Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ce that if you took one British pound, converted it to 1.5593 U.S. dollars, and then converted those 1.5593 dollars back to British pounds,

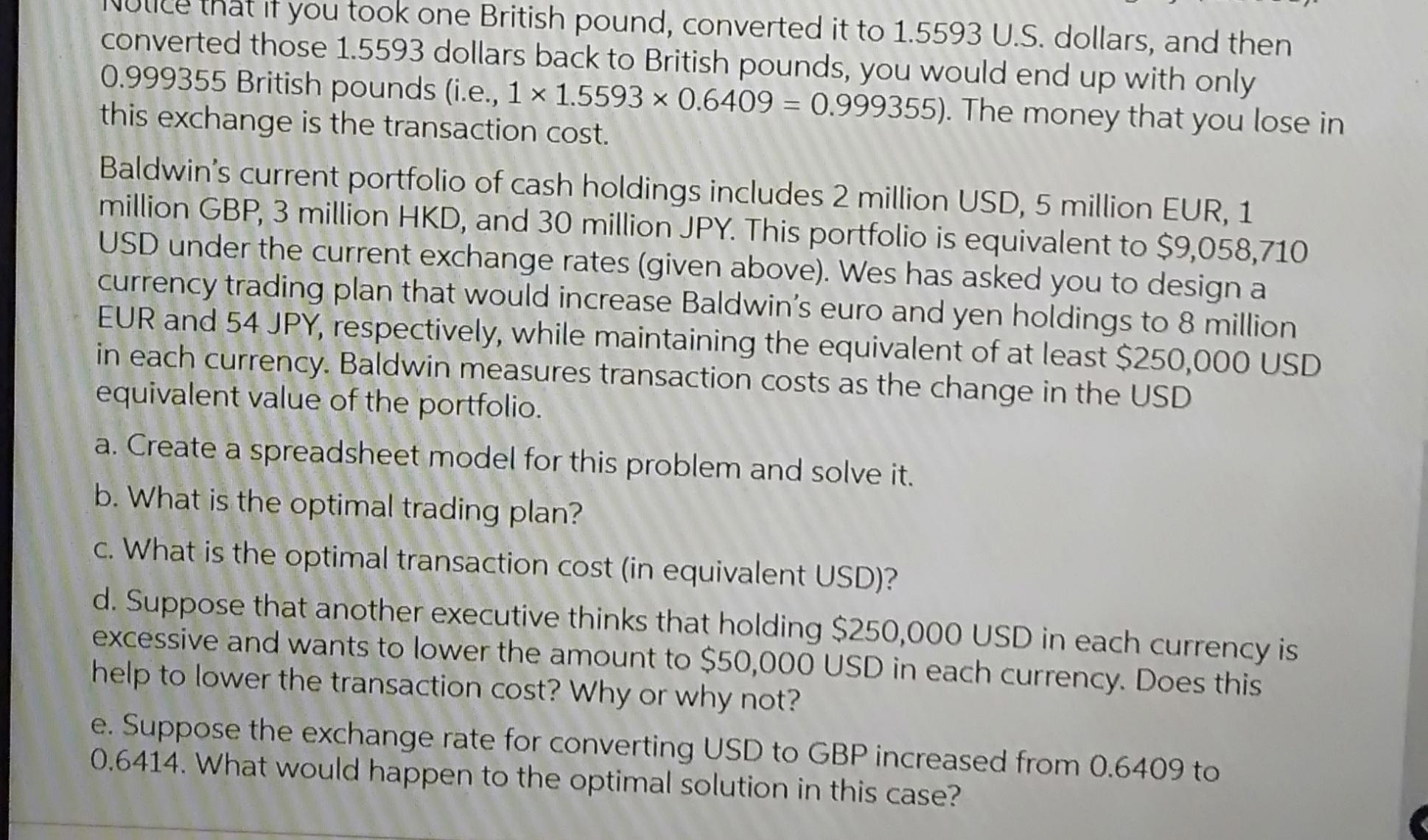

ce that if you took one British pound, converted it to 1.5593 U.S. dollars, and then converted those 1.5593 dollars back to British pounds, you would end up with only 0.999355 British pounds (i.e., 1 x 1.5593 x 0.6409 = 0.999355). The money that you lose in this exchange is the transaction cost. Baldwin's current portfolio of cash holdings includes 2 million USD, 5 million EUR, 1 million GBP, 3 million HKD, and 30 million JPY. This portfolio is equivalent to $9,058,710 USD under the current exchange rates (given above). Wes has asked you to design a currency trading plan that would increase Baldwin's euro and yen holdings to 8 million EUR and 54 JPY, respectively, while maintaining the equivalent of at least $250,000 USD in each currency. Baldwin measures transaction costs as the change in the USD equivalent value of the portfolio. a. Create a spreadsheet model for this problem and solve it. b. What is the optimal trading plan? c. What is the optimal transaction cost (in equivalent USD)? d. Suppose that another executive thinks that holding $250,000 USD in each currency is excessive and wants to lower the amount to $50,000 USD in each currency. Does this help to lower the transaction cost? Why or why not? e. Suppose the exchange rate for converting USD to GBP increased from 0.6409 to 0.6414. What would happen to the optimal solution in this case?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started