation base ( 400 hours for Elder Meals; 1,000 hours for Jobs4U). Complete this question by entering your answers in the tabs below. Complete the income statement using activity-based costing and cCS's three cost drivers. Note: Do not round intermediate calculations. The following data have been collected concerning activities at CCS: Required: a. Complete the income statement using activity-based costing and CCS's three cost drivers. b. Recompute the income statement using direct labor-hours as the only allocation base ( 400 hours for Elder Meals; 1,000 hours for Jobs4U). Complete this question by entering your answers in the tabs below. Recompute the income statement using direct labor-hours as the only allocation base ( 400 hours for Elder Meals; 1,000 hours for Jobs4U). Note: Do not round intermediate calculations and round your final answers to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started