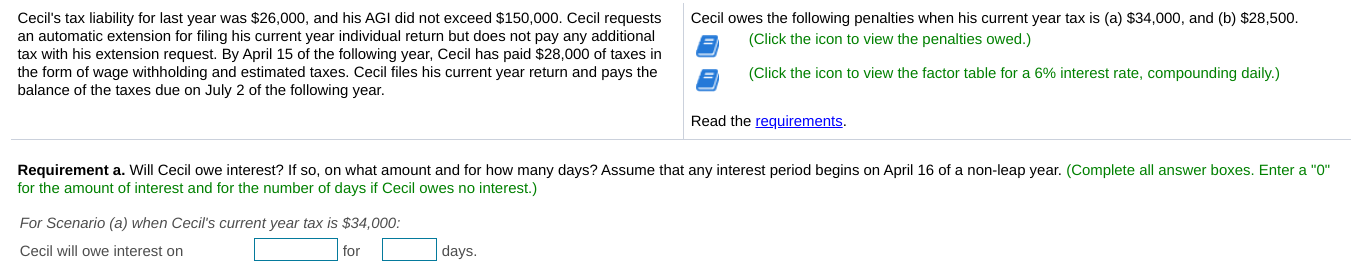

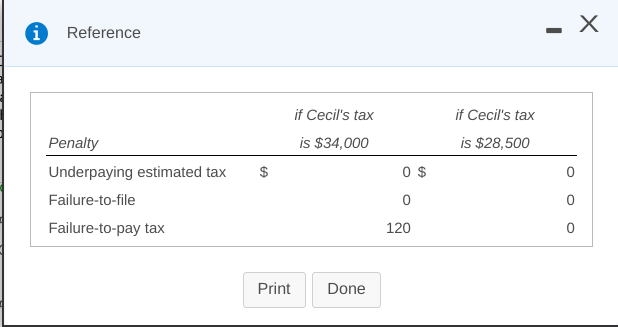

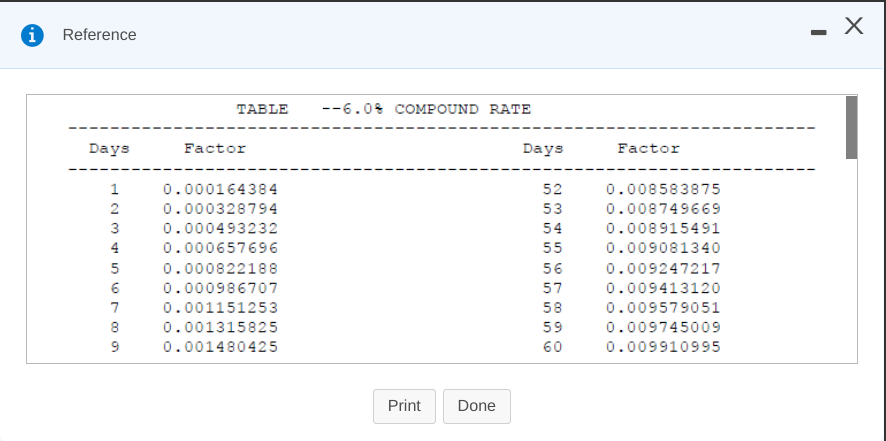

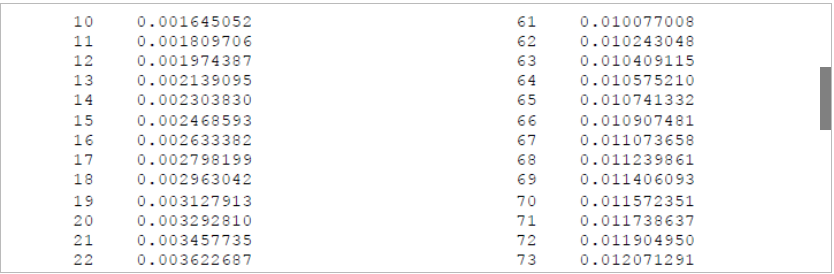

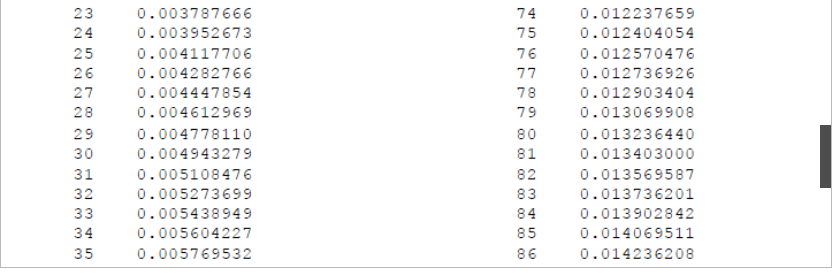

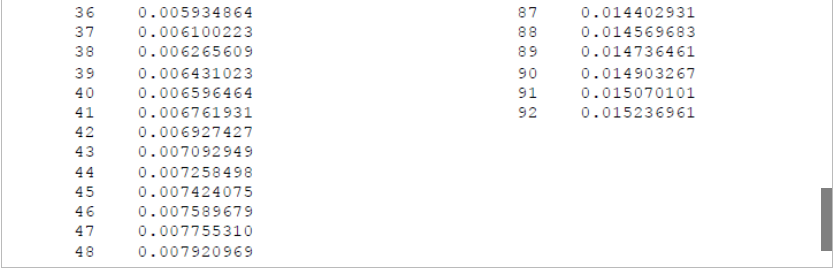

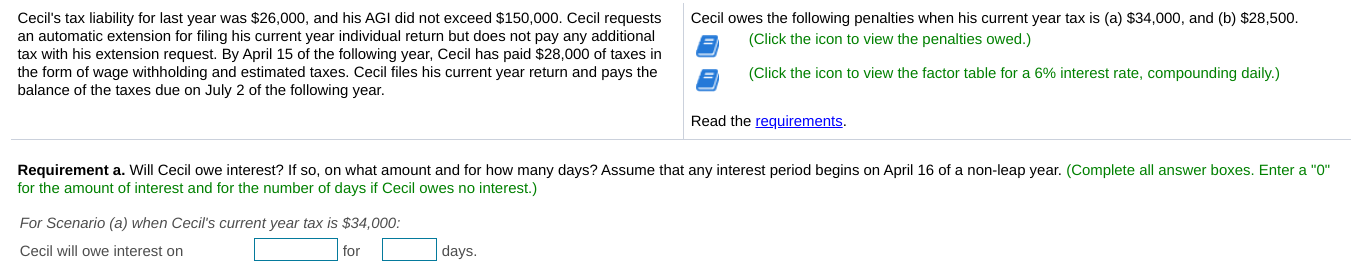

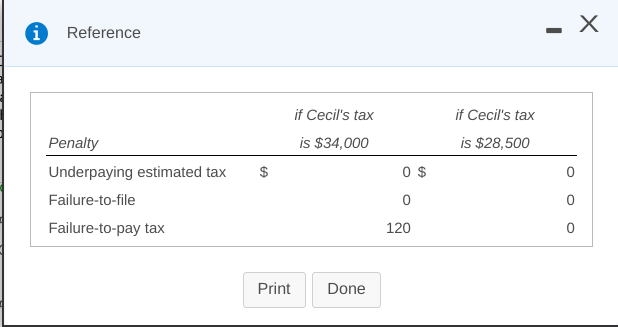

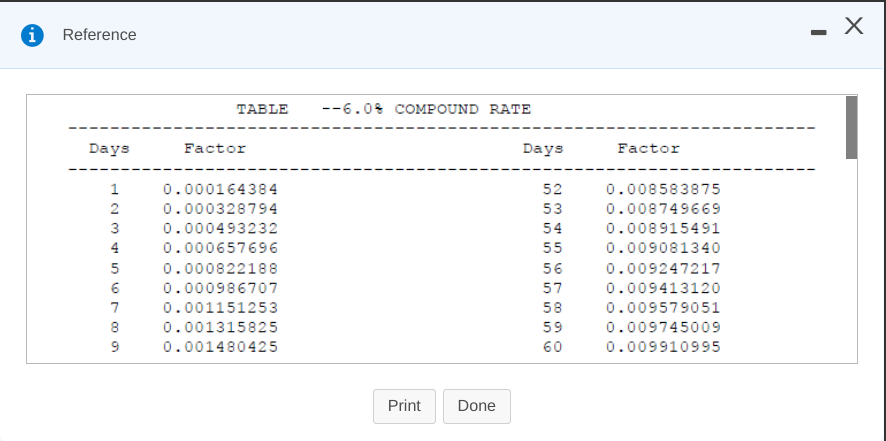

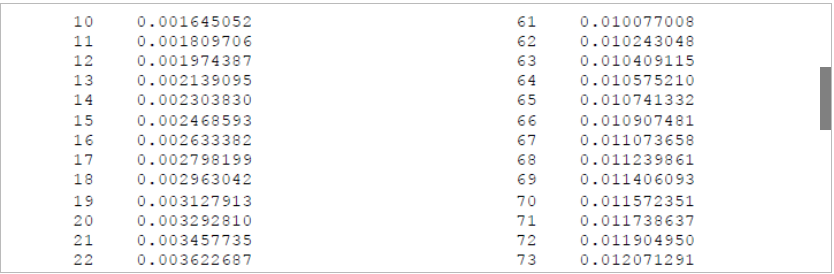

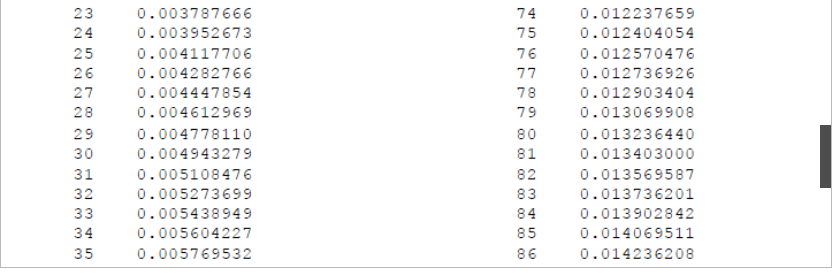

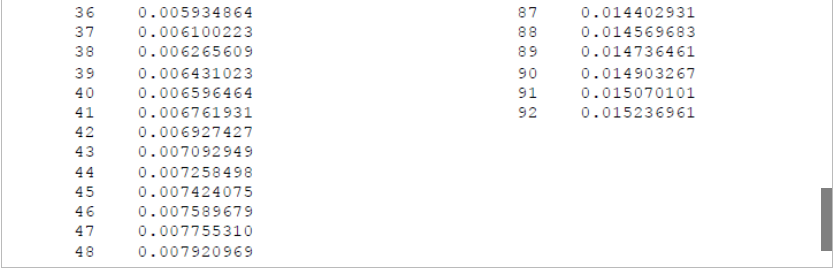

Cecil owes the following penalties when his current year tax is (a) $34,000, and (b) $28,500. (Click the icon to view the penalties owed.) Cecil's tax liability for last year was $26,000, and his AGI did not exceed $150,000. Cecil requests an automatic extension for filing his current year individual return but does not pay any additional tax with his extension request. By April 15 of the following year, Cecil has paid $28,000 of taxes in the form of wage withholding and estimated taxes. Cecil files his current year return and pays the balance of the taxes due on July 2 of the following year. (Click the icon to view the factor table for a 6% interest rate, compounding daily.) Read the requirements. Requirement a. Will Cecil owe interest? If so, on what amount and for how many days? Assume that any interest period begins on April 16 of a non-leap year. (Complete all answer boxes. Enter a "0" for the amount of interest and for the number of days if Cecil owes no interest.) For Scenario (a) when Cecil's current year tax is $34,000: Cecil will owe interest on for days. For Scenario (b) when Cecil's current year tax is $28,500: Cecil will owe interest on for days. i Reference if Cecil's tax if Cecil's tax is $28,500 is $34,000 0 $ Penalty Underpaying estimated tax Failure-to-file Failure-to-pay tax 0 0 120 0 Print Done i - X Reference TABLE --6.0% COMPOUND RATE 1 1 - - - 1 1 1 1 1 ! - - 1 Days Factor Days Factor -- - - 1 2 52 53 54 4 5 000 W 0.000164384 0.000328794 0.000493232 0.000657696 0.000822188 0.000986707 0.001151253 0.001315825 0.001480425 55 56 57 58 59 60 0.008583875 0.008749669 0.008915491 0.009081340 0.009247217 0.009413120 0.009579051 0.009745009 0.009910995 7. 0 0 0 Print Done 10 11 12 13 61 62 63 64 65 3 14 15 16 17 18 19 0.001645052 0.001809706 0.001974387 0.002139095 0.002303830 0.002468593 0.002633382 0.002798199 0.002963042 0.003127913 0.003292810 0.003457735 0.003622687 67 68 0.010077008 0.010243048 0.010409115 0.010575210 0.010741332 0.010907481 0.011073658 0.011239861 0.011406093 0.011572351 0.011738637 0.011904950 0.012071291 69 70 21 22 71 72 73 7 23 24 25 26 27 28 29 30 31 32 33 34 35 0.003787666 0.003952673 0.004117706 0.004282766 0.004447854 0.004612969 0.004778110 0.004943279 0.005108476 0.005273699 0.005438949 0.005604227 0.005769532 00 00 00 00 00 00 74 75 76 77 78 79 80 81 82 83 84 85 86 0.012237659 0.012404054 0.012570476 0.012736926 0.012903404 0.013069908 0.013236440 0.013403000 0.013569587 0.013736201 0.013902842 0.014069511 0.014236208 87 88 89 36 37 38 39 40 41 42 43 0.014402931 0.014569683 0.014736461 0.014903267 0.015070101 0.015236961 0.005934864 0.006100223 0.006265609 0.006431023 0.006596464 0.006761931 0.006927427 0.007092949 0.007258498 0.007424075 0.007589679 0.007755310 0.007920969 44 45 47 48