Answered step by step

Verified Expert Solution

Question

1 Approved Answer

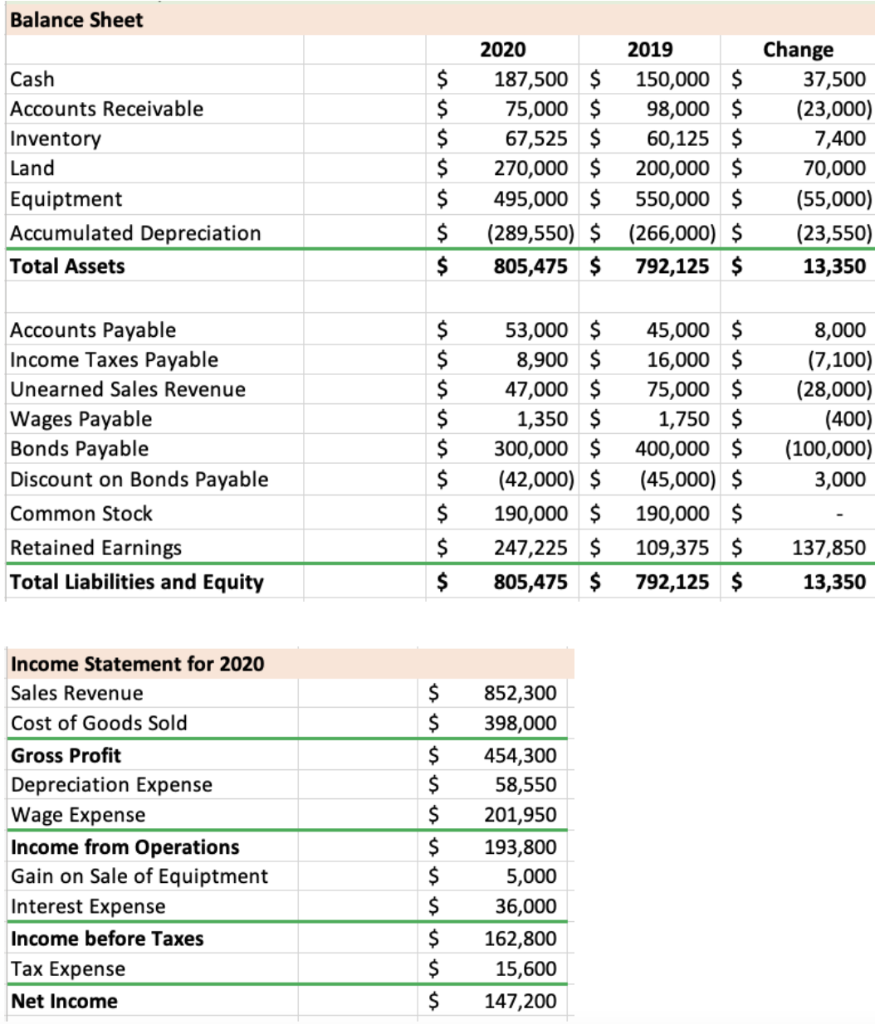

Cats Hats Company had just completed preparing its balance sheet and income statement. Below are the 2020 and 2019 comparative balance sheet and the 2020

Cats Hats Company had just completed preparing its balance sheet and income statement. Below are the 2020 and 2019 comparative balance sheet and the 2020 income statement. They have asked you to help them prepare the Statement of Cash Flows.

Additional Information.

- Cats Hats sold equipment with a historical cost of $55,000 and an accumulated depreciation of $35,000 for $25,000 cash. No new equipment was purchased.

- Interest expense is correctly stated.

- On January 1, 2020 Cats Hats made a $100,000 maturity payment on bonds. There was no discount or premium account associated with this bond on that date.

- Land was purchased for $70,000 with cash.

- Accounts payable are liabilities the company owes to suppliers of the goods the company sells.

What is this companys Cash Flow from Operations?

Group of answer choices

224,850

188,850

191,850

None of the other choices shown are correct.

215,650

193,850

Balance Sheet Cash Accounts Receivable Inventory Land Equiptment Accumulated Depreciation Total Assets $ $ $ $ $ $ $ 2020 187,500 $ 75,000 $ 67,525 $ 270,000 $ 495,000 $ (289,550) $ 805,475 $ 2019 150,000 $ 98,000 $ 60,125 $ 200,000 $ 550,000 $ (266,000) $ 792,125 $ Change 37,500 (23,000) 7,400 70,000 (55,000) (23,550) 13,350 Accounts Payable Income Taxes Payable Unearned Sales Revenue Wages Payable Bonds Payable Discount on Bonds Payable Common Stock Retained Earnings Total Liabilities and Equity $ $ $ $ $ $ 53,000 $ 8,900 $ 47,000 $ 1,350 $ 300,000 $ (42,000) $ 190,000 $ 247,225 $ 805,475 $ 45,000 $ 16,000 $ 75,000 $ 1,750 $ 400,000 $ (45,000) $ 190,000 $ 109,375 $ 792,125 $ 8,000 (7,100) (28,000) (400) (100,000) 3,000 $ $ $ 137,850 13,350 Income Statement for 2020 Sales Revenue Cost of Goods Sold Gross Profit Depreciation Expense Wage Expense Income from Operations Gain on Sale of Equiptment Interest Expense Income before Taxes Tax Expense Net Income $ $ $ $ $ $ $ $ $ $ $ 852,300 398,000 454,300 58,550 201,950 193,800 5,000 36,000 162,800 15,600 147,200Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started