Question

Cay Inc. (Cay) issued $150,000,000 of 7% debentures (bonds) on April 1, 2022. The bonds pay interest semiannually on April 1 and October 1. The

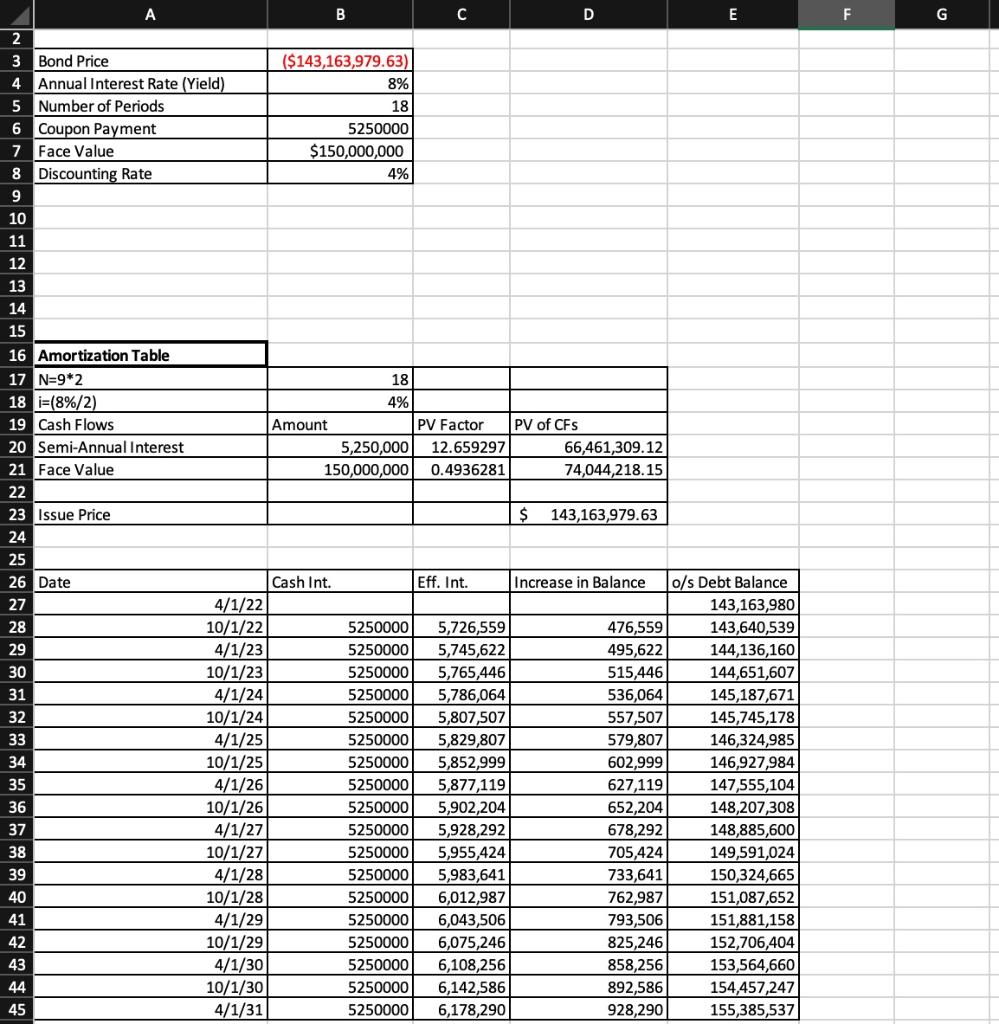

Cay Inc. (Cay) issued $150,000,000 of 7% debentures (bonds) on April 1, 2022. The bonds pay interest semiannually on April 1 and October 1. The first interest payment starts on 10/1/2022. The maturity date on these bonds is April 1, 2031. The firm uses the effective-interest method of amortizing discounts and premiums. The bonds were sold to yield an effective-interest rate of 8%. Cays fiscal year end is December 31 of each year. The debentures are callable at the issuers discretion.

Using a blank Excel worksheet (do not copy or use the worksheet provided in class or from Canvas activities) develop the following:

3) Prepare all journal entries for the year ended December 31, 2022, related to the sale and servicing of the bonds. This would include any appropriate adjusting entries (i.e., accruals) at year end.

6) On April 2, 2027, Cay calls the bonds at 101. Prepare the journal entry for Cays retirement of the bonds.

Use the Data in the screenshot for Journal Entries if helpful.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started