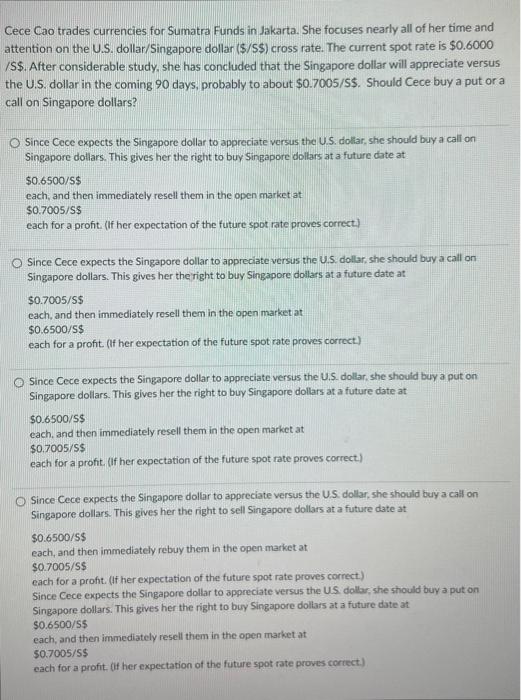

Cece Cao trades currencies for Sumatra Funds in Jakarta. She focuses nearly all of her time and attention on the U.S. dollar/Singapore dollar (\$/S\$) cross rate. The current spot rate is $0.6000 /S\$. After considerable study, she has concluded that the Singapore dollar will appreciate versus the U.S. dollar in the coming 90 days, probably to about $0.7005/5$. Should Cece buy a put or a call on Singapore dollars? Since Cece expects the Singapore dollar to appreciate versus the U.S. dollar, she should buy a call on Singapore dollars. This gives her the right to buy Singapore dollars at a future date at $0.6500/5$ each, and then immediately resell them in the open market at. $0.7005/5$ each for a profit. (If her expectation of the future spot rate proves correct) Since Cece expects the Singapore dollar to appreciate versus the U.S. dollar, she should buy a call on Singapore dollars. This gives her the right to buy Singapore doilars at a future date at $0.7005/5$ each, and then immediately resell them in the open market at $0.6500/SS each for a profit. (If her expectation of the future spot rate proves correct) Since Cece expects the Singapore dollar to appreciate versus the U.S. dollar, she should buy a put on Singapore dollars. This gives her the right to buy Singapore dollars at a future date at $0.6500/5$ each, and then immediately resell them in the open market at $0.7005/s5 each for a profit. (If her expectation of the future spot rate proves correct) Since Cece expects the Singapore dollar to appreciate versus the U.S. dollar, she should buy a call on Singapore dollars. This gives her the right to sell Singapore dollars at a future date at $0.6500/5$ each, and then immediately rebuy them in the open market at \$0.7005/Ss each for a profit. (If her expectation of the future spot rate proves correct). Since Cece expects the Singapore dollar to appreciate versus the US dollar, she should buy a put on Singapore dollars. This gives her the right to buy Singapore dollars at a future date at \$0.6500/55 each, and then immediately resell them in the open market at \$0.7005/5\$ each for a profit. (if her expectation of the future spot rate proves correct.)