Question: On January 2, 20x3, the Bevin Corporation, a publicly accountable entity, issued 300,000 Share Appreciation Rights to its employees. The SARS vest on June

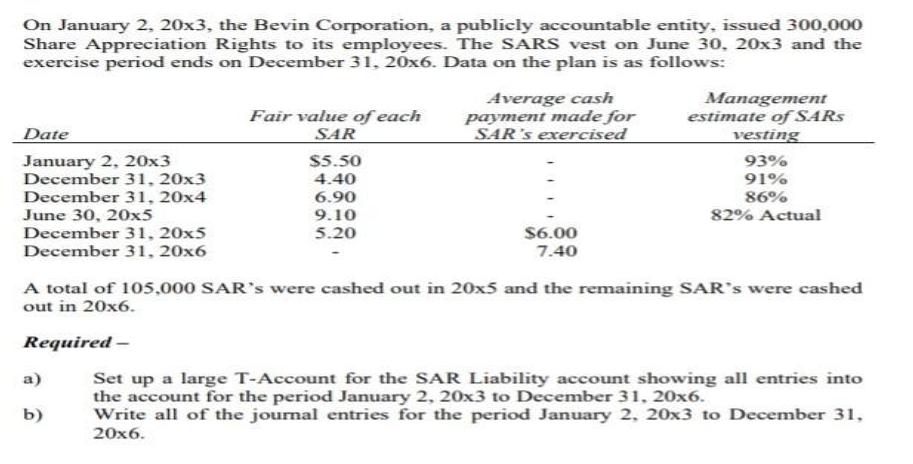

On January 2, 20x3, the Bevin Corporation, a publicly accountable entity, issued 300,000 Share Appreciation Rights to its employees. The SARS vest on June 30, 20x3 and the exercise period ends on December 31, 20x6. Data on the plan is as follows: Fair value of each SAR Average cash payment made for SAR's exercised Management estimate of SARS vesting Date January 2, 20x3 December 31, 20x3 December 31, 20x4 June 30, 20x5 December 31, 20x5 December 31, 20x6 S5.50 93% 4.40 91% 86% 82% Actual 6.90 9.10 5.20 $6.00 7.40 A total of 105,000 SAR's were cashed out in 20x5 and the remaining SAR's were cashed out in 20x6. Required - a) Set up a large T-Account for the SAR Liability account showing all entries into the account for the period January 2, 20x3 to December 31, 20x6. Write all of the journal entries for the period January 2, 20x3 to December 31, b) 20x6.

Step by Step Solution

3.53 Rating (146 Votes )

There are 3 Steps involved in it

Working Note Date Fair Value To be Vested Cumulative Expense A B CAB300000 DC Previous period C January 220x3 550 93 1534500 1534500 December 3120x3 4... View full answer

Get step-by-step solutions from verified subject matter experts