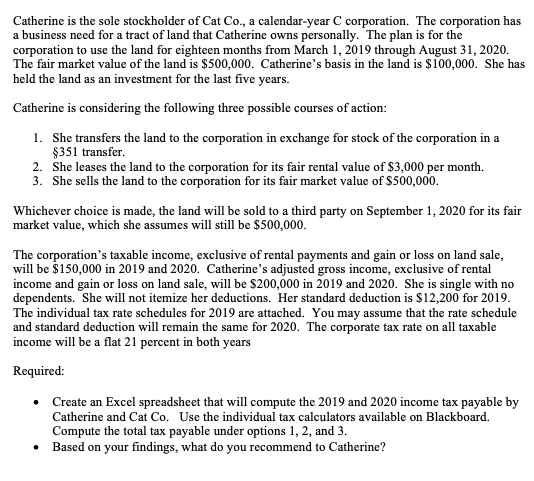

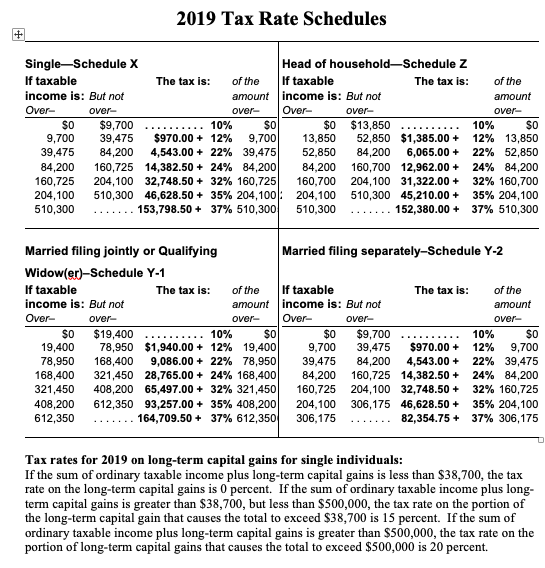

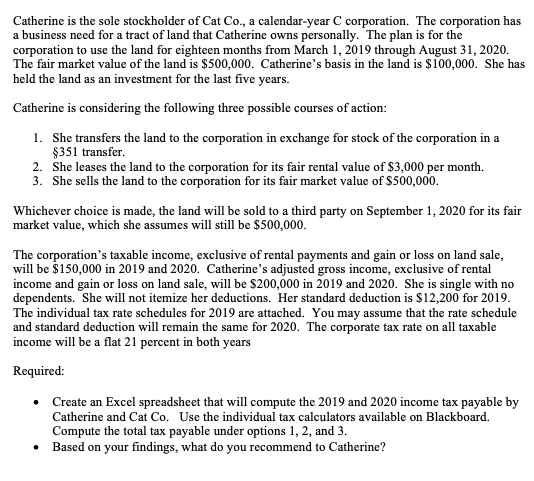

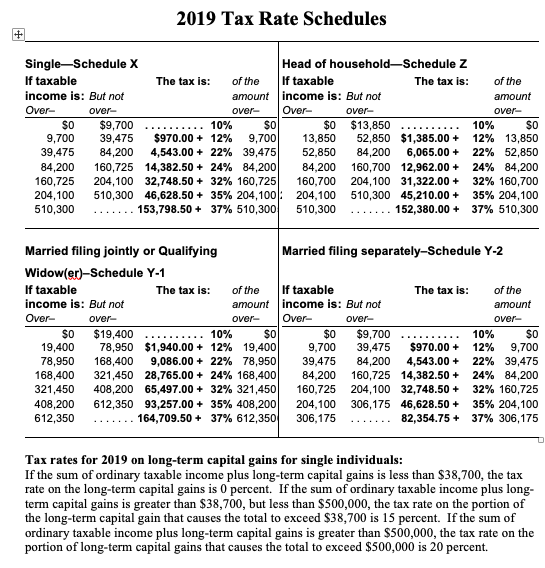

Catherine is the sole stockholder of Cat Co., a calendar-year C corporation. The corporation has a business need for a tract of land that Catherine owns personally. The plan is for the corporation to use the land for eighteen months from March 1, 2019 through August 31,2020 The fair market value of the land is $500,000. Catherine's basis in the land is $100,000. She has held the land as an investment for the last five years. Catherine is considering the following three possible courses of action: 1. She transfers the land to the corporation in exchange for stock of the corporation in a $351 transfer 2. She leases the land to the corporation for its fair rental value of $3,000 per month. 3. She sells the land to the corporation for its fair market value of $500,000 Whichever choice is made, the land will be sold to a third party on September 1, 2020 for its fair market value, which she assumes will still be $500,000 The corporation's taxable income, exclusive of rental payments and gain or loss on land sale will be $150,000 in 2019 and 2020. Catherine's adjusted gross income, exclusive of rental income and gain or loss on land sale, will be $200,000 in 2019 and 2020. She is single with no dependents. She will not itemize her deductions. Her standard deduction is $12,200 for 2019 The individual tax rate schedules for 2019 are attached. You may assume that the rate schedule and standard deduction will remain the same for 2020, The corporate tax rate on all taxable income will be a flat 21 percent in both years Required: . Create an Excel spreadsheet that will compute the 2019 and 2020 income tax payable by Catherine and Cat Co. Use the individual tax calculators available on Blackboard. Compute the total tax payable under options 1, 2, and 3 . Based on your findings, what do you recommend to Catherine? 2019 Tax Rate Schedules Single-Schedule X If taxable income is: But not Over- Head of household-Schedule Z The tax is: The tax is of the If taxable of the amountincome is: But not overOver over over over S0 9,700 39,475 $970.00 + 12% 9,700| 13,850 52,850 $1,385.00 + 12% 13,850 39,475 84,200 4,543.00+22% 39,475 52,850 84,200 6,065.00 + 22% 52,850 84,200 160,725 14,382.50 + 24% 84,200| 84,200 160,700 12,962.00 + 24% 84,200 160,725 204,100 32,748.50+32% 160,725 160,700 204,100 31,322.00 + 32% 160,700 204,100 510,300 46,628.50 + 35% 204,100|: 204.100 510,300 45,21 0.00+ 35% 204,100 152,380.00 + 37% 510,300 SO $9,700 10% S0 S0 $13,850 10% . 510,300 153,798.50 + 37% 510,300| 510,300 Married filing jointly or Qualifying Married filing separately-Schedule Y-2 Widow(er-Schedule Y-1 If taxable income is: But not Over- The tax is of the If taxable The tax is: amountincome is: But not overOver of the amount over over over SO $19,400 $0 $9,700 S0 9,700 39,475 $970.00 + 12% 9,700 78,950 168,400 9,086.00+22% 78,950| 39.475 84,200 4,543.00 + 22% 39,475 168,400 321,450 28,765.00 24% 168,400| 84.200 160,725 14,382.50 24% 84,200 321,450 408,200 65,497.00 32% 321,450| 160,725 204,100 32,748.50 + 32% 160,725 408,200 612,350 93,257.00+35% 408,2001 204.100 306,175 46,628.50 + 35% 204,100 82,354.75 + 37% 306,175 S0 78,950 $1,940.00+ 12% 19,400 10% 10% 19,400 612,350 164,709.50 + 37% 612,350| 306,175 Tax rates for 2019 on long-term capital gains for single individuals: If the sum of ordinary taxable income plus long-term capital gains is less than $38,700, the tax rate on the long-term capital gains is 0 percent. If the sum of ordinary taxable income plus long term capital gains is greater than $38,700, but less than S500,000, the tax rate on the portion of the long-term capital gain that causes the total to exceed S38,700 is 15 percent. If the sum of ordinary taxable income plus long-term capital gains is greater than $500,000, the tax rate on the portion of long-term capital gains that causes the total to exceed $500,000 is 20 percent