Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Catherine lives in Montreal and just graduated in December 2022 from Concordias Gina Cody School of Engineering. To save money for a house in two

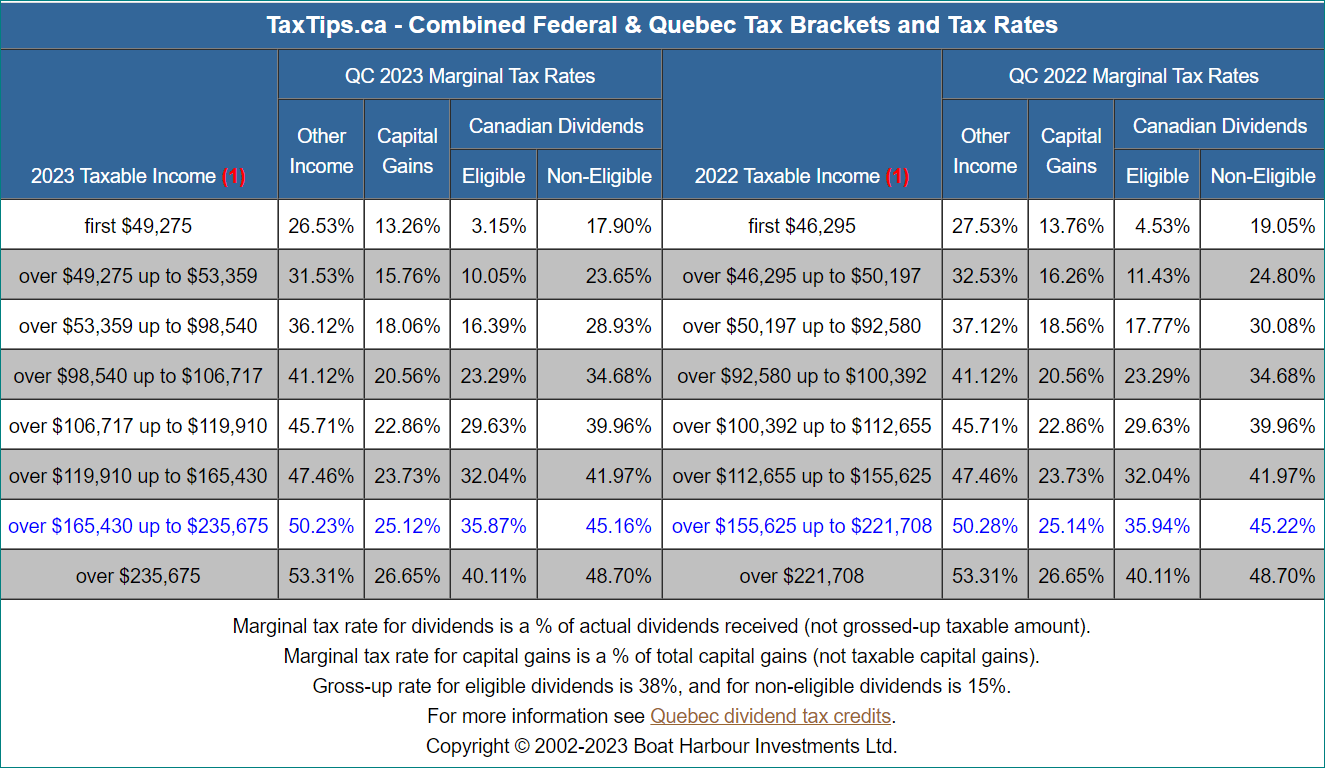

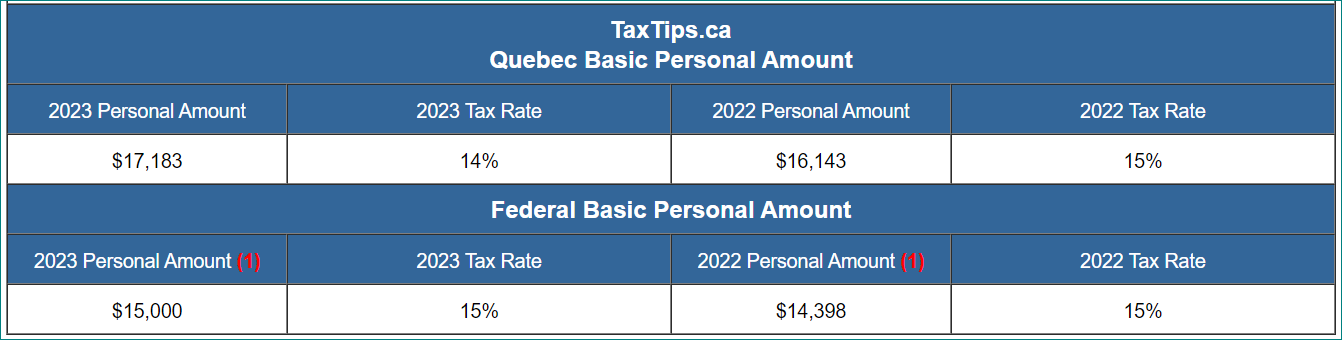

- Catherine lives in Montreal and just graduated in December 2022 from Concordias Gina Cody School of Engineering. To save money for a house in two (2) years, she decided to take a great job opportunity on January 1, 2023, by working in a remote area in northern Quebec in engineering. Many of her expenses such as food and lodging are covered by her employer. She is making great money and earning a gross salary of $120,000. At the start of 2023, she put $6,500 in her Tax-Free Savings Account (TFSA) and is making regular Registered Retirement Savings Plan (RRSP) contributions of $1,000 per month (as she has previous years RRSP contribution room of $12,000). She paid her Quebec Engineering professional annual dues of $600 and is also paying her annual union dues of $450 as she is part of a labour union. The remainder of her pay is going to her chequing account, which she will eventually transfer into a savings account. What is Catherines marginal tax rate in 2023?

- 36.12%

- 41.12%

- 45.71%

- 47.46%

- 50.23%

TABLE A

TABLE B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started