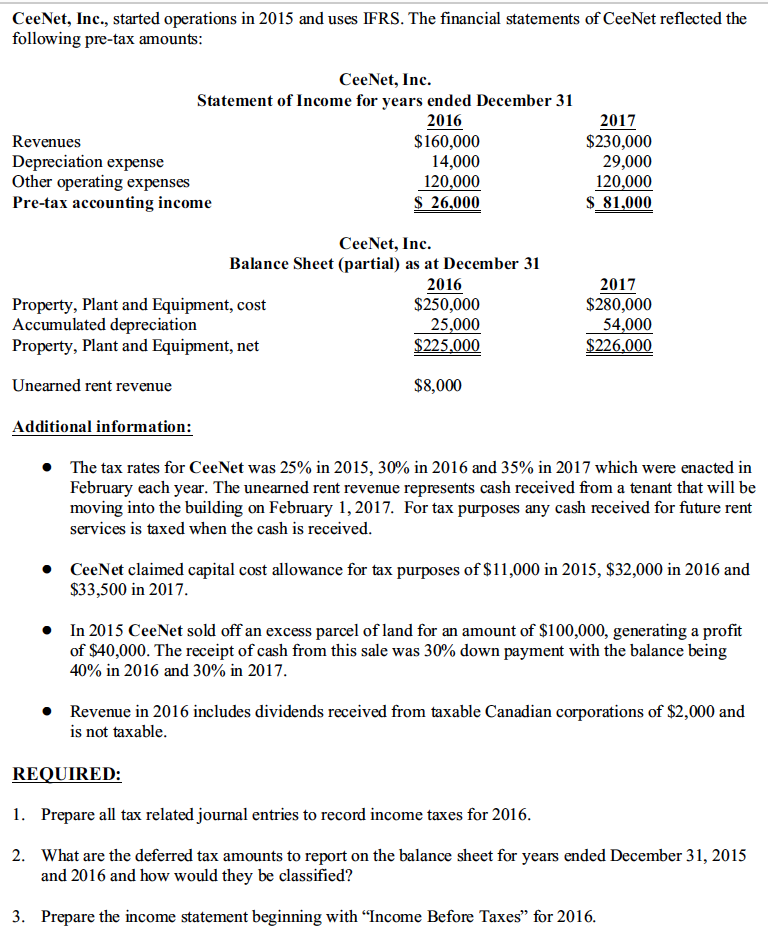

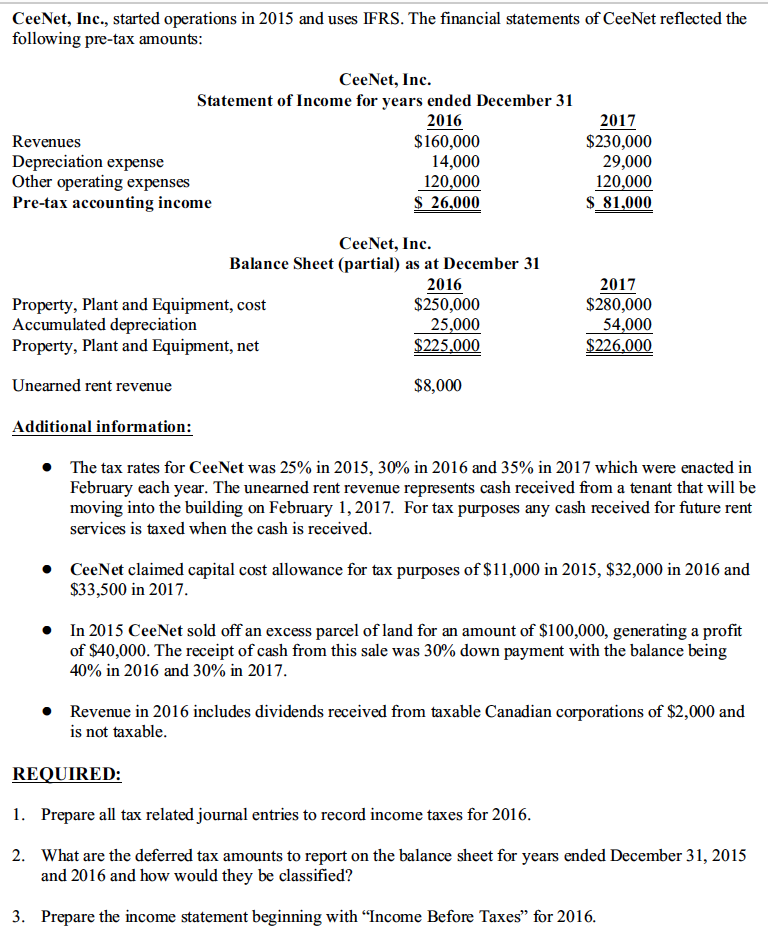

CeeNet, Inc., started operations in 2015 and uses IFRS. The financial statements of CeeNet reflected the following pre-tax amounts: CeeNet, Inc. Statement of Income for years ended December 31 2016 Revenues $160,000 Depreciation expense 14,000 Other operating expenses 120,000 Pre-tax accounting income $ 26,000 2017 $230,000 29,000 120,000 $ 81,000 CeeNet, Inc. Balance Sheet (partial) as at December 31 2016 Property, Plant and Equipment, cost $250,000 Accumulated depreciation 25,000 Property, Plant and Equipment, net $225,000 2017 $280,000 54,000 $226,000 Unearned rent revenue $8,000 Additional information: The tax rates for CeeNet was 25% in 2015, 30% in 2016 and 35% in 2017 which were enacted in February each year. The unearned rent revenue represents cash received from a tenant that will be moving into the building on February 1, 2017. For tax purposes any cash received for future rent services is taxed when the cash is received. CeeNet claimed capital cost allowance for tax purposes of $11,000 in 2015, $32,000 in 2016 and $33,500 in 2017. . In 2015 CeeNet sold off an excess parcel of land for an amount of $100,000, generating a profit of $40,000. The receipt of cash from this sale was 30% down payment with the balance being 40% in 2016 and 30% in 2017. Revenue in 2016 includes dividends received from taxable Canadian corporations of $2,000 and is not taxable. REQUIRED: 1. Prepare all tax related journal entries to record income taxes for 2016. 2. What are the deferred tax amounts to report on the balance sheet for years ended December 31, 2015 and 2016 and how would they be classified? 3. Prepare the income statement beginning with Income Before Taxes for 2016. CeeNet, Inc., started operations in 2015 and uses IFRS. The financial statements of CeeNet reflected the following pre-tax amounts: CeeNet, Inc. Statement of Income for years ended December 31 2016 Revenues $160,000 Depreciation expense 14,000 Other operating expenses 120,000 Pre-tax accounting income $ 26,000 2017 $230,000 29,000 120,000 $ 81,000 CeeNet, Inc. Balance Sheet (partial) as at December 31 2016 Property, Plant and Equipment, cost $250,000 Accumulated depreciation 25,000 Property, Plant and Equipment, net $225,000 2017 $280,000 54,000 $226,000 Unearned rent revenue $8,000 Additional information: The tax rates for CeeNet was 25% in 2015, 30% in 2016 and 35% in 2017 which were enacted in February each year. The unearned rent revenue represents cash received from a tenant that will be moving into the building on February 1, 2017. For tax purposes any cash received for future rent services is taxed when the cash is received. CeeNet claimed capital cost allowance for tax purposes of $11,000 in 2015, $32,000 in 2016 and $33,500 in 2017. . In 2015 CeeNet sold off an excess parcel of land for an amount of $100,000, generating a profit of $40,000. The receipt of cash from this sale was 30% down payment with the balance being 40% in 2016 and 30% in 2017. Revenue in 2016 includes dividends received from taxable Canadian corporations of $2,000 and is not taxable. REQUIRED: 1. Prepare all tax related journal entries to record income taxes for 2016. 2. What are the deferred tax amounts to report on the balance sheet for years ended December 31, 2015 and 2016 and how would they be classified? 3. Prepare the income statement beginning with Income Before Taxes for 2016