Answered step by step

Verified Expert Solution

Question

1 Approved Answer

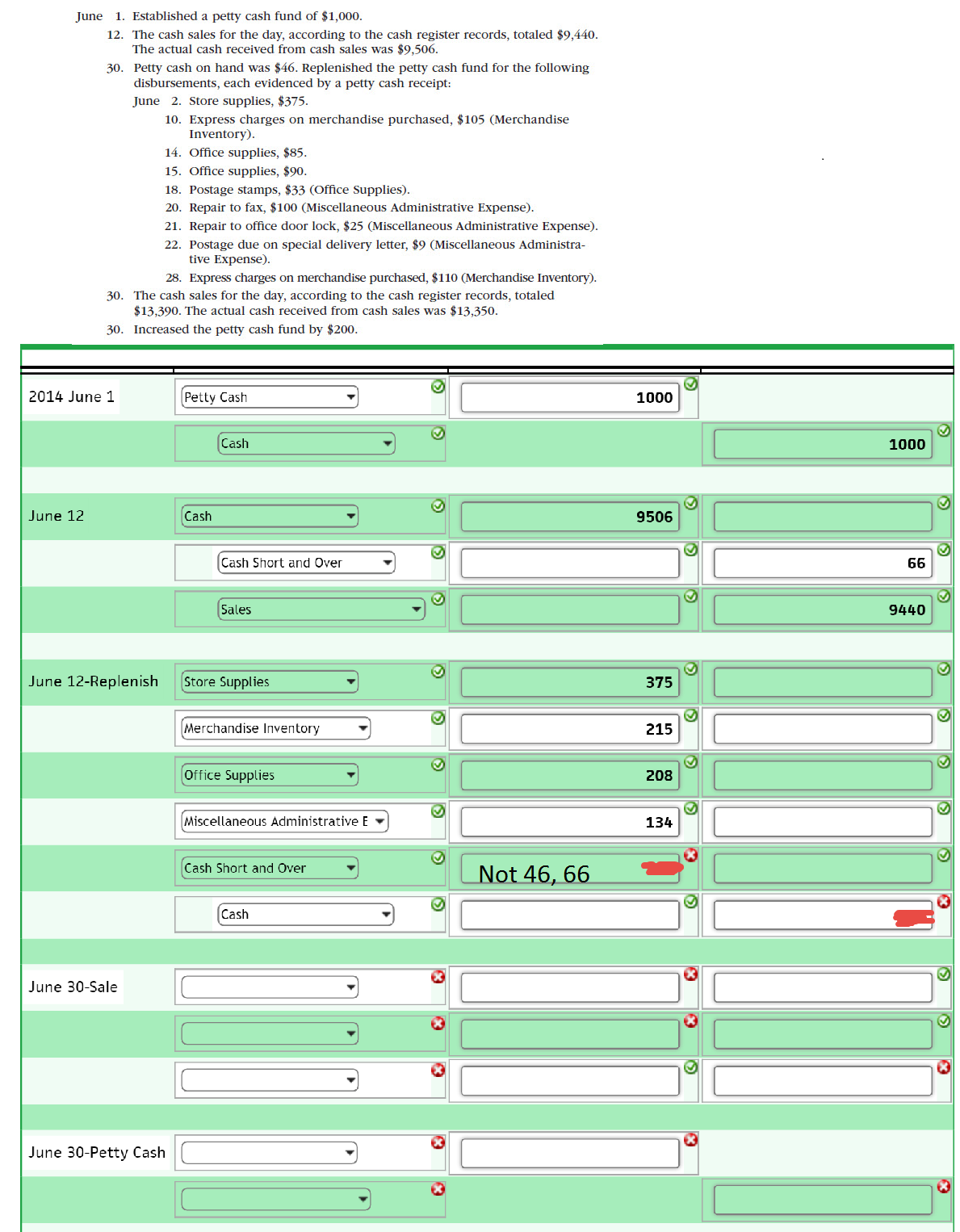

Cedar Springs Company completed the following selected transactions during June 2014: Journalize the transactions. For a compound transaction, if an amount box does not require

Cedar Springs Company completed the following selected transactions during June 2014:

Journalize the transactions. For a compound transaction, if an amount box does not require an entry, leave it blank.

1. Established a petty cash fund of $1,000 12. The cash sales for the day, according to the cash register records, totaled $9,440 June The actual cash received from cash sales was $9,506 30. Petty cash on hand was $46. Replenished the petty cash fund for the following disbursements, each evidenced by a petty cash receipt: June 2. Store supplies, $375 10. Express charges on merchandise purchased, $105 (Merchandise Inventory) 14. Office supplies, $85 15. Office supplies, $90 18. Postage stamps, $33 (Office Supplies) 20. Repair to fax, $100 (Miscellaneous Administrative Expense) 21. Repair to office door lock, $25 (Miscellaneous Administrative Expense) 22. Postage due on special delivery letter, $9 (Miscellaneous Administra tive Expense) 28. Express charges on merchandise purchased, $110 (Merchandise Inventory) 30. The cash sales for the day, according to the cash register records, totaled $13,390. The actual cash received from cash sales was $13,350 30. Increased the petty cash fund by $200 2014 June 1 Petty Caslh 1000 Cash 1000 June 12 Cash 9506 Cash Short and Over Sales 9440 June 12-Replenish Store Supplies 375 Merchandise Inventory 215 Office Supplies 208 Miscellaneous Administrative E 134 Cash Short and Over ot 46 Cash June 30-Sale June 30-Petty CashStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started