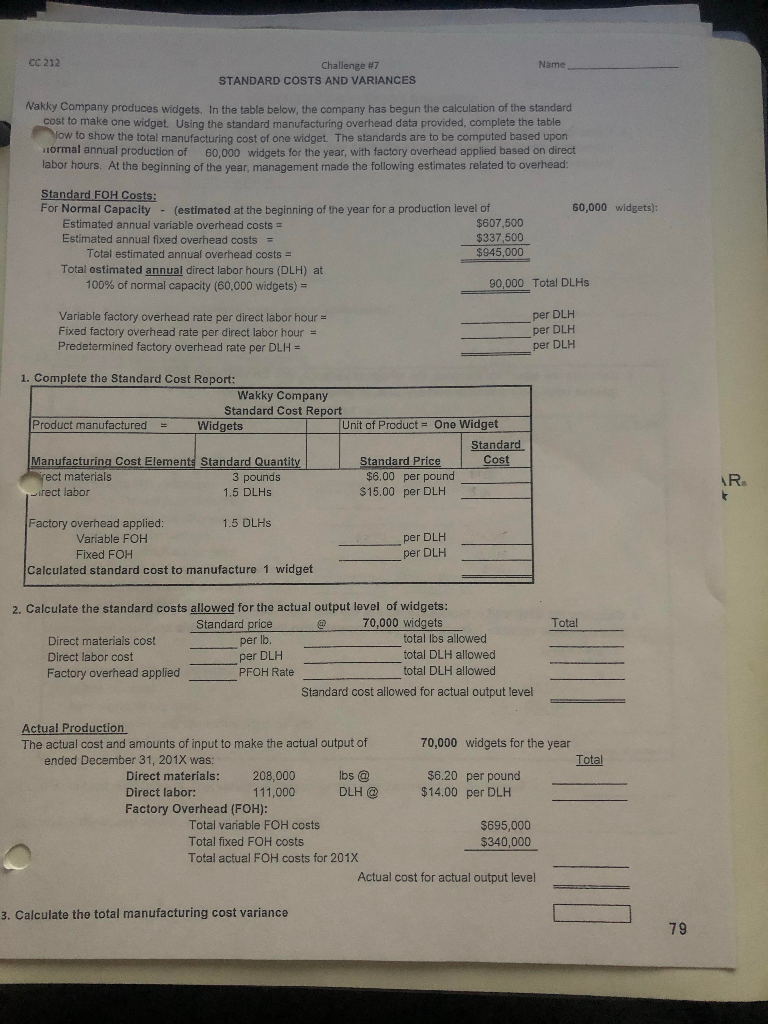

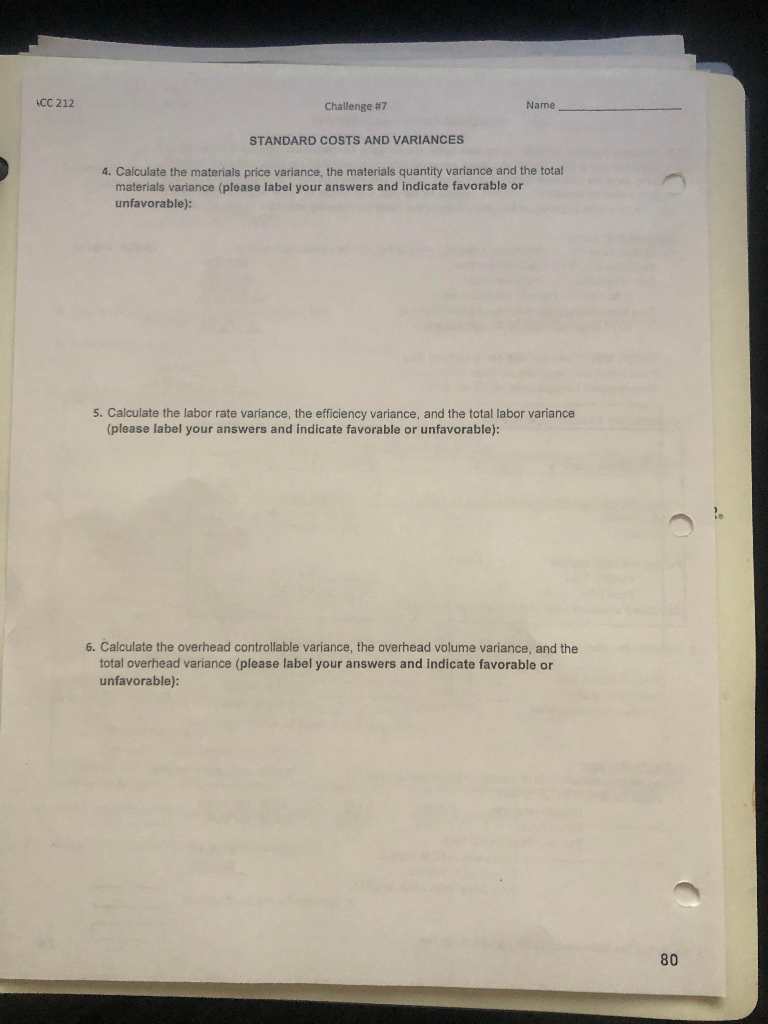

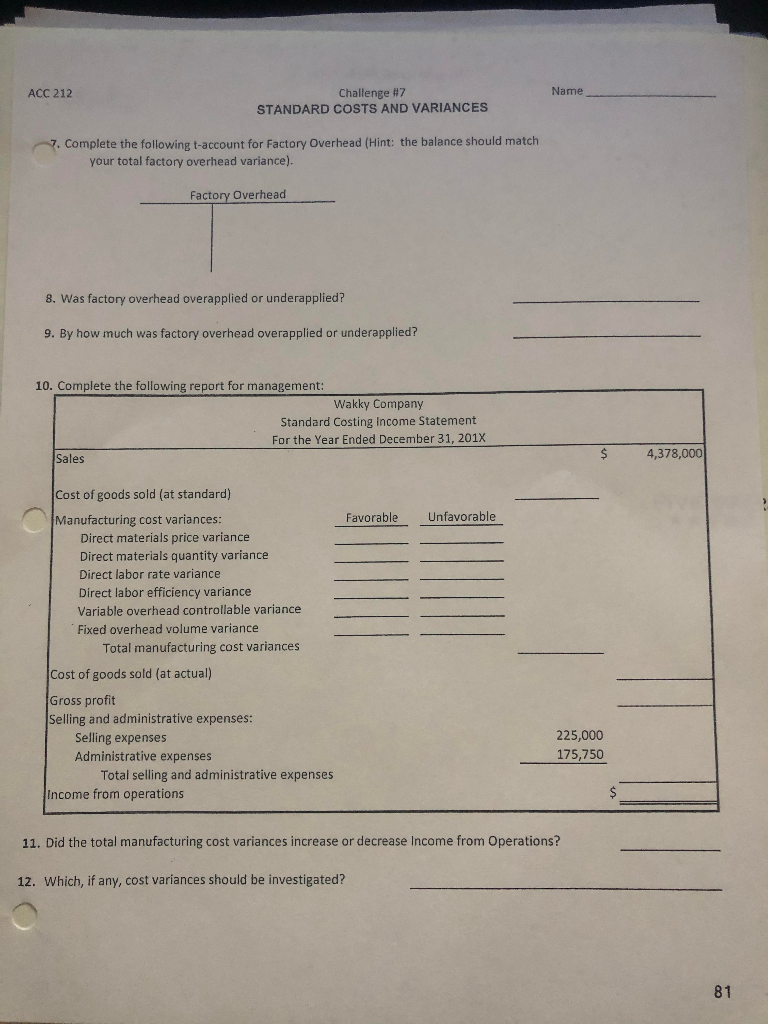

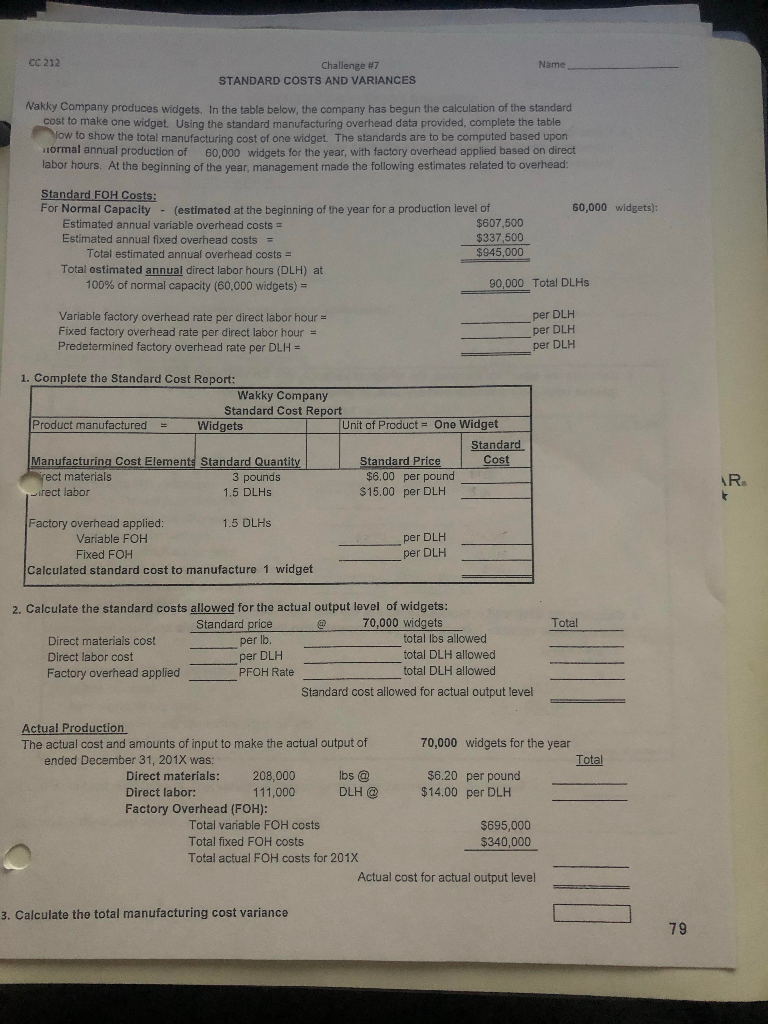

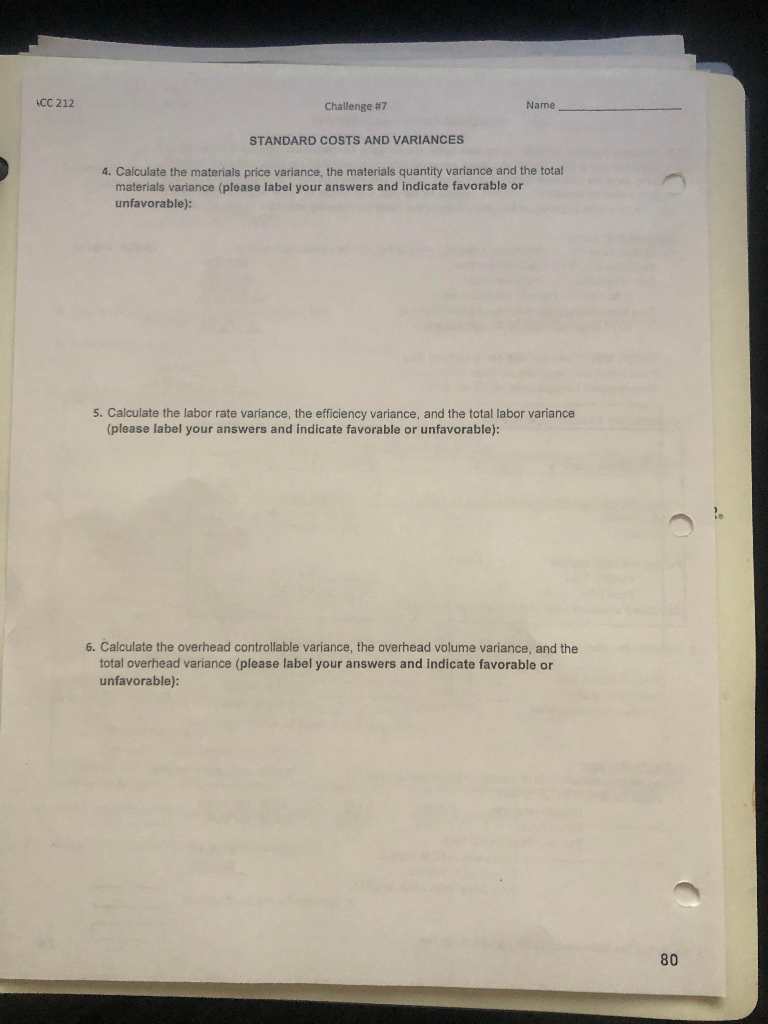

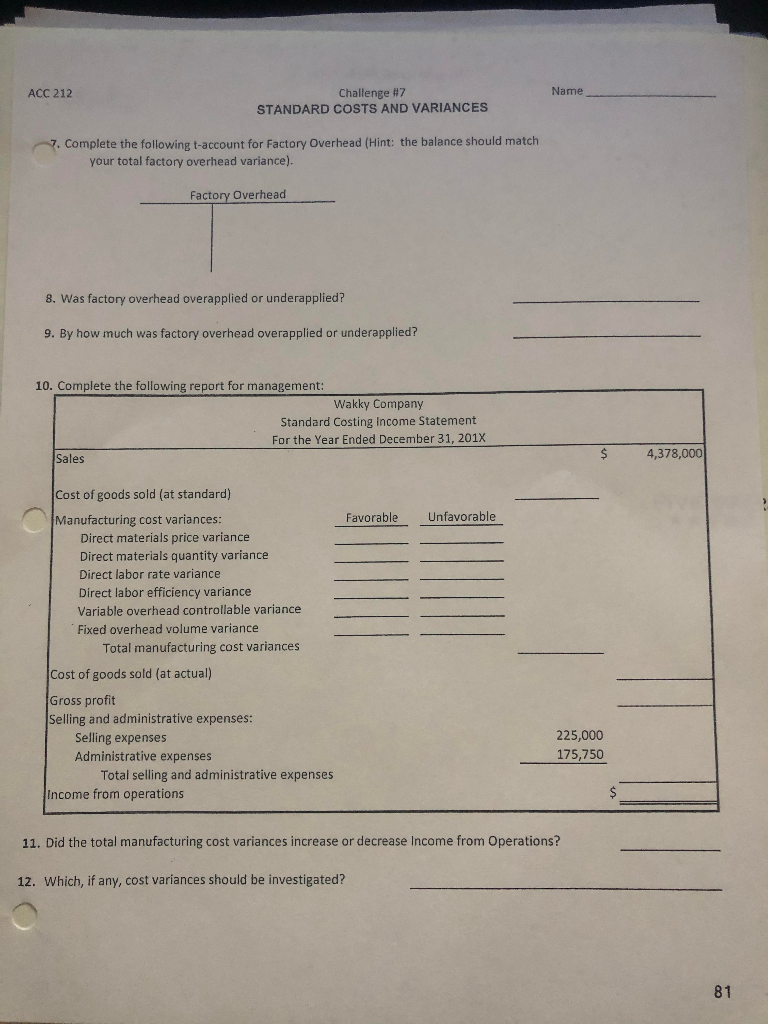

CC 212 Name Challenge #7 STANDARD COSTS AND VARIANCES Nakky Company produces widgets. In the table below the company has begun the calculation of the standard cost to make one widget. Using the standard manufacturing overhead data provided, complete the table low to show the total manufacturing cost of one widget. The standards are to be computed based upon normal annual production of 60.000 widgets for the year, with factory overhead applied based on direct labor hours. At the beginning of the year, management made the following estimates related to overhead Standard FOH Costs: For Normal Capacity - (estimated at the beginning of the year for a production level of 60,000 widgets): Estimated annual variable overhead costs = $607,500 Estimated annual fixed overhead costs = $337,500 Total estimated annual overhead costs = $945,000 Total estimated annual direct labor hours (DLH) at 100% of normal capacity (60,000 widgets) = 90,000 Total DLHS Variable factory overhead rate per direct labor hour = Fixed factory overhead rate per direct labor hour = Predetermined factory overhead rate per DLH = per DLH per DLH per DLH 1. Complete the Standard Cost Report: Wakky Company Standard Cost Report Product manufactured = Widgets Unit of Product = One Widget Standard Manufacturing Cost Elements Standard Quantity Standard Price Trect materials 3 pounds $6.00 per pound irect labor 1.5 DLHS $15.00 per DLH Cost R Factory overhead applied: 1.5 DLHS Variable FOH Fixed FOH Calculated standard cost to manufacturo 1 widget per DLH per DLH Total 2. Calculate the standard costs allowed for the actual output level of widgets: Standard price @ 70,000 widgets Direct materials cost per lb. total los allowed Direct labor cost per DLH total DLH allowed Factory overhead applied PFOH Rate total DLH allowed Standard cost allowed for actual output level Actual Production The actual cost and amounts of input to make the actual output of 70,000 widgets for the year ended December 31, 201X was: Total Direct materials: 208,000 lbs @ $6.20 per pound Direct labor: 111,000 DLH @ $14.00 per DLH Factory Overhead (FOH): Total variable FOH costs $695,000 Total fixed FOH costs $340,000 Total actual FOH costs for 201X Actual cost for actual output level 3. Calculate the total manufacturing cost variance CC 212 Challenge #7 Name STANDARD COSTS AND VARIANCES 4. Calculate the materials price variance, the materials quantity variance and the total materials variance (please label your answers and indicate favorable or unfavorable): 5. Calculate the labor rate variance, the efficiency variance, and the total labor variance (please label your answers and indicate favorable or unfavorable): 6. Calculate the overhead controllable variance, the overhead volume variance, and the total overhead variance (please label your answers and indicate favorable or unfavorable): ACC 212 Name Challenge #7 STANDARD COSTS AND VARIANCES 7. Complete the following t-account for Factory Overhead (Hint: the balance should match your total factory overhead variance). Factory Overhead 8. Was factory overhead overapplied or underapplied? 9. By how much was factory overhead overapplied or underapplied? 10. Complete the following report for management: Wakky Company Standard Costing Income Statement For the Year Ended December 31, 2017 Sales $ 4,378,000 Favorable Unfavorable Cost of goods sold (at standard) Manufacturing cost variances: Direct materials price variance Direct materials quantity variance Direct labor rate variance Direct labor efficiency variance Variable overhead controllable variance Fixed overhead volume variance Total manufacturing cost variances Cost of goods sold (at actual) Gross profit Selling and administrative expenses: Selling expenses Administrative expenses Total selling and administrative expenses Income from operations 225,000 175,750 11. Did the total manufacturing cost variances increase or decrease Income from Operations? 12. Which, if any, cost variances should be investigated