Question

CBC Ltd. will be exporting 380 million Yen worth of goods in four months. In order to make the sale, CBC agreed to be

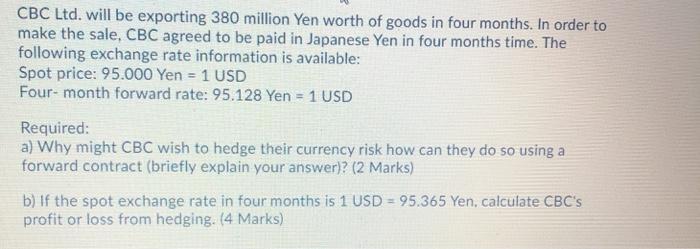

CBC Ltd. will be exporting 380 million Yen worth of goods in four months. In order to make the sale, CBC agreed to be paid in Japanese Yen in four months time. The following exchange rate information is available: Spot price: 95.000 Yen = 1 USD Four- month forward rate: 95.128 Yen = 1 USD Required: a) Why might CBC wish to hedge their currency risk how can they do so using a forward contract (briefly explain your answer)? (2 Marks) b) If the spot exchange rate in four months is 1 USD = 95.365 Yen, calculate CBC's profit or loss from hedging. (4 Marks)

Step by Step Solution

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a CBC might wish to hedge its currency risk because fluctuations in the exchange rate can affect the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Accounting

Authors: Frederick D. Choi, Gary K. Meek

7th Edition

978-0136111474, 0136111475

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App