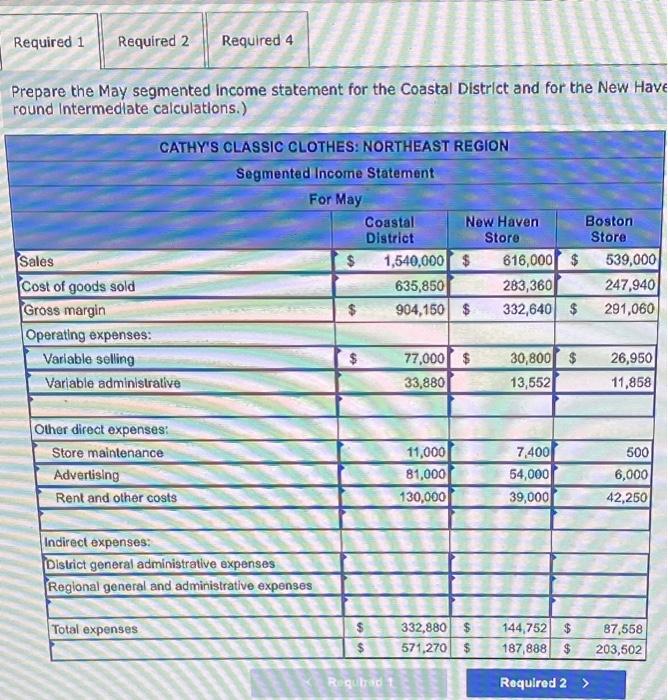

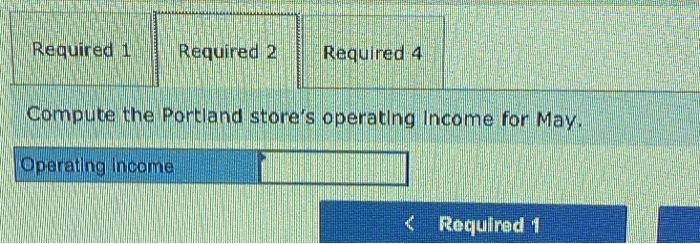

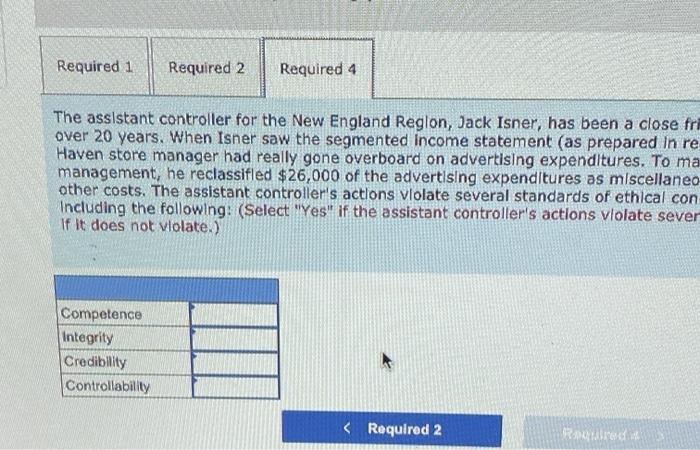

Cathy's Classic Clothes is a retailer that sells to professional women in the northeast. The firm leases space for stores in upscale shopping centers, and the organizational structure consists of regions, districts, and stores. Each region consists of two or more districts; each district consists of three or more stores. Each store, district, and region has been established as a profit center. At all levels, the company uses a responsibility accounting system focusing on information and knowledge rather than blame and control. Each year, managers, in consultation with their supervisors, establish financial and nonfinancial goals, and these goals are integrated into the budget. Actual performance is measured each month The New England Region consists of the Coastal District and the Inland District. The Coastal District Includes the New Haven, Boston, ond Portland stores. The Coastal District's performance has not been up to expectations in the past. For the month of May, the district manager has set performance gools with the managers of the New Haven and Boston stores, who will receive bonuses if certain performance measures are exceeded. The manager in Portland decided not to participate in the bonus scheme. Since the district manager is unsure what type of bonus will encourage better performance, the New Haven manager will receive a bonus based on sales in excess of budgeted sales of $590,000, while the Boston manager will receive a bonus based on operating income in excess of budget. The company's operating income goal for each store is 10 percent of sales. The budgeted sales revenue for the Boston store is $550,000 Other pertinent deta for May are as follows: Coastal District sales revenue was $1,540,000, and its cost of goods sold amounted to $635,850, The Coastal District spent $81,000 on advertising. General and administrative expenses for the Coastal District amounted to $182,000 At the New Haven store, sales were 40 percent of Coastal District sales, while sales at the Boston store were 35 percent of district sales. The cost of goods sold in both New Haven and Boston was 46 percent of sales. Variable selling expenses (sales commissions) were 5 percent of sales for all stores, districts, and regions. Variable administrative expenses were 2.2 percent of sales for all stores, districts, and regions. Maintenance cost includes janitorial and repair services and is a direct cost for each store. The store manager has complete control over this outlay, Maintenance costs were incurred as follows: Now Haven $7,400, Boston, $500; Advertising is considered a direct cost for each store and is completely under the control of the store manager. The New Haven store spent two-thirds of the Coastal District total outlay for advertising, which was 9 times the amount spent in Boston on advertising. Coastal District rental expense amounted to $130,000. The rental expenses at the New Haven store were 30 percent of the Coastal District's tool, while the Boston store incurred 20 percent of the district total. District expenses were allocated to the stores based on sales. New England Region general and administrative expenses of $159,000 were allocated to the coastal District. These expenses were, in turn, allocated equally to the district's three stores. Required: 1. Prepare the May segmented income statement for the Coastal District and for the New Haven and Boston stores. 2. Compute the Portland store's operating income for May 4. The assistant controller for the New England Region, Jack Isner, has been a close friend of the New Haven store manager for over 20 years. When Isner sow the segmented income statement (as prepared In requirement 1). he realized that the New Haven store manager had really gone overboard on advertising expenditures. To make his friend look better to the regional management, he reclassified $26,000 of the advertising expenditures os miscellaneous expenses, and buried them in rent and other costs. The assistant controller's actions violate several standards of ethical conduct for management accountants, including the following: Complete this question by entering your answers in the tabs below. Required 1 Required 2 Rad4 Required 1 Required 2 Required 4 Prepare the May segmented income statement for the Coastal District and for the New Have round Intermediate calculations.) CATHY'S CLASSIC CLOTHES: NORTHEAST REGION Segmented Income Statement For May Coastal New Haven Boston District Store Store Sales $ 1,540,000 $ 616,000 $ 539,000 Cost of goods sold 635,850 283,360 247,940 (Gross margin $ 904,150 $ 332,640 $ 291,060 Operating expenses: Variable selling $ 77,000 $ 30,800 $ 26,950 Variable administrative 33,880 13,552 11,858 Other direct expenses Store maintenance Advertising Rent and other costs 11,000 81,000 130,000 7,400 54,000 39,000 500 6,000 42,250 Indirect expenses: District general administrative expenses Regional general and administrative expenses Total expenses 332,880 $ 571,270 $ 144,752 $ 187,888 $ 87,558 203,502 $ Required Required 2 > Required 1 Required 2 Required 4 compute the Portland store's operating Income for May. Operating income