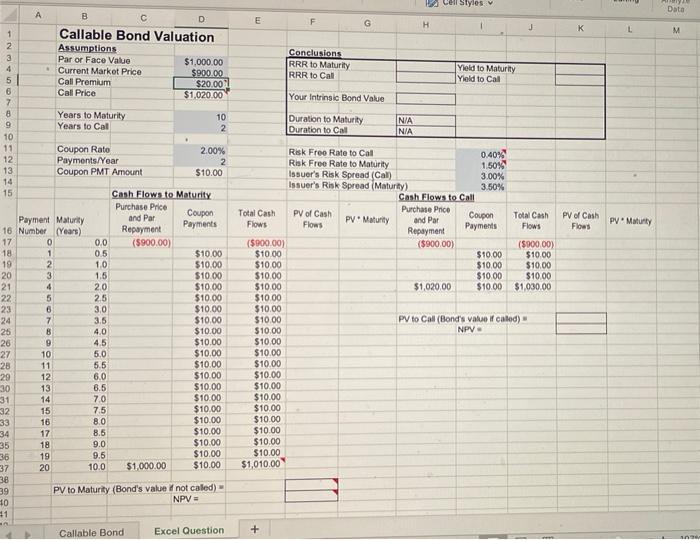

Ceir Styles Data E F G H J K L M Conclusions RRR to Maturity RRR to Call Yield to Maturity Yield to Call Your Intrinsic Bond Value GOOOOOON Duration to Maturity Duration to Call NA N/A PV of Cash Floes PV. Maturty A B D Callable Bond Valuation Assumptions Par or Face Value $1,000.00 Current Market Price $900.00 Call Premium $20.00 Call Price $1,020.00 Years to Maturity 10 Years to Cal 2 10 11 Coupon Rato 2.00% 12 Payments/Year 2 13 Coupon PMT Amount $10.00 14 15 Cash Flows to Maturity Purchase Price Coupon and Par Payment Maturity 16 Number (Yeart) Repayment Payments 17 0 0.0 ($900.00) 18 1 0.5 $10.00 19 2 1.0 $10.00 20 3 1.5 $10.00 21 4 2.0 $10.00 22 5 25 $10.00 23 6 3.0 $10.00 24 7 3.5 $10.00 25 8 4.0 $10.00 26 9 4.5 $10.00 27 10 5.0 $10.00 28 11 5.5 $10.00 29 12 6.0 $10.00 30 13 6.5 $10.00 31 14 70 $10.00 32 15 7.5 $10.00 33 16 8.0 $10.00 34 17 8.5 $10.00 35 18 9.0 $10.00 36 19 9.5 $10.00 37 20 10.0 $1,000.00 $10.00 38 39 PV to Maturity (Bond's value inot caled) 10 NPV = 1 Callable Bond Excel Question 9&N&& Risk Free Rate to Cal 0.40% Risk Free Rate to Maturity 1.50% Issuer's Risk Spread (Cal) 3.00% Issuer's Risk Spread Maturity) 3.50% Cash Flows to Call Total Cash PV of Cash Purchase Price PV. Maturity Coupon and Par Total Cash Flows Flows Flows Payments Repayment ($900.00) ($900.00) ($900.00) $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $1,020.00 $10.00 $1,030.00 $10.00 $10.00 $10.00 PV to Call (Bond's value if cated) $10.00 NPV $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $1,010.00 ooo Ceir Styles Data E F G H J K L M Conclusions RRR to Maturity RRR to Call Yield to Maturity Yield to Call Your Intrinsic Bond Value GOOOOOON Duration to Maturity Duration to Call NA N/A PV of Cash Floes PV. Maturty A B D Callable Bond Valuation Assumptions Par or Face Value $1,000.00 Current Market Price $900.00 Call Premium $20.00 Call Price $1,020.00 Years to Maturity 10 Years to Cal 2 10 11 Coupon Rato 2.00% 12 Payments/Year 2 13 Coupon PMT Amount $10.00 14 15 Cash Flows to Maturity Purchase Price Coupon and Par Payment Maturity 16 Number (Yeart) Repayment Payments 17 0 0.0 ($900.00) 18 1 0.5 $10.00 19 2 1.0 $10.00 20 3 1.5 $10.00 21 4 2.0 $10.00 22 5 25 $10.00 23 6 3.0 $10.00 24 7 3.5 $10.00 25 8 4.0 $10.00 26 9 4.5 $10.00 27 10 5.0 $10.00 28 11 5.5 $10.00 29 12 6.0 $10.00 30 13 6.5 $10.00 31 14 70 $10.00 32 15 7.5 $10.00 33 16 8.0 $10.00 34 17 8.5 $10.00 35 18 9.0 $10.00 36 19 9.5 $10.00 37 20 10.0 $1,000.00 $10.00 38 39 PV to Maturity (Bond's value inot caled) 10 NPV = 1 Callable Bond Excel Question 9&N&& Risk Free Rate to Cal 0.40% Risk Free Rate to Maturity 1.50% Issuer's Risk Spread (Cal) 3.00% Issuer's Risk Spread Maturity) 3.50% Cash Flows to Call Total Cash PV of Cash Purchase Price PV. Maturity Coupon and Par Total Cash Flows Flows Flows Payments Repayment ($900.00) ($900.00) ($900.00) $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $1,020.00 $10.00 $1,030.00 $10.00 $10.00 $10.00 PV to Call (Bond's value if cated) $10.00 NPV $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $10.00 $1,010.00 ooo