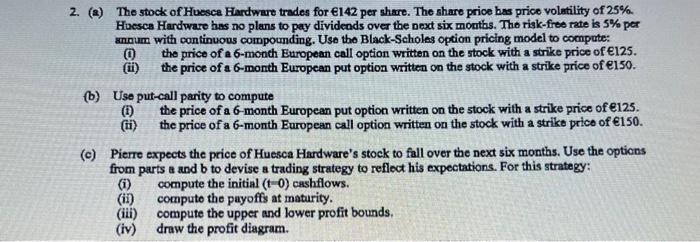

CE E 2. (@) The stock of Huesca Hardware trades for 142 per share. The share price bas price volatility of 25%. Huesca Hardware has no plans to pay dividends over the next six months. The risk-free rate is 5% per annum with continuous compounding. Use the Black-Scholes option pricing model to compute: the price of a 6-month European call option written on the stock with a strike price of 125. the price of a 6-month European put option written on the stock with a strike price of 150. (b) Use put-call parity to compute (1) the price of a 6-month European put option written on the stock with a strike price of 125. (ti) the price of a 6-month European call option written on the stock with a strike price of 150. (c) Pierre expects the price of Huesca Hardware's stock to fall over the next six months. Use the options from parts a and b to devise a trading strategy to reflect his expectations. For this strategy: (1) compute the initial (1-0) cashflows. (ii) computo the payoffs at maturity. (iii) compute the upper and lower profit bounds, (iv) draw the profit diagram. CE E 2. (@) The stock of Huesca Hardware trades for 142 per share. The share price bas price volatility of 25%. Huesca Hardware has no plans to pay dividends over the next six months. The risk-free rate is 5% per annum with continuous compounding. Use the Black-Scholes option pricing model to compute: the price of a 6-month European call option written on the stock with a strike price of 125. the price of a 6-month European put option written on the stock with a strike price of 150. (b) Use put-call parity to compute (1) the price of a 6-month European put option written on the stock with a strike price of 125. (ti) the price of a 6-month European call option written on the stock with a strike price of 150. (c) Pierre expects the price of Huesca Hardware's stock to fall over the next six months. Use the options from parts a and b to devise a trading strategy to reflect his expectations. For this strategy: (1) compute the initial (1-0) cashflows. (ii) computo the payoffs at maturity. (iii) compute the upper and lower profit bounds, (iv) draw the profit diagram