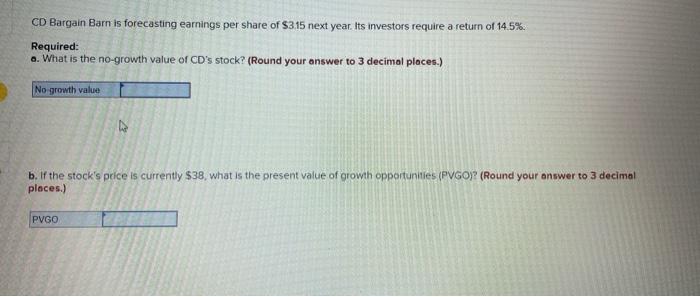

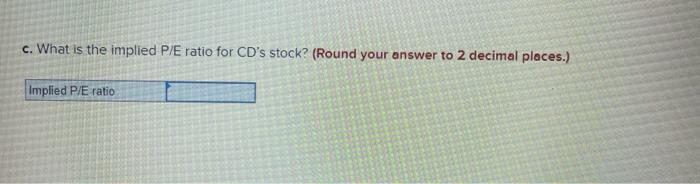

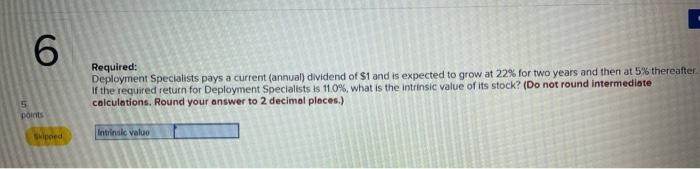

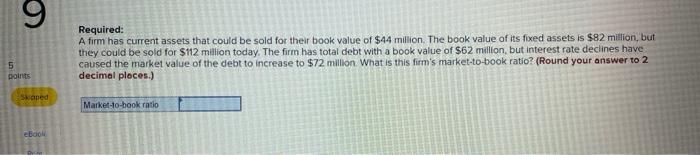

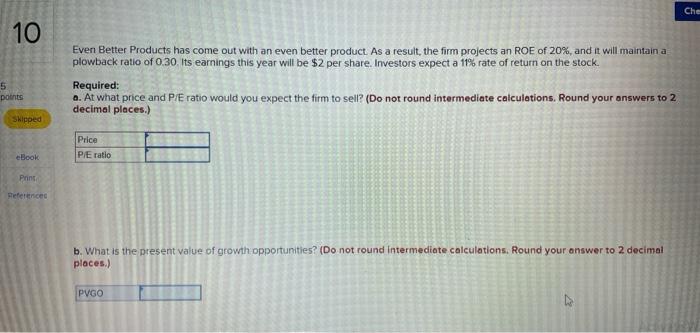

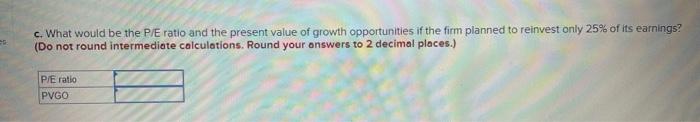

CD Bargain Barn is forecasting earnings per share of $3.15 next year. Its investors require a return of 14.5%. Required: a. What is the no-growth value of CD's stock? (Round your answer to 3 decimal places.) No-growth value b. If the stock's price is currently $38, what is the present value of growth opportunities (PVGO)? (Round your answer to 3 decimal places.) PVGO c. What is the implied P/E ratio for CD's stock? (Round your answer to 2 decimal places.) Implied P/E ratio 6 5 points Svipped Required: Deployment Specialists pays a current (annual) dividend of $1 and is expected to grow at 22% for two years and then at 5% thereafter. If the required return for Deployment Specialists is 11.0%, what is the intrinsic value of its stock? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Intrinsic value 9 5 points Skraped eBook Required: A firm has current assets that could be sold for their book value of $44 million. The book value of its fixed assets is $82 million, but they could be sold for $112 million today. The firm has total debt with a book value of $62 million, but interest rate declines have caused the market value of the debt to increase to $72 million. What is this firm's market-to-book ratio? (Round your answer to 2 decimal places.) Market-to-book ratio 10 5 points Skipped eBook Print References Even Better Products has come out with an even better product. As a result, the firm projects an ROE of 20%, and it will maintain a plowback ratio of 0.30. Its earnings this year will be $2 per share. Investors expect a 11% rate of return on the stock. Required: a. At what price and P/E ratio would you expect the firm to sell? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Price P/E ratio b. What is the present value of growth opportunities? (Do not round intermediate calculations. Round your answer to 2 decimal places.) PVGO V Che c. What would be the P/E ratio and the present value of growth opportunities if the firm planned to reinvest only 25% of its earnings? (Do not round intermediate calculations. Round your answers to 2 decimal places.) P/E ratio PVGO