Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cecil Incorporated provided the following information regarding its only product: Sale price per unit Direct materials used Direct labor incurred Variable manufacturing overhead Variable

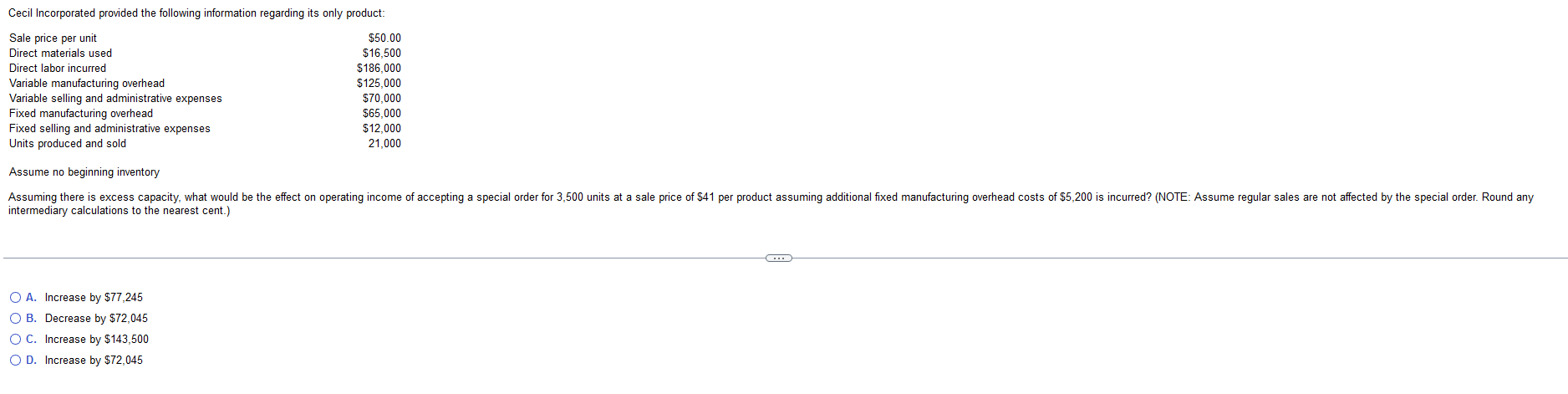

Cecil Incorporated provided the following information regarding its only product: Sale price per unit Direct materials used Direct labor incurred Variable manufacturing overhead Variable selling and administrative expenses Fixed manufacturing overhead Fixed selling and administrative expenses Units produced and sold $50.00 $16,500 $186,000 $125,000 $70,000 $65,000 $12,000 21,000 Assume no beginning inventory Assuming there is excess capacity, what would be the effect on operating income of accepting a special order for 3,500 units at a sale price of $41 per product assuming additional fixed manufacturing overhead costs of $5,200 is incurred? (NOTE: Assume regular sales are not affected by the special order. Round any intermediary calculations to the nearest cent.) O A. Increase by $77,245 O B. Decrease by $72,045 O C. Increase by $143,500 O D. Increase by $72,045

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Excess capacity is profitable if it is able to recover the variable cos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started