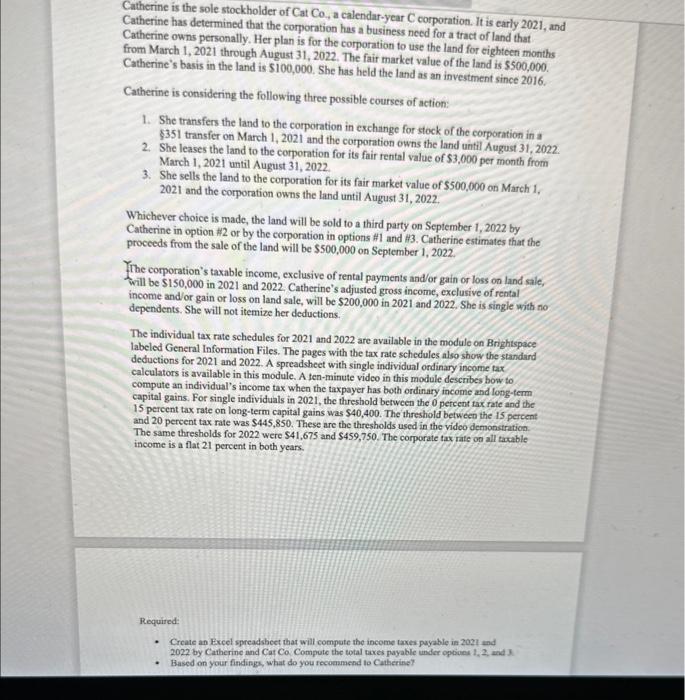

Catherine has detel stockholder of CatCo, a calendar-year C corporation. It is early 2021, and Catherine owns determined that the corporation has a business need for a tract of land that from March 1, 2021 thronally. Her plan is for the corporation to use the land for eighteen months Catherine's basis in the land is $100,000. She The fair market value of the land is 5500,000 . Catherine is considering the following three possible courses of action: March 1, 2021 until August 31, 2022. 3. She sells the land to the corporation for its fair market value of $500,000 on March 1, 2021 and the corporation owns the land until August 31, 2022. Whichever choice is made, the land will be sold to a third party on September 1,2022 by Catherine in option \#2 or by the corporation in options \#1 and \#3. Catherine estimates that the proceeds from the sale of the land will be $500,000 on September 1, 2022. The comporation's taxable income, exclusive of rental payments and/or gain or loss on land sale, will be $150,000 in 2021 and 2022, Catherine's adjusted gross income, exclusive of rental income and or gain or loss on land sale, will be $200,000 in 2021 and 2022 . She is single with no dependents. She will not itemize her deductions. The individual tax rate schedules for 2021 and 2022 are available in the module on Brightspace labeled General Information Files. The pages with the tax rate schedules also show the standand deductions for 2021 and 2022. A spreadsheet with single individual ordinary income tax calculators is available in this module. A ten-minute video in this module describes bow to compute an individual's income tax when the taxpayer has both ordinary income and long-term capital gains. For single individuals in 2021, the threshold between the 0 percent rax rate and the 15 percent tax rate on long-term capital gains was $40,400. The threshold between the 15 pereent and 20 percent tax rate was $445,850. These are the thresholds used in the video demonstration. The same thresholds for 2022 were $41,675 and $459,750. The corporate tax rate on all tacable income is a flat 21 percent in both years. Required: - Create an Excel spreadsheet that will compute the income taxes payable in 2027 and 2022 by Catherine and Cat Co Compute the total taxes payable under eptions 1,2 and 3. - Based on your findings, what do you recoeamend to Catherine