Question

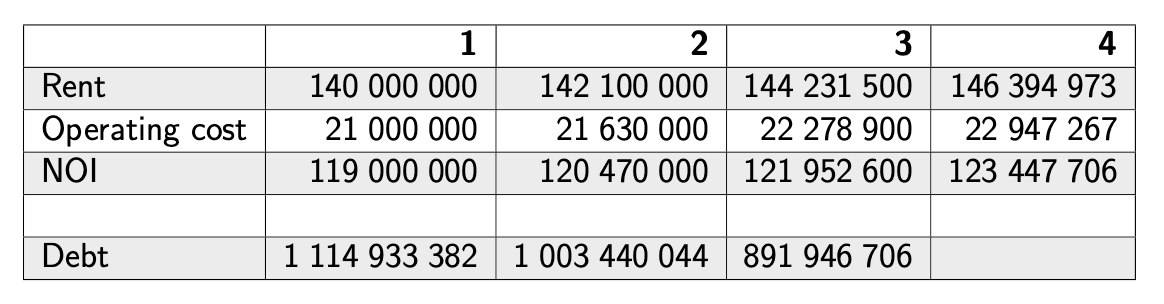

CBD Property is a firm owning commercial properties. Based on the information below displaying the Net Operating Income (NOI) from the firms property portfolio and

CBD Property is a firm owning commercial properties. Based on the information below displaying the Net Operating Income (NOI) from the firms property portfolio and the debt for year 1-3, use the APV method to calculate the value of the firm in the beginning of year 1.

The marginal corporate tax rate is 30% and the cost of capital for unlevered equity is 8.0%. The interest rate on the debt is 5.5%. The NOI year 4 is expected to grow with 1.5% per year in perpetuity. From the beginning of year 4 the firm will hold a constant debt of 900 000 000 in perpetuity with the same interest rate as the current debt, i.e. 5.5%.

The figures for rent, operating cost and NOI are in the end of the years and the figures for debt are in the beginning of the years.

1 140 000 000 Rent Operating cost NOI 2 3 4 142 100 000 144 231 500 146 394 973 21 630 000 22 278 900 22 947 267 120 470 000 121 952 600 123 447 706 21 000 000 119 000 000 Debt 1 114 933 382 1 003 440 044 891 946 706Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started