Answered step by step

Verified Expert Solution

Question

1 Approved Answer

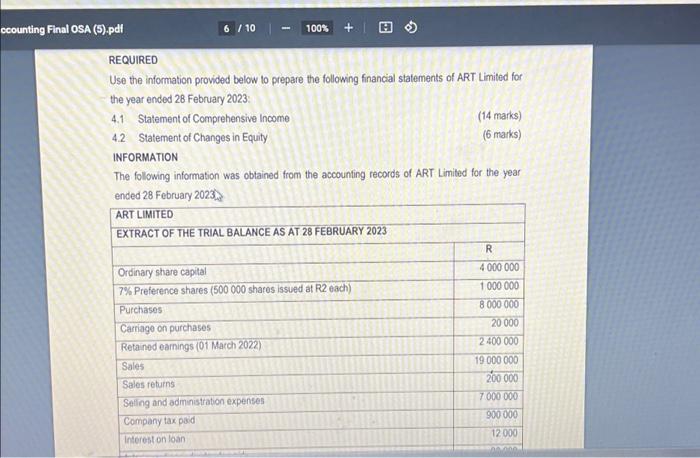

ccounting Final OSA (5).pdf 6/10 | I 100% + REQUIRED Use the information provided below to prepare the following financial statements of ART Limited for

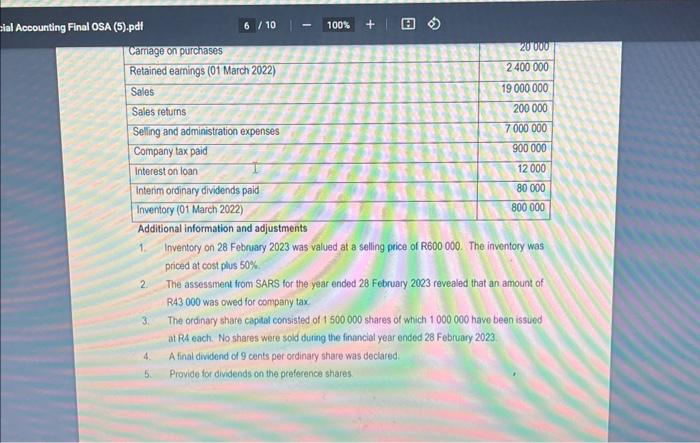

ccounting Final OSA (5).pdf 6/10 | I 100% + REQUIRED Use the information provided below to prepare the following financial statements of ART Limited for the year ended 28 February 2023: 4.1 Statement of Comprehensive Income 4.2 Statement of Changes in Equity Purchases Carriage on purchases Retained earnings (01 March 2022) Sales Sales returns Selling and administration expenses Company tax paid Interest on loan INFORMATION The following information was obtained from the accounting records of ART Limited for the year ended 28 February 2023 ART LIMITED EXTRACT OF THE TRIAL BALANCE AS AT 28 FEBRUARY 2023 Ordinary share capital 7% Preference shares (500 000 shares issued at R2 each) (14 marks) (6 marks) R 4 000 000 1 000 000 8 000 000 20 000 2 400 000 19 000 000 200 000 7 000 000 900 000 FE 12.000 13 990

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started