Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CB Corporation was formed as a calendar-year S corporation. Casey is a 60% shareholder and Bryant is a 40% shareholder. On September 30, 2019, Bryant

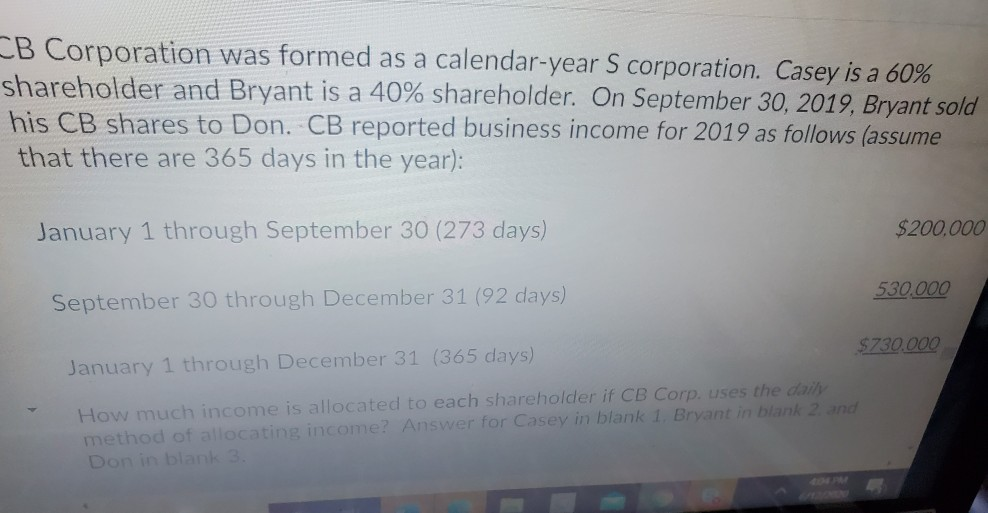

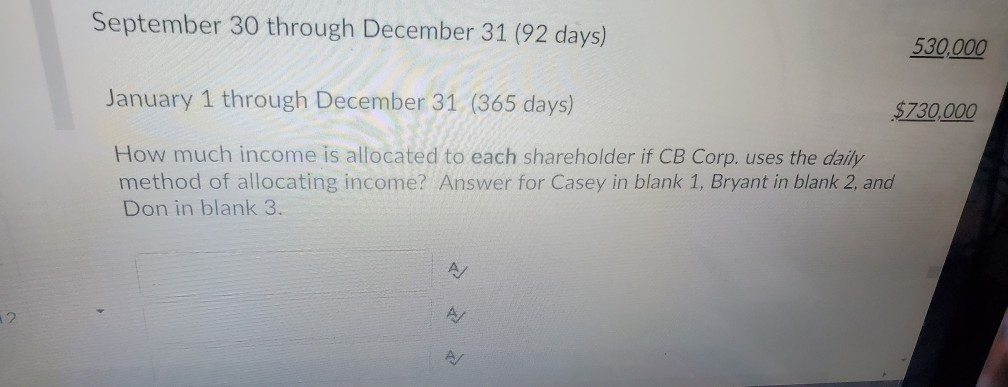

CB Corporation was formed as a calendar-year S corporation. Casey is a 60% shareholder and Bryant is a 40% shareholder. On September 30, 2019, Bryant sold his CB shares to Don. CB reported business income for 2019 as follows (assume that there are 365 days in the year): January 1 through September 30 (273 days) $200.000 530,000 September 30 through December 31 (92 days) $730.000 January 1 through December 31 (365 days) How much income is allocated to each shareholder if CB Corp. uses the daily method of allocating income? Answer for Casey in blank 1. Bryant in blank 2. and Don in blank 3. September 30 through December 31 (92 days) 530,000 January 1 through December 31 (365 days) $730,000 How much income is allocated to each shareholder if CB Corp. uses the daily method of allocating income? Answer for Casey in blank 1, Bryant in blank 2, and Don in blank 3. A/ 2 AM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started