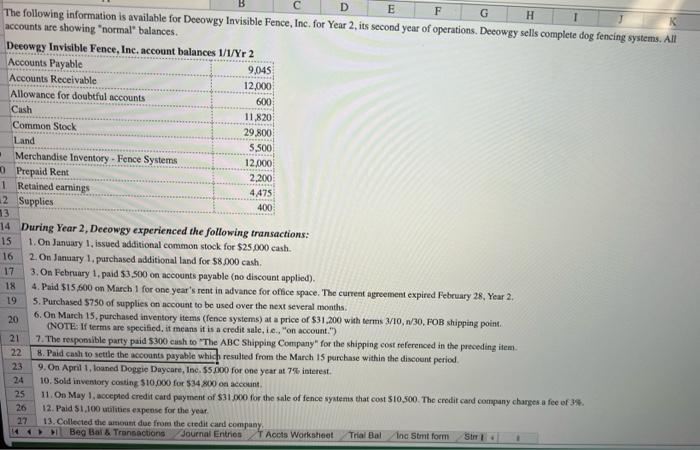

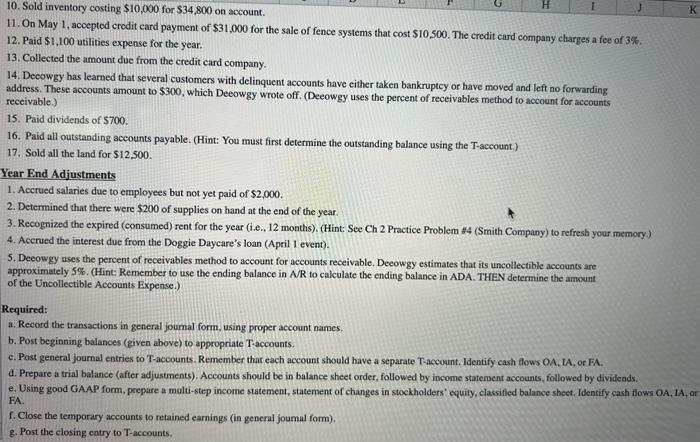

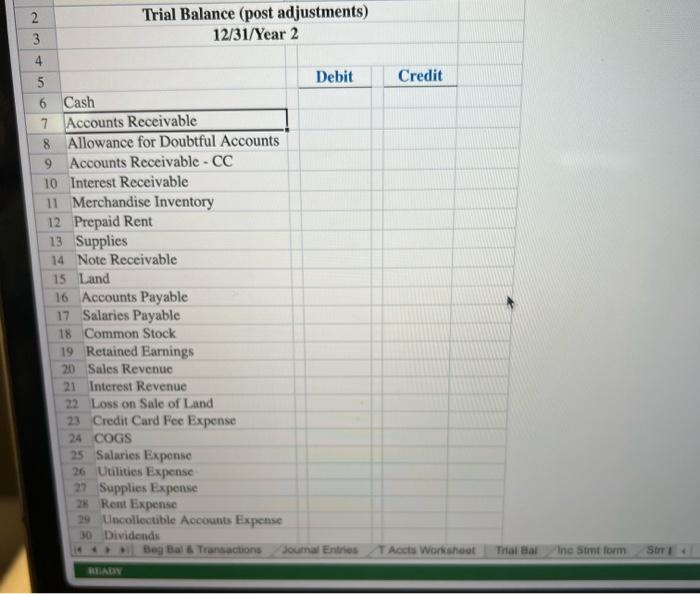

cccounts are showing "normal" balances. Deeowgy Invisible Fence. Inc, acmonat halanone During Year 2, Deeowgy experienced the following transactions: 1. On Jantaary 1, issued additional common stock for $25,000 cash 2. On January 1, purchased additional land for $8,000 cash. 3. On February 1, paid 53,500 on accounts payable (no discount applied). 4. Paid $15,600on March 1 for one year's rent in advance for office space. The curreat agreement expired February 28, Year 2, 5. Purchased 5750 of supplies on ncoount to be used over the next several months. 6. On March 15, purchased inventory items (fence sysiems) at a price of $31,200 with terms 3/10,N30, FOB shipping point. (NOTE: If terms are specificd, it means it is a credit sale, ie., "on account.") 7. The respomible party paid $300 cush to "The ABC Shipping Conpany" for the shipping cost referenoed in the preeeding item. 8. Paid cash to setule the accounts payable which resulted from the March 15 purchase within the discount period 9. On April 1, haned Dogeie Daycare, Inc, 55.000 for one year at 7% isterest. 10. Sold inveniory conting $10,000 for 534800 on account. 11. On May 1, iooeped credit card payment of $31,ovo for the sile of fence syatems that cost 510500 . The crodit card company churges a fee of 3%. 12. Paid 51,100 unilities expense for the year. 13. Collected the assount due frum the ctodit cand company. 12. Paid $1,100 utilities expense for the year. 13. Collected the amount due from the credit card company. 14. Decowgy has learned that several customers with delinquent accounts have either taken bankruptcy or have moved and left no forwarding address. These accounts amount to $300, which Deeowgy wrote off. (Deeowgy uses the percent of receivables method to account for accounts receivable.) 15. Paid dividends of 5700 . 16. Paid all outstanding accounts payable. (Hint: You must first determine the outstanding balance using the T-account.) 17. Sold all the land for $12.500. Year Eind Adjustments 1. Accrued salaries due to employees but not yet paid of $2,000. 2. Determined that there were $200 of supplies on hand at the end of the year. 3. Recognized the expired (consumed) rent for the year (i.e, 12 months), (Hint: See Ch2 Practice Problem $4 (Smith Company) to refresh your memory) 4. Acerued the interest due from the Doggie Daycare's loan (April 1 event). 5. Deeowgy uses the percent of receivables method to aceount for accounts receivable. Deeowgy estimates that its uncollectible accounts are approximately 5\%. (Hint: Remember to use the ending balance in A/R to calculate the ending balance in ADA. THEN determine the amsount of the Uncollectible Accounts Expense.) Required: a. Record the transactions in general joumal form, using proper account names. b. Post beginning balances (given above) to appropriate Taccounts. c. Post general journal entries to T-accounts. Remember that each account should have a separate T-account, Identify cash flows OA, IA, or EA. d. Prepare a trial balance (after adjustments). Accounts should be in balance sheet order, followed by income staternent accounts, followed by divideads. e. Using good GAAP form, prepare a multi-step income statement, statement of changes in stockholders' equity, classified balance sheet, Identify cash flows OA, 1/ FA. f. Close the temporary accounts to retained earnings (in general joumal form). 2 Trial Balance (post adjustments) \begin{tabular}{|c|} \hline 3 \\ \hline 4 \\ \hline 5 \\ \hline 6 \\ \hline \end{tabular} 12/31/ Year 2 \begin{tabular}{|l|l|l|} \hline & Debit & Credit \\ \hline Cash & & \\ \hline \end{tabular} 7 Accounts Receivable 8 Allowance for Doubtful Accounts 9 Accounts Receivable - CC 10 Interest Receivable 11 Merchandise Inventory 12 Prepaid Rent 13 Supplies 14 Note Receivable 15 Land 16 Accounts Payable 17 Salaries Payable 18 Common Stock 19 Retained Earnings 20 Sales Revenue 21 Interest Revenue 22 Loss on Sale of Land 23 Credit Card Fee Expense 24 COGS 25 Salaries Expense 26 Uuilities Expense 27 Supplies Expense 23. Rent Expense 29 Uncollectible Accounts Expense 30 Dividends