Question

Cecilia who is a currency trader in Japan observes the following market conditions: Annual interest rate in Japan: 1.5% per annum Annual interest rate in

Cecilia who is a currency trader in Japan observes the following market conditions:

Annual interest rate in Japan: 1.5% per annum

Annual interest rate in France: 7.0% per annum

Current spot exchange rate: 114.4733/

One-year forward exchange rate: 110.2423/

No transaction costs

If Cecilia can borrow 100,000,000, specific the transactions he may carry out in order to make some arbitrage profit and calculate the amount of the profit.

Step 1

1) Different i for Base rate -Quote rate =

2) Different between Spot and Forward =

(1) + (2) =

invest in _ borrow in _

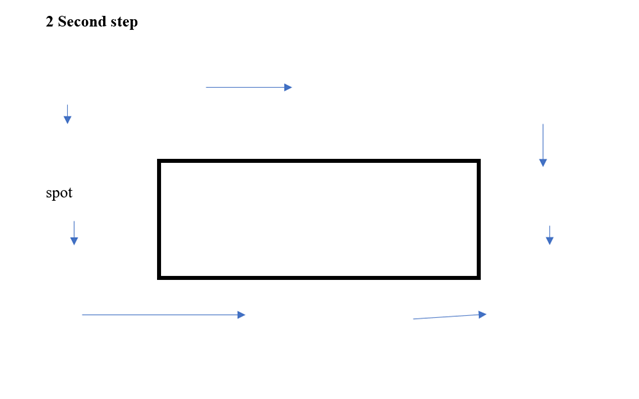

Step 2 explain using table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started