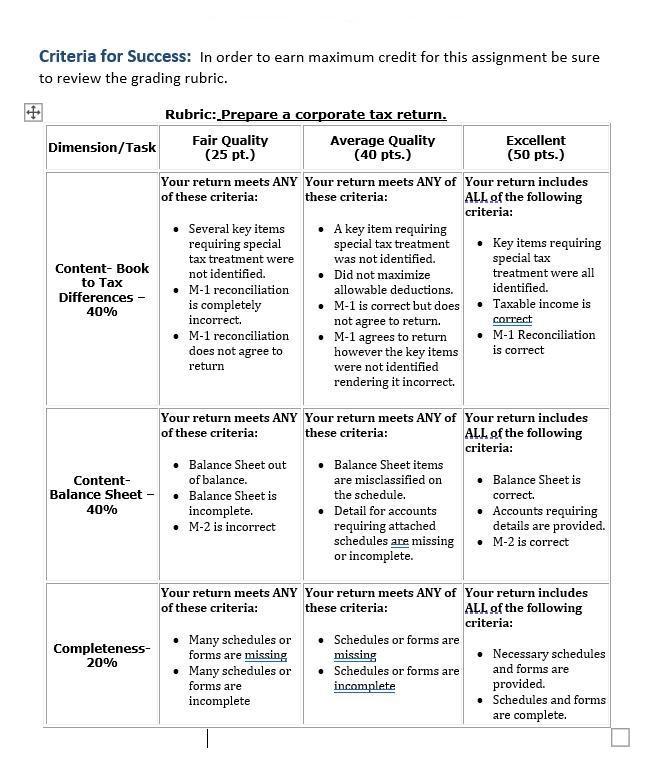

Complete Celebrity Catering Service Inc.s (CCS) Form 1120 and all related schedules. Be sure to attach schedules for any line item which indicates one is

Complete Celebrity Catering Service Inc.’s (CCS)

Form 1120 and all related schedules.

Be sure to attach schedules for any line item which indicates one is required on the 1120.

•FORM4562 is not required. (Do not complete Form 4562 [depreciation calculation] since you do not have all the information).

•If any information is missing, use reasonable assumptions to fill in the gaps and list those

assumptions as an attachment.

• The forms schedules and instructions can be found at www.irs.gov and download the

necessary forms.

![CCS Corporate Tax Return Problem Income Statement Additional Information: [1] CCSS inventory-related purchases during the ye](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2021/06/60bfa1127792e_1623171311775.jpg)

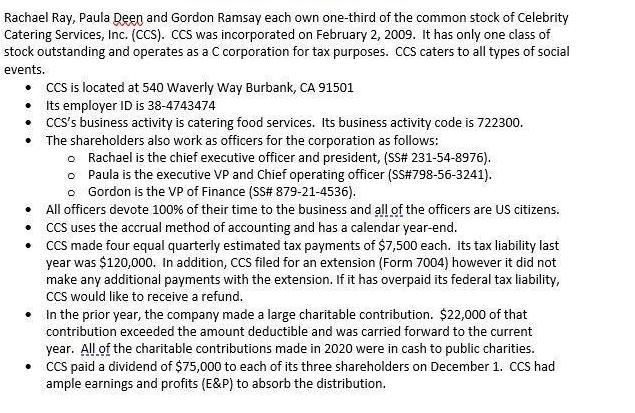

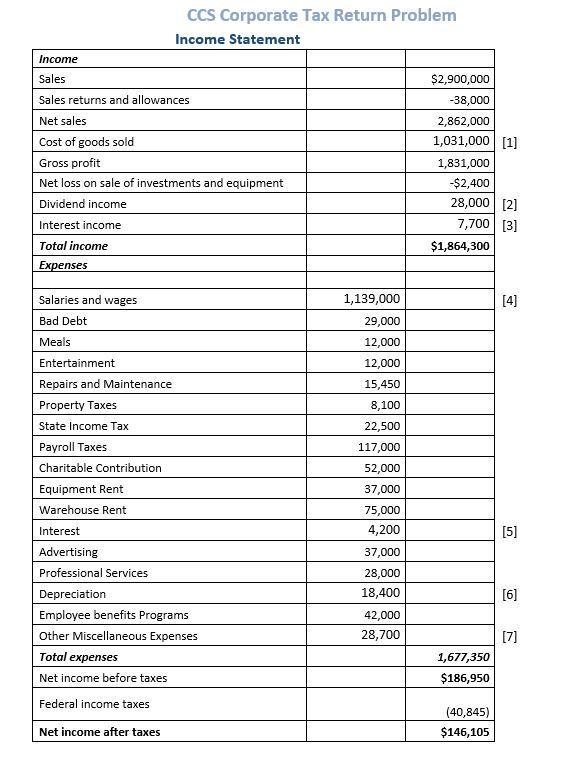

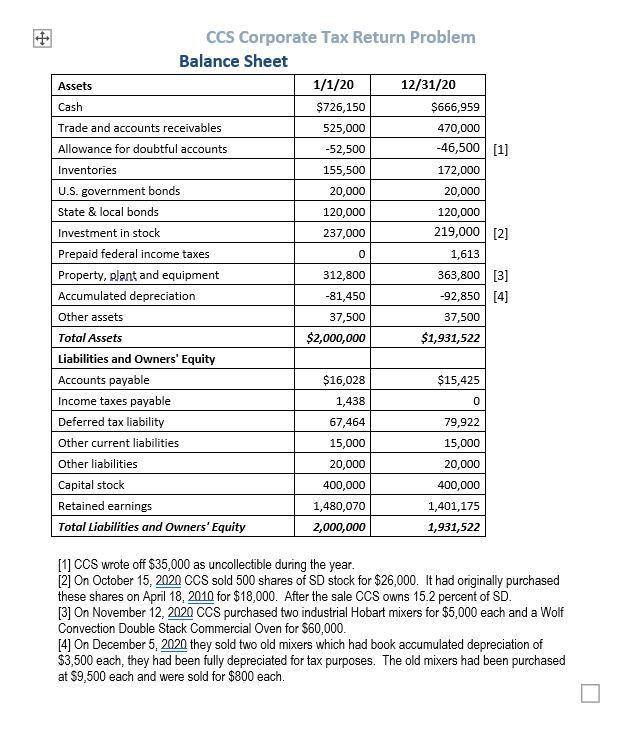

Rachael Ray, Paula Deen and Gordon Ramsay each own one-third of the common stock of Celebrity Catering Services, Inc. (CCS). CCS was incorporated on February 2, 2009. It has only one class of stock outstanding and operates as a C corporation for tax purposes. CCS caters to all types of social events. CCS is located at 540 Waverly Way Burbank, CA 91501 Its employer ID is 38-4743474 CCS's business activity is catering food services. Its business activity code is 722300. The shareholders also work as officers for the corporation as follows: o Rachael is the chief executive officer and president, (SS# 231-54-8976). o Paula is the executive VP and Chief operating officer (SS#798-56-3241). o Gordon is the VP of Finance (SS# 879-21-4536). All officers devote 100% of their time to the business and all of the officers are US citizens. CCS uses the accrual method of accounting and has a calendar year-end. CCS made four equal quarterly estimated tax payments of $7,500 each. Its tax liability last year was $120,000. In addition, CCS filed for an extension (Form 7004) however it did not make any additional payments with the extension. If it has overpaid its federal tax liability, CCS would like to receive a refund. In the prior year, the company made a large charitable contribution. $22,000 of that contribution exceeded the amount deductible and was carried forward to the current year. All of the charitable contributions made in 2020 were in cash to public charities. CCS paid a dividend of $75,000 to each of its three shareholders on December 1. CCS had ample earnings and profits (E&P) to absorb the distribution.

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Ill help you organize the information youve provided into the appropriate sections of Form 1120 and related schedules Please note that while I can gui...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started