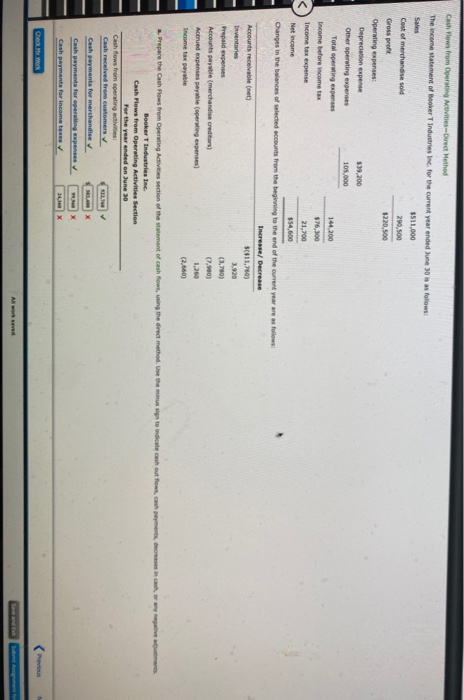

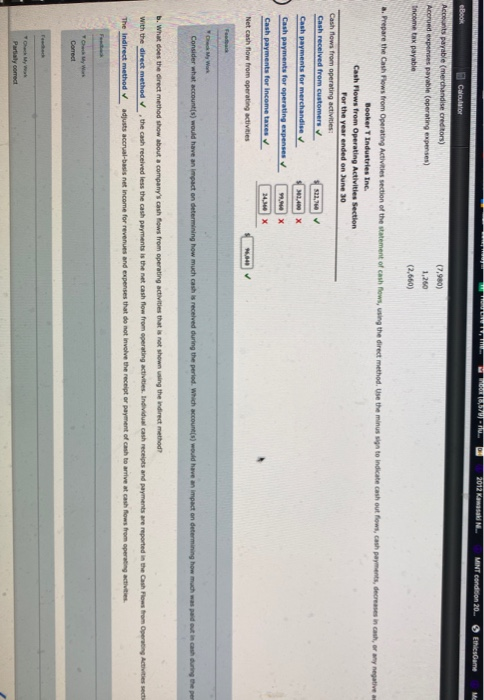

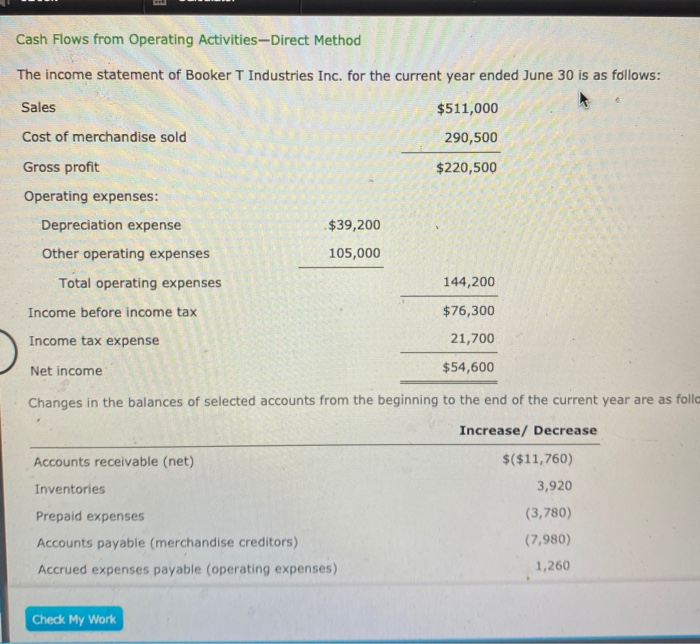

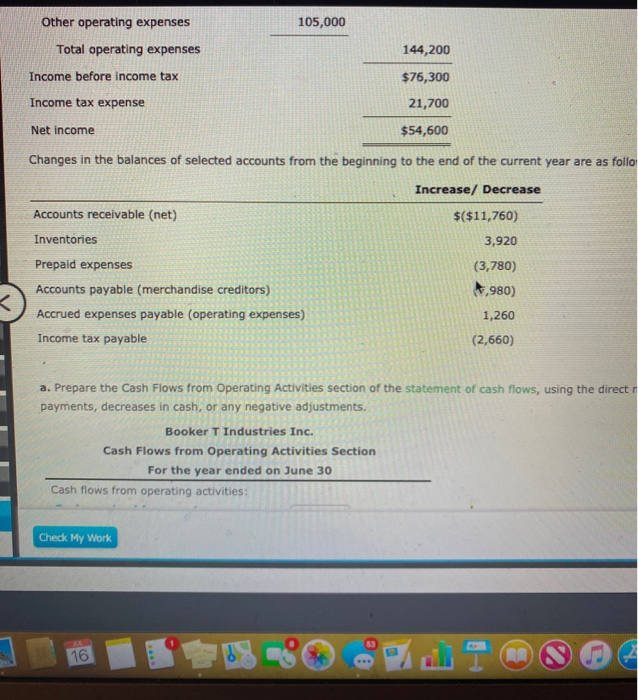

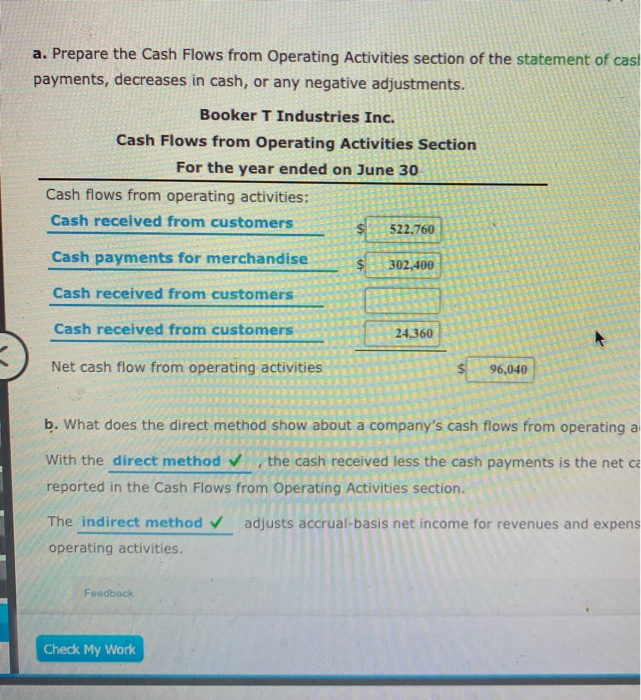

Cathrow from Operating Activities Direct Method The income statement of Booker Industries Inc. for the current year ended June 30 is as follows: Sales $511.000 Cost of merchandise sold 290,500 Gross profit 1220,500 Operating expenses Depreciation expert $39,200 Other operating expenses 105,000 Total operating expenses 144.200 Income before income tax $76,300 Income tax expense 21,700 Net Income 354,600 Changes in the balances of selected accounts from the beginning to the end of the current year are as follows Increase/ Decrease Accounts receivablet) $($11,760) Inventories 3,920 Prepaid expenses (9,780) Accounts payable (merchandise creditors) Accrued expenses payable (operating expenses) 1,260 Income tax payable (2.660) 7.10) Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the direct method. Use the minuto indicate cash out ows, cash payments, decrease in Booker Industries Inc. Cash Flows from Operating Activities Section For the year ended on June 30 Cash flows from operating active Cash received from customers Cash payments for merchandise Cash payments for cering expenses Cash payments for income taxes Check My Work Previous Save and MATUPIL 2012 Kamasak MINT condition 20. Ethics Game eBook Calculator Accounts payable (merchandise creditors) Acred expenses payable (operating expenses) Income tax payable (7,980) 1,260 (2,660) . Prepare the Cash Flows from Operating Activities section of the statement of cash rows, using the direct method. Use the minus un to indicate cash out fom, cash payments, decreases in cash, or any negative Booker T Industries Inc. Cash Flows from Operating Activities Section For the year ended on June 30 Cash flows from operating activities: Cash received from customers 520,760 Cash payments for merchandise 2.400 x Cash payments for operating expenses 79.900 x Cash payments for income taxes 24.140 x Net cash flow from operating activities . Feedback Consider what account(s) would have an impact on determining how much cash is received during the period. Which account(s) would have an impact on determining how much was post in cash during the per b. What does the direct method show about a company's cash flows from operating activities that is not shown using the Indirect method with the direct method the cash received less the cash payments is the net cash flow from operating activities. Individual cash receipts and payments are reported in the Cash Flows from Operating Activitet The Indirect method adjusts accrual basis net income for revenues and expenses that do not involve the receipt or payment of cash to arrive at cash flows from operating activities Fed Che Want Correct Partially correct Cash Flows from Operating Activities-Direct Method The income statement of Booker T Industries Inc. for the current year ended June 30 is as follows: Sales $511,000 Cost of merchandise sold 290,500 $220,500 Gross profit Operating expenses: Depreciation expense Other operating expenses $39,200 105,000 Total operating expenses 144,200 Income before income tax $76,300 21,700 Income tax expense Net income $54,600 Changes in the balances of selected accounts from the beginning to the end of the current year are as folla Accounts receivable (net) Inventories Increase/ Decrease $($11,760) 3,920 (3,780) (7,980) Prepaid expenses Accounts payable (merchandise creditors) Accrued expenses payable (operating expenses) 1,260 Check My Work Other operating expenses 105,000 144,200 Total operating expenses Income before income tax Income tax expense $76,300 21,700 Net income $54,600 Changes in the balances of selected accounts from the beginning to the end of the current year are as follo Increase/ Decrease Accounts receivable (net) Inventories Prepaid expenses Accounts payable (merchandise creditors) Accrued expenses payable (operating expenses) Income tax payable $($11,760) 3,920 (3,780) ,980)