Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ccc From the perspective of the new Finance Manager of FA to respond to the Board of Directors request to present a big picture brief

ccc

ccc

From the perspective of the new Finance Manager of FA to respond to the Board of Directors request to present a big picture brief report on FAs financial performance from 2000 to 2004. In particulars, the Board of Directors like to hear from you whether FA is able to generate value as measured by ROE going forward; in particular, whether there are any concerns about FAs financial performance.

Your Report: Word limit 100

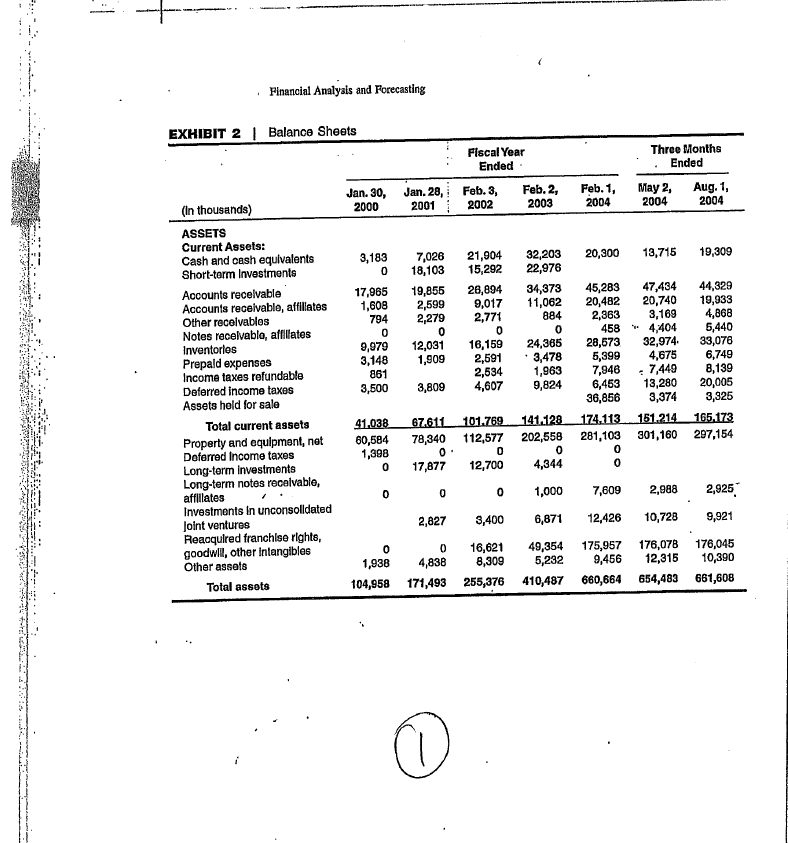

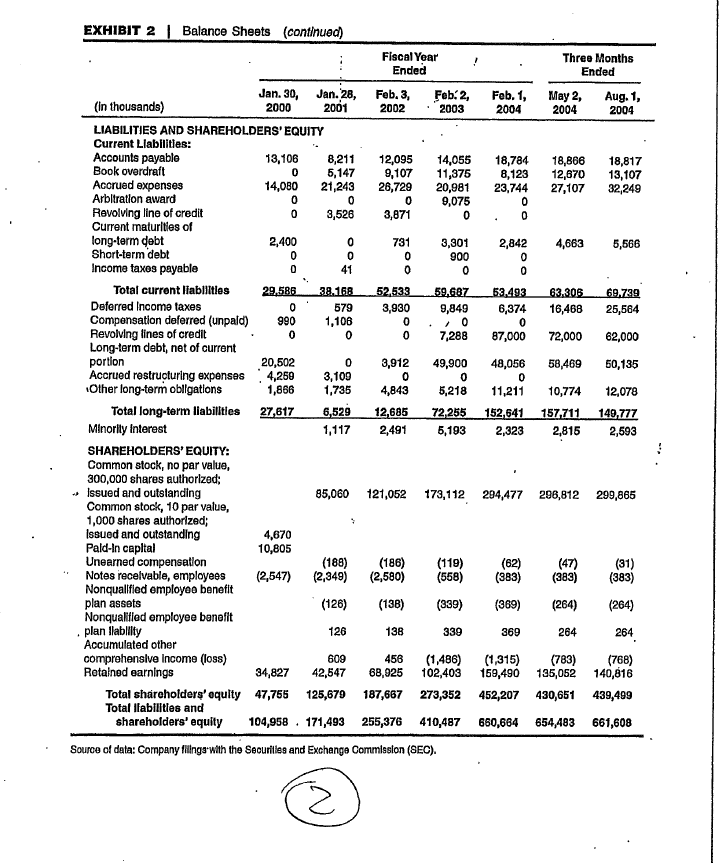

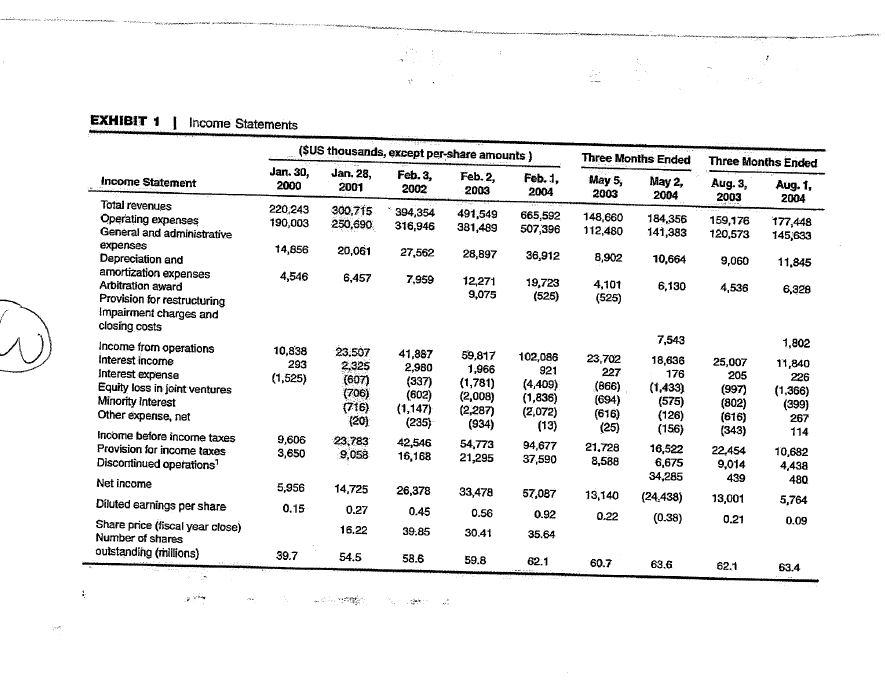

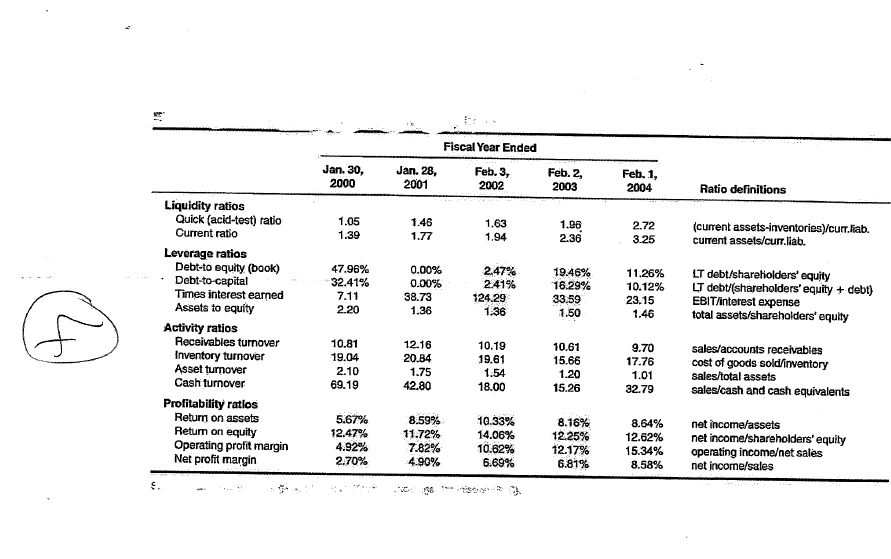

| Financial Analysis and Forecasting EXHIBIT 2 | Balance Sheets Fiscal Year Ended Three Months Ended May 2, Aug. 1, 2004 2004 Jan. 30, 2000 Jan. 28, 2001 Feb. 3, 2002 Feb. 2, 2003 Feb. 1, 2004 20,300 13,715 19,309 3,183 0 17,965 1,608 794 0 9,979 3,148 861 3,500 7,026 18,103 19,855 2,599 2,279 0 12,031 1,909 21,904 15,292 26,894 9,017 2,771 0 16,159 2,591 2,534 4,607 32,203 22,976 34,373 11,062 884 0 24,365 3,478 1,963 9,824 47,434 20,740 3,169 4,404 32,974 4,675 45,283 20,482 2,863 458 28,573 5,399 7,946 6,453 36,856 174.113 281,103 0 0 (In thousands) ASSETS Current Assets: Cash and cash equivalents Short-term Investments Accounts recevable Accounts receivable, affiliates Other receivablos Notes recevable, affilates Inventories Prepald expenses Income taxes refundable Deferred income taxes Assets held for sale Total current assets Property and equipment, net Deferred Income taxes Long-term Investments Long-term notes recalvable, affilates Investments in unconsolidated Joint ventures Reacquired franchise rights, goodwil, other intangibles Other assets Total assets 44,329 19,933 4,868 5,440 33,076 6,749 8,139 20,005 3,325 165.173 297,154 = 7,449 3,809 13,280 3,374 151.214 301,160 41.038 60,584 1,398 0 67.611 101.769 141.128 78,340 112,577 202,558 0 0 0 17,877 12,700 4,344 0 0 0 1,000 7,609 2,988 2,925 2,827 3,400 6,871 12,426 10,728 9,921 Z 0 0 16,621 49,354 175,957 176,078 176,045 1,938 4,838 8,309 5,232 9,456 12,315 10,390 104,958 171,493 255,376 410,487 660,664 654,483 661,608 EXHIBIT 2 | Balance Sheets (continued) Fiscal Year ! Three Months Ended Ended Jan. 30, Jan. 28, Feb. 3, Feb 2 Feb. 1, May 2, Aug. 1, (in thousands) 2000 2001 2002 2003 2004 2004 2004 LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities: Accounts payable 13,106 8,211 12,095 14,055 18,784 18,866 18,817 Book overdraft 0 5,147 9,107 11,375 8,123 12,670 13,107 Accrued expenses 14,0B0 21,243 26,729 20,981 23,744 27,107 32,249 Arbitration award 0 0 0 9,075 0 Revolving line of credit 0 3,526 3,871 0 0 Current maturities of long-term debt 2,400 0 731 3,301 2,842 4,663 5,566 Short-term debt 0 0 0 900 0 Income taxes payable 0 41 0 0 0 Total current liablittles 29.586 39.16.8 52 533 59.687 52,493 63.306 69.739 Deferred Income taxes 0 579 3,930 9,849 6,374 16,468 25,584 Compensation deferred (unpald) 990 1,106 0 0 0 Revolving lines of credit 0 0 0 7,288 87,000 72,000 62,000 Long-term debt, net of current portion 20,502 0 3,912 49,900 48,056 58,469 50,135 Accrued restructuring expenses 4,269 3,109 0 0 0 Other long-term obligations 1,866 1,735 4,843 5,218 11,211 10,774 12,078 Total long-term liabilities 27,617 6,529 12,685 72.255 152,641 157 711 149,777 Minority interest 1,117 2,491 5,193 2,815 2,593 SHAREHOLDERS' EQUITY: Common stock, no par value, 300,000 shares authorized: Issued and outstanding 85,060 121,052 173,112 294,477 296,812 299,865 Common stock, 10 par value, 1,000 shares authorized; Issued and outstanding 4,670 Pald-in capital 10,805 Unearned compensation (188) (186) (119) (62) (47) (31) Notes receivable, employees (2,547) (2,349) (2,580) (558) (383) (383) (383) Nonqualified employee benefit plan assets (126) (138) (369) (264) (264) Nonqualified employee benefit plan Ilablilty 126 138 339 369 264 264 Accumulated other comprehensive Income (loss) 609 458 (1,486) (1,315) (783) (768) Retalnod earnings 34,827 42,547 88,925 102,403 159,490 135,052 140,816 Total shareholders' equity 47,755 125,679 187,667 273,352 452,207 430,651 439,499 Total Ifabilities and shareholders' equity 104,958 . 171,493 255,376 410,487 660,664 654,483 661,608 Source of data: Company flings with the Securities and Exchange Commission (SEC). 2,323 (339) + N Three Months Ended May 5, May 2, 2003 2004 Three Months Ended Aug. 3, Aug. 1, 2003 2004 148,660 112,480 184,356 141,383 159,176 120,573 177,448 145,633 8,902 10,664 9,060 11,845 6,130 4,101 (525) 4,536 6,328 EXHIBIT 1 | Income Statements ($US thousands, except per-share amounts) Jan. 30, Jan. 28, Feb. 3, Feb. 2, Feb. 1, Income Statement 2000 2001 2002 2003 2004 Total revenues 220,243 300,715 394,354 491,549 665,592 Operating expenses 190,003 250,690 316,946 381,489 507,396 General and administrative expenses 14,856 20,061 27,562 28,897 36,912 Depreciation and amortization expenses 4,546 6,457 7.959 12,271 19,723 Arbitration award 9,075 (525) Provision for restructuring Impairment charges and closing costs Income from operations 10,838 23.507 41,887 59,817 102,086 Interest income 293 2.325 2,980 1,966 921 Interest expense (1,525) (607) (337) (1,781) (4,409) Equity loss in joint ventures (706) (602) (2,008) (1,835) Minority Interest (716) (1,147) (2,287) (2,072) Other expense, net (20) (235) (934) Income before income taxes 9,606 23,783 42,546 54,773 94,677 Provision for income taxes 3,650 9,058 16,168 21,295 37,590 Discontinued operations Net income 5,956 14,725 26,378 33,478 57,087 Diluted earnings per share 0.15 0.27 0.45 0.92 Share price fiscal year close) 16.22 39.85 30.41 35.64 Number of shares outstanding (millions) 39.7 54.5 58.6 59.8 62.1 23,702 227 (866) (694) (616) (25) 21,728 8,588 1,802 11,840 226 (1,366) (399) 267 114 7,543 18,636 176 (1,433) (575) (126) (156) 16,522 6,675 34,285 (24.438) (0.38) (13) 25,007 205 (997) (802) (616) (343) 22,454 9,014 439 13,001 0.21 10,682 4,438 480 5,764 13,140 0.22 0.56 0.09 60.7 63.6 62.1 63.4 ? Jan. 30, 2000 Fiscal Year Ended Jan. 28, Feb. 3, 2001 2002 Feb. 2, 2003 Feb. 1, 2004 Ratio definitions 1.05 1.39 1.46 1.77 1.63 1.94 1.96 2.36 2.72 3.25 (current assets-inventories)/curr.lib. current assets/curr.lib. 47.96% 32.41% 7.11 2.20 0.00% 0.00% 38.73 1.36 2.47% 2.41% 124.29 1.36 19.46% 16.29% 33.59 1.50 11.26% 10.12% 23.15 1.46 LT debt/shareholders' equity LT debt/(shareholders' equity + debt) EBIT/interest expense total assets/shareholders' equlty Liquidity ratios Quick (acid-test) ratio Current ratio Leverage ratios Debt-to equity (book) Debt-to-capital Times interest earned Assets to equity Activity ratios Receivables turnover Inventory turnover Asset turnover Cash turnover Profitability ratlos Return on assets Return on equity Operating profit margin Net profit margin 10.81 19.04 2.10 69.19 12.16 20.84 1.75 42.80 10.19 19.61 1.54 18.00 10.61 15.66 1.20 15.26 9.70 17.76 1.01 32.79 sales/accounts receivables cost of goods sold inventory sales/total assets sales/cash and cash equivalents 5.67% 12.47% 4.92% 2.70% 8.59% 11.72% 7.82% 4.90% 10.33% 14.06% 10.62% 6.69% 8.16% 12.25% 12.17% 6.81% 8.64% 2.62% 15.34% 8.58% net income/assets net income/shareholders' equity operating incomeet sales net income/sales 16 | Financial Analysis and Forecasting EXHIBIT 2 | Balance Sheets Fiscal Year Ended Three Months Ended May 2, Aug. 1, 2004 2004 Jan. 30, 2000 Jan. 28, 2001 Feb. 3, 2002 Feb. 2, 2003 Feb. 1, 2004 20,300 13,715 19,309 3,183 0 17,965 1,608 794 0 9,979 3,148 861 3,500 7,026 18,103 19,855 2,599 2,279 0 12,031 1,909 21,904 15,292 26,894 9,017 2,771 0 16,159 2,591 2,534 4,607 32,203 22,976 34,373 11,062 884 0 24,365 3,478 1,963 9,824 47,434 20,740 3,169 4,404 32,974 4,675 45,283 20,482 2,863 458 28,573 5,399 7,946 6,453 36,856 174.113 281,103 0 0 (In thousands) ASSETS Current Assets: Cash and cash equivalents Short-term Investments Accounts recevable Accounts receivable, affiliates Other receivablos Notes recevable, affilates Inventories Prepald expenses Income taxes refundable Deferred income taxes Assets held for sale Total current assets Property and equipment, net Deferred Income taxes Long-term Investments Long-term notes recalvable, affilates Investments in unconsolidated Joint ventures Reacquired franchise rights, goodwil, other intangibles Other assets Total assets 44,329 19,933 4,868 5,440 33,076 6,749 8,139 20,005 3,325 165.173 297,154 = 7,449 3,809 13,280 3,374 151.214 301,160 41.038 60,584 1,398 0 67.611 101.769 141.128 78,340 112,577 202,558 0 0 0 17,877 12,700 4,344 0 0 0 1,000 7,609 2,988 2,925 2,827 3,400 6,871 12,426 10,728 9,921 Z 0 0 16,621 49,354 175,957 176,078 176,045 1,938 4,838 8,309 5,232 9,456 12,315 10,390 104,958 171,493 255,376 410,487 660,664 654,483 661,608 EXHIBIT 2 | Balance Sheets (continued) Fiscal Year ! Three Months Ended Ended Jan. 30, Jan. 28, Feb. 3, Feb 2 Feb. 1, May 2, Aug. 1, (in thousands) 2000 2001 2002 2003 2004 2004 2004 LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities: Accounts payable 13,106 8,211 12,095 14,055 18,784 18,866 18,817 Book overdraft 0 5,147 9,107 11,375 8,123 12,670 13,107 Accrued expenses 14,0B0 21,243 26,729 20,981 23,744 27,107 32,249 Arbitration award 0 0 0 9,075 0 Revolving line of credit 0 3,526 3,871 0 0 Current maturities of long-term debt 2,400 0 731 3,301 2,842 4,663 5,566 Short-term debt 0 0 0 900 0 Income taxes payable 0 41 0 0 0 Total current liablittles 29.586 39.16.8 52 533 59.687 52,493 63.306 69.739 Deferred Income taxes 0 579 3,930 9,849 6,374 16,468 25,584 Compensation deferred (unpald) 990 1,106 0 0 0 Revolving lines of credit 0 0 0 7,288 87,000 72,000 62,000 Long-term debt, net of current portion 20,502 0 3,912 49,900 48,056 58,469 50,135 Accrued restructuring expenses 4,269 3,109 0 0 0 Other long-term obligations 1,866 1,735 4,843 5,218 11,211 10,774 12,078 Total long-term liabilities 27,617 6,529 12,685 72.255 152,641 157 711 149,777 Minority interest 1,117 2,491 5,193 2,815 2,593 SHAREHOLDERS' EQUITY: Common stock, no par value, 300,000 shares authorized: Issued and outstanding 85,060 121,052 173,112 294,477 296,812 299,865 Common stock, 10 par value, 1,000 shares authorized; Issued and outstanding 4,670 Pald-in capital 10,805 Unearned compensation (188) (186) (119) (62) (47) (31) Notes receivable, employees (2,547) (2,349) (2,580) (558) (383) (383) (383) Nonqualified employee benefit plan assets (126) (138) (369) (264) (264) Nonqualified employee benefit plan Ilablilty 126 138 339 369 264 264 Accumulated other comprehensive Income (loss) 609 458 (1,486) (1,315) (783) (768) Retalnod earnings 34,827 42,547 88,925 102,403 159,490 135,052 140,816 Total shareholders' equity 47,755 125,679 187,667 273,352 452,207 430,651 439,499 Total Ifabilities and shareholders' equity 104,958 . 171,493 255,376 410,487 660,664 654,483 661,608 Source of data: Company flings with the Securities and Exchange Commission (SEC). 2,323 (339) + N Three Months Ended May 5, May 2, 2003 2004 Three Months Ended Aug. 3, Aug. 1, 2003 2004 148,660 112,480 184,356 141,383 159,176 120,573 177,448 145,633 8,902 10,664 9,060 11,845 6,130 4,101 (525) 4,536 6,328 EXHIBIT 1 | Income Statements ($US thousands, except per-share amounts) Jan. 30, Jan. 28, Feb. 3, Feb. 2, Feb. 1, Income Statement 2000 2001 2002 2003 2004 Total revenues 220,243 300,715 394,354 491,549 665,592 Operating expenses 190,003 250,690 316,946 381,489 507,396 General and administrative expenses 14,856 20,061 27,562 28,897 36,912 Depreciation and amortization expenses 4,546 6,457 7.959 12,271 19,723 Arbitration award 9,075 (525) Provision for restructuring Impairment charges and closing costs Income from operations 10,838 23.507 41,887 59,817 102,086 Interest income 293 2.325 2,980 1,966 921 Interest expense (1,525) (607) (337) (1,781) (4,409) Equity loss in joint ventures (706) (602) (2,008) (1,835) Minority Interest (716) (1,147) (2,287) (2,072) Other expense, net (20) (235) (934) Income before income taxes 9,606 23,783 42,546 54,773 94,677 Provision for income taxes 3,650 9,058 16,168 21,295 37,590 Discontinued operations Net income 5,956 14,725 26,378 33,478 57,087 Diluted earnings per share 0.15 0.27 0.45 0.92 Share price fiscal year close) 16.22 39.85 30.41 35.64 Number of shares outstanding (millions) 39.7 54.5 58.6 59.8 62.1 23,702 227 (866) (694) (616) (25) 21,728 8,588 1,802 11,840 226 (1,366) (399) 267 114 7,543 18,636 176 (1,433) (575) (126) (156) 16,522 6,675 34,285 (24.438) (0.38) (13) 25,007 205 (997) (802) (616) (343) 22,454 9,014 439 13,001 0.21 10,682 4,438 480 5,764 13,140 0.22 0.56 0.09 60.7 63.6 62.1 63.4 ? Jan. 30, 2000 Fiscal Year Ended Jan. 28, Feb. 3, 2001 2002 Feb. 2, 2003 Feb. 1, 2004 Ratio definitions 1.05 1.39 1.46 1.77 1.63 1.94 1.96 2.36 2.72 3.25 (current assets-inventories)/curr.lib. current assets/curr.lib. 47.96% 32.41% 7.11 2.20 0.00% 0.00% 38.73 1.36 2.47% 2.41% 124.29 1.36 19.46% 16.29% 33.59 1.50 11.26% 10.12% 23.15 1.46 LT debt/shareholders' equity LT debt/(shareholders' equity + debt) EBIT/interest expense total assets/shareholders' equlty Liquidity ratios Quick (acid-test) ratio Current ratio Leverage ratios Debt-to equity (book) Debt-to-capital Times interest earned Assets to equity Activity ratios Receivables turnover Inventory turnover Asset turnover Cash turnover Profitability ratlos Return on assets Return on equity Operating profit margin Net profit margin 10.81 19.04 2.10 69.19 12.16 20.84 1.75 42.80 10.19 19.61 1.54 18.00 10.61 15.66 1.20 15.26 9.70 17.76 1.01 32.79 sales/accounts receivables cost of goods sold inventory sales/total assets sales/cash and cash equivalents 5.67% 12.47% 4.92% 2.70% 8.59% 11.72% 7.82% 4.90% 10.33% 14.06% 10.62% 6.69% 8.16% 12.25% 12.17% 6.81% 8.64% 2.62% 15.34% 8.58% net income/assets net income/shareholders' equity operating incomeet sales net income/sales 16

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started